Crypto Split Watch: Is Ethereum Next?

Digital assets surge while traditional finance scrambles to keep up.

THE DEFI REVOLUTION ACCELERATES

Smart contracts continue eating Wall Street's lunch—processing transactions while legacy systems struggle with paperwork. Ethereum's ecosystem now handles more value daily than some national stock exchanges.

TOKEN ECONOMICS 2.0

Layer-2 solutions slash gas fees by 90% while maintaining security. Validator queues stretch months ahead as institutions rush to stake positions. The merge completed what Bitcoin started—creating digital gold that actually generates yield.

THE INSTITUTIONAL FOMO

BlackRock's ETF approval triggered a domino effect. Pension funds now allocate percentages once considered reckless. Meanwhile, traditional brokers still charge 2% management fees for underperforming index funds.

Regulators scramble to understand technology that's already moved on. SEC meetings debate last year's problems while developers ship next year's solutions. The cynical take? Banks will eventually offer crypto services—with twice the fees and half the functionality.

Image source: Getty Images.

How a stock split works

First, though, a few more details about how a stock split unfolds. In a split, a company offers more shares to current holders -- this lowers the value of each individual share without changing the total value of an investor's position or the market value of the company. The ratio of the split determines the final value of your shares, so, for example, in a 10-for-one stock split, your one share valued at $1,000 WOULD become 10 shares valued at $100 each post-split.

Now, let's consider the likelihood of an Oracle stock split. The company has done several in the past -- 10 to be exact -- suggesting it's amenable to the idea of such an operation. But all of Oracle's stock splits happened prior to 2001, showing such moves haven't been a part of the company's strategy in recent years.

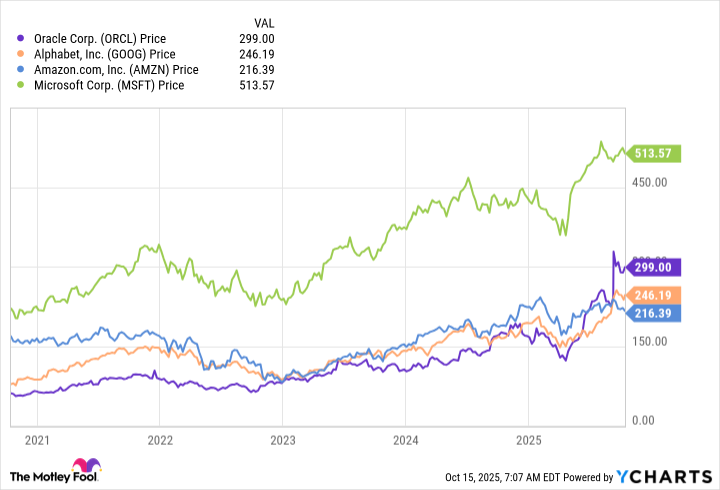

Today, Oracle stock is trading for around $300, and that's about $30 lower than a record high reached a few weeks ago following the company's latest earnings report. To reach this level, the stock price has climbed almost 400% over the past five years.

Oracle stock compared to rivals

All of this shows growth in the stock price, but the shares haven't necessarily reached a level that would push away investors. For example, the level of $1,000 per share often represents a psychological barrier, meaning some investors see stocks at that price or higher as expensive even if valuation tells a different story. Today, Oracle stock is very far from $1,000, and trades at a level that's comparable to others in the cloud space.

ORCL data by YCharts

Meanwhile, Oracle today has reached a key turning point. The company is seeing revenue soar amid demand for cloud capacity from AI customers. The recent quarter illustrates this and suggests we may be in the very early stages of this story. In the quarter, Oracle's cloud infrastructure revenue advanced 55% to $3.3 billion -- and the company predicted that it will increase 77% to $18 billion this year, and then progress to $144 billion in the coming four years.

This is supported by surging demand for capacity, something that could be in great need for many years to come. It's important to remember that after AI models are trained, they still need compute for inferencing, or the thinking process that leads to them answering complex questions. All of this bodes well for companies offering this access to compute.

Oracle's CEOs

At the same time, Oracle recently announced that longtime chief Safra Catz was shifting into the role of executive vice chair of the board -- and that Clay Magouyrk and Mike Sicilia, who have held executive AI roles at Oracle, would become co-CEOs.

With all of this happening right now, will Oracle soon announce a stock split? I don't think that will be the company's next MOVE -- for two main reasons. First, the stock hasn't reached levels that beg for such an operation. And second, Oracle right now is keenly focused on serving demand for AI capacity and turning this into earnings growth -- the new CEOs may prioritize this over organizing a stock split.

That said, it makes sense to keep Oracle on your stock split watch list. The stock has what it takes to explode higher amid AI growth in the quarters to come -- and that means the company eventually could decide to launch a split and bring that stock price back down to Earth.