Pepenode: The Meme Coin Mining Revolution That’s Creating Crypto Millionaires

Forget traditional mining rigs—Pepenode's virtual mining approach is turning meme coin speculation into systematic wealth generation.

The Viral Mining Protocol

Pepenode bypasses energy-intensive hardware requirements that plague conventional crypto mining operations. Instead, users participate through cloud-based virtual nodes that generate returns without the electricity bills or hardware costs that typically eat into profits.

From Memes to Millions

The platform's unique approach to meme coin accumulation has already produced numerous success stories. While traditional finance scoffs at dog-themed tokens, Pepenode users are quietly building positions in what many consider the most volatile—and potentially rewarding—sector of the crypto market.

Of course, Wall Street analysts will tell you this is pure gambling—right before they charge you 2% annually for underperforming the S&P 500.

Virtual mining cuts through the noise of meme coin mania by providing structured exposure to assets that routinely deliver triple-digit returns during market surges. The method transforms random speculation into calculated accumulation.

As regulatory uncertainty continues to plague major cryptocurrencies, meme coins operated through platforms like Pepenode represent one of the few remaining pure plays on crypto's disruptive potential—whether the suits in traditional finance want to admit it or not.

1. A reversal in China

"I think you have to see the D3 exit China as soon as they possibly can,"auto analyst John Murphy said a little over a year ago during the "Car Wars" report. He continued, "China is no longer Core to GM,or."

That quote from Murphy was the brutal truth reflecting a substantial change in China's market potential. Remember that years ago General Motors, along with other foreign automakers such as Ford Motor Company and, enjoyed massive success in the Chinese market, with GM at one point generating billions in profit and selling more cars in China than in America -- but that success quickly reversed. Foreign autos suffered great financial and market share losses as the market quickly turned to electric vehicles where China's domestic brands began to thrive and dominate.

Despite the dire warning and suggestion from Murphy and other analysts, General Motors has stayed in the Chinese market to fight for its portion of the pie -- and October brings good news.

General Motors' sales in China surged 10% higher during the third quarter, which marks the third consecutive quarter of growth and a fundamental change in its business. Recall that the Detroit automaker took a hefty NEAR $5 billion charge to restructure its business in China to remain on pace to profitability in the brutally competitive overseas market for 2025.

More specifically, GM China delivered roughly 470,000 vehicles during the third quarter, which was a much welcomed reversal from the company losing roughly half of its sales volume in less than a decade's time. It wasn't a one-quarter wonder with GM China's sales volume growing a similar 9.7% through the first nine months of the year, up to roughly 1.4 million vehicles. That's a step forward after the company posted sales of only 1.8 million in China during 2024, a fraction of its record high 4 million during 2017.

Image source: General Motors.

2. Returning value to shareholders

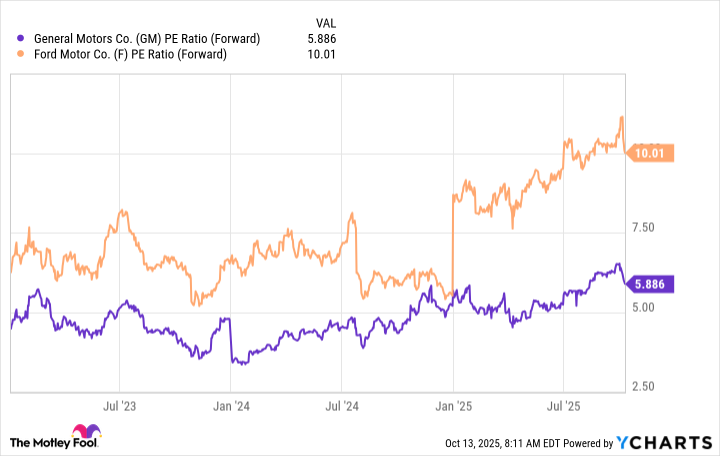

One thing that General Motors identified as an opportunity was its shares trading at such a cheap valuation. In fact, while General Motors has traded in the single digits for price-to-earnings ratio, it's even trailed its crosstown rival's valuation despite arguably far outperforming Ford.

GM PE Ratio (Forward) data by YCharts

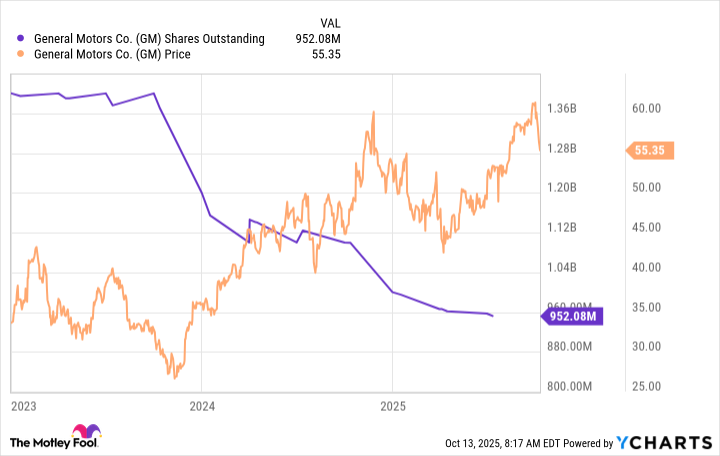

The opportunity to begin repurchasing its stock in earnest was too tantalizing to pass up. Since 2023 General Motors has announced $16 billion in share buyback programs that have led to the retiring of more than 400,000 shares outstanding. General Motors even increased its quarterly dividend by 25% in February at the same time it announced its most recent $6 billion buyback program with $2 billion completed during that quarter.

The result has had the desired impact. In the chart below, you can see the massive reduction in shares outstanding while the stock price simultaneously rose.

GM Shares Outstanding data by YCharts

Ford is often lauded for its lucrative dividend, and rightly so, as it sits at a robust 5.2% forward dividend yield compared to General Motors' more modest 1% dividend yield. However, that's only part of the equation for returning value to shareholders. Looking at total yield, which includes the dividend as well as the impact of share buybacks, GM's total yield soars to 15.6% while Ford's climbs to about 6.9%. GM returns far more value to shareholders than it gets credit for.

What it all means

October looks like an opportunity for long-term investors who are willing to zig while others zag to scoop up shares of a top automotive stock before the market appreciates the progress the company has made financially, operationally, and in returning value to shareholders through significant share repurchases.

The automotive market is competitive, capital-intensive, and cyclical, and it can lead to rough patches of ups and downs for the stock price. That said, General Motors is well positioned to outperform its competitors as well as return value to shareholders.