Warren Buffett Dumps 46.3 Million Shares of Top Holdings - Here’s Where the Billionaire Is Parking His Cash Now

Buffett's massive stock sale signals major portfolio shift as markets wobble

The Oracle of Omaha just made his biggest move in years - unloading precisely 46.3 million shares across two of his favorite positions. While the exact stocks remain unnamed, the scale suggests Buffett sees storm clouds gathering.

Ultra-Safe Haven Attracts Billions

Instead of chasing risky tech plays or crypto hype, Buffett's deploying capital into what he calls "ultra-safe" territory. The move screams defensive positioning - because when billionaires start hoarding cash equivalents, retail investors should probably pay attention.

Classic Buffett timing strikes again - just when everyone's chasing returns, he's building a war chest. Because nothing says "I told you so" like having dry powder during a market panic while others are liquidating at fire-sale prices.

Diminishing Apple stake

One of the best investments Warren Buffett ever made is(AAPL 0.04%). After purchasing shares about a decade ago, Berkshire Hathaway ended up with about 5% of the smartphone Maker and rode the stock up to a whopping $175 billion valuation, at least as of the end of 2023.

Since the end of 2023, Buffett has begun to sell pieces of his Apple stake. Last quarter, he sold another 20 million shares, with the stake now at $57 billion even though Apple stock keeps climbing. Berkshire Hathaway now owns less than 2% of Apple's shares outstanding.

Why WOULD Buffett trim Apple? Likely because of the stock's increasing valuation and decreasing growth prospects. Apple has a price-to-earnings ratio (P/E) of 39, which is well above what Buffett likes in a stock -- his typical range is 5 to 15 -- and even above theindex average of 31 right now. This valuation places large expectations on Apple's future growth.

That growth has not materialized recently. During the past three years, Apple's revenue is up a cumulative 5.4%, growing significantly slower than other large technology peers. Combine that with a high P/E, and you can see why Buffett has begun to sell Berkshire's stake in Apple stock.

Image source: The Motley Fool.

Trimming a large banking position

The third largest position in Berkshire Hathaway's stock portfolio is(BAC 2.42%). It's one of the largest banks in the U.S. with close to $2 trillion in total deposits. Buffett made an investment in the company during the 2011 market downturn, eventually owning 12% of its shares outstanding by the end of 2022.

Buffett saw Bank of America as a cheap financial stock in a time of turmoil. In 2011, the business was unprofitable, but has since gotten back on even footing and generated positive earnings per share (EPS) in each of the past 10 years, growing 156% during that timeframe. Last quarter, Buffett reduced his position in Bank of America by 4%.

Why is Buffett still selling Bank of America when Berkshire Hathaway already has a gargantuan cash pile? Like Apple, this is due to Bank of America's elevated valuation. The stock now trades at a price-to-book (P/B) of 1.4, a key valuation metric for a banking stock. Anything above 1 means that Bank of America is valued at more than the equity reported on its balance sheet. On top of this, digital banks such asare bringing in new competition for consumer banking, taking deposits from legacy players like Bank of America.

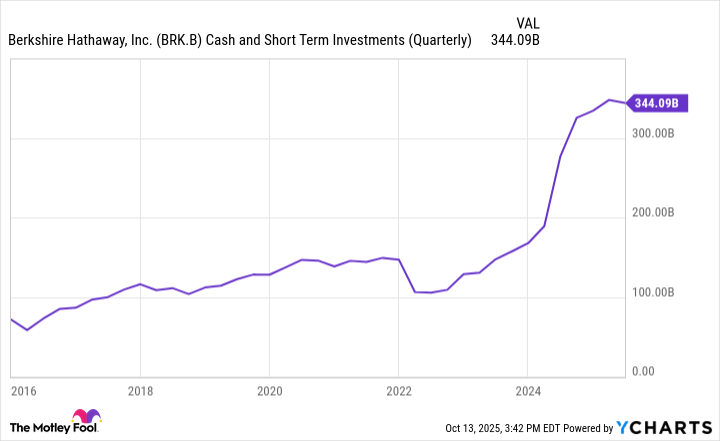

BRK.B Cash and Short-Term Investments (Quarterly) data by YCharts.

Should you follow Buffett into Treasuries?

Instead of piling into different stocks, Buffett is taking the cash raised from selling Apple and Bank of America shares and buying short-term Treasury bonds issued by the federal government. After the Federal Reserve raised interest rates beginning in 2022, holders of Treasury bonds have received higher annual interest rates. Even though interest rates have begun falling, the three-month Treasury bond is still yielding about 4% as of this writing.

Berkshire has cash and equivalents of more than $300 billion, much of which is in short-term U.S. Treasuries. This should tell investors that he thinks the risk-free return of about 4% offered by these bonds is a better investment than most stocks today, even his existing holdings like Apple and Bank of America that he has begun to trim.

Should you follow Buffett and buy some Treasury bonds? This is a personal question that depends on your financial situation. If you hold a lot of growth and artificial intelligence (AI) stocks, it might be smart to diversify and add some Treasuries to balance out your portfolio. This can be easily done through exchange-traded funds (ETFs) with low annual fees, which make it easier for individual investors to obtain exposure to the bonds.

Don't get too caught up with soaring stocks in a bull market. Perhaps it is time to follow Warren Buffett and diversify with Treasury bonds in your investment portfolio.