2 Stock-Split Stocks Flying Under the Radar: One Primed for 22% Upside by 2026, While Wall Street Sleeps on the Other

Wall Street's crystal ball sees massive potential in one stock-split play—while completely ignoring another hidden gem.

The Analyst Darling

One stock-split candidate has analysts buzzing with projections of up to 22% upside by 2026. The street's favorite child gets all the attention, fancy price targets, and glowing reports—because following the herd always works out perfectly in finance.

The Invisible Opportunity

Meanwhile, the other stock-split play operates in Wall Street's blind spot. No coverage, no price targets, no analyst fanfare—just pure market opportunity waiting to be discovered by investors who do their own homework.

Split Decisions

Stock splits continue to capture investor imagination, creating psychological buying opportunities even when the fundamental math remains unchanged. Because nothing says 'smart investment' like celebrating a pizza cut into more slices.

One gets the red-carpet treatment with bullish projections, while the other thrives in the shadows—proving sometimes the best opportunities are the ones Wall Street hasn't ruined with excessive hype yet.

Image source: Getty Images.

In June, O'Reilly did a huge 15-for-1 stock split, its first stock split since 2005. Coca-Cola Consolidated executed a 10-for-1 stock split back in May.

Here's why analysts believe that there's upside for O'Reilly stock and why investors might want to put Coca-Cola Consolidated on their radars even though it's completely off of Wall Street's.

Wall Street is bullish on O'Reilly Automotive

O'Reilly Automotive operates about 6,500 retail stores in North America, selling everything you need for maintaining and repairing used vehicles. There's nothing fancy about this business. But management is consistently able to achieve top-notch operating margins, which currently sit at 19%.

Analysts at TD Cowen are among Wall Street's most bullish on O'Reilly. Last month, the investment firm gave O'Reilly stock a price target of $125 per share, implying about 21% upside from where it trades as of this writing. Price targets usually have about a one-year outlook, so TD Cowen believes O'Reilly stock could see this appreciation before the end of 2026.

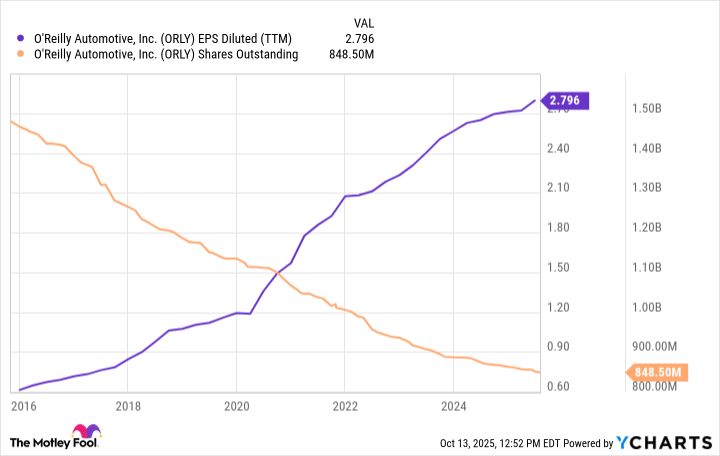

O'Reilly's management expects to have about $2.90 in full-year earnings per share (EPS) in its fiscal 2025, which WOULD represent about a 6% increase from its split-adjusted EPS of $2.73 in 2024. But TD Cowen believes EPS growth in 2026 will be even better, calling for 2026 EPS of $3.30, a 14% increase from management's projections for this year.

To be sure, O'Reilly Automotive continues to grow revenue with new locations and same-store-sales gains. But management repurchases a lot of stock as well, which boosts its EPS. It's a big reason that it's been a long-term winner, and it's something that many investors expect to continue.

Data by YCharts.

Coca-Cola Consolidated is not getting as much attention

According to TipRanks and MarketWatch, there aren't any prominent Wall Street firms currently covering Coca-Cola Consolidated stock. Despite its long-term market-beating performance, it's completely off of Wall Street's radar.

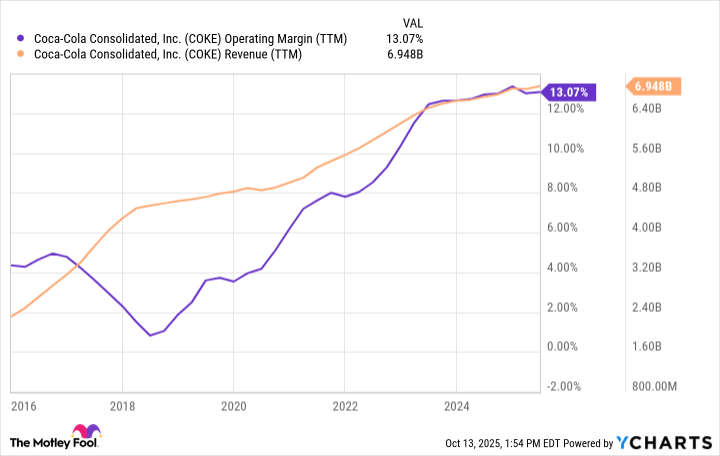

Coca-Cola Consolidated is the largest bottler ofproducts in the U.S., and it has grown substantially over the years by acquiring the rights to distribute in more territories. That seems to be less of an opportunity today compared to what it's been in the past. But management still has ways to increase profits.

In 2025, Coca-Cola Consolidated focused its investments in its own facilities. For example, it invested $90 million in its facility in Columbus, Ohio. Past facility investments have made operations more profitable, boosting overall profits. And this long-term trend has helped make it a winner.

Data by YCharts.

It won't be flashy, which is likely why it gets so little attention. But Coca-Cola Consolidated has a steady business bottling and distributing some of the most well-known beverage brands. Management generates substantial cash FLOW that it invests back in the business. And this often results in higher profits, leading to a higher stock price. That can keep working from here.

The better buy today

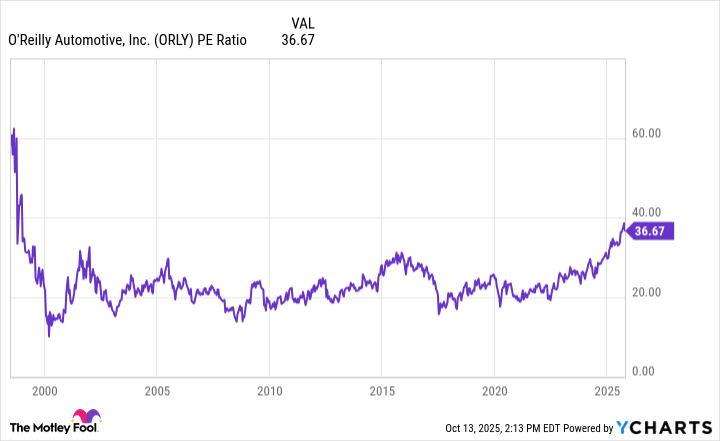

While O'Reilly may enjoy better EPS growth from here, Coca-Cola Consolidated may be a better long-term buy. TD Cowen is perhaps the most enthusiastic about O'Reilly stock from here. But the firm's price target implies it will trade at 38 times its earnings. That's pricey.

Not only is it pricey in absolute terms, but if O'Reilly traded at 38 times its earnings, it would be the most expensive valuation for the stock in nearly 30 years.

Data by YCharts.

Future stock buybacks could make the valuation a little more palatable. But still, the valuation for O'Reilly Automotive is stretched for a low-growth business. Therefore, as much as O'Reilly is a high-quality company, I'd choose Coca-Cola Consolidated stock today. It's also a high-quality business, and the valuation is far more reasonable.