Warren Buffett’s Top Stock Picks: How to Turn $1,000 Into a Fortune Today

Buffett's timeless wisdom meets modern opportunity—discover how a grand can become your gateway to wealth.

The Oracle's Blueprint

Forget complex algorithms and day trading stress. Warren Buffett's strategy boils down to buying wonderful businesses at fair prices and holding them forever. With $1,000, you're not just investing—you're buying ownership in companies built to last decades.

Cash Flow Machines

These aren't speculative bets or trendy tech plays. We're talking about businesses that generate cash like printing presses—companies with wide economic moats, loyal customer bases, and pricing power that withstands market cycles.

The $1,000 Advantage

While Wall Street obsesses over hedge funds and private equity, Buffett's approach remains remarkably accessible. Fractional shares mean you can own pieces of legendary companies without needing his billions—proving once again that the best investment strategies are often the simplest.

Because let's be honest—if traditional finance had all the answers, we wouldn't need an Oracle from Omaha to show us how money really works.

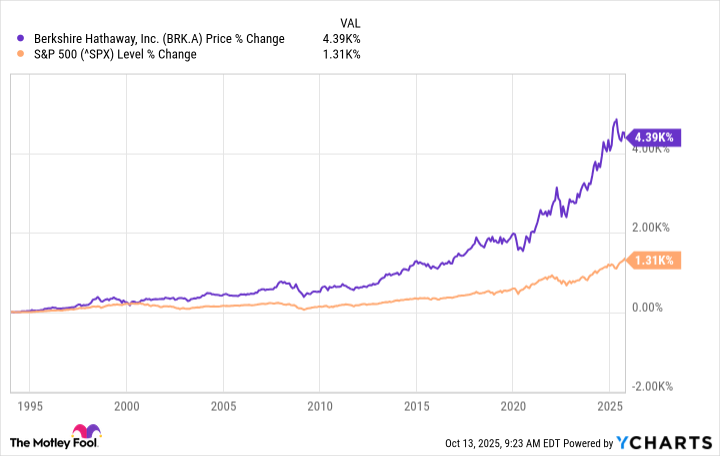

BRK.A data by YCharts

Coca-Cola: Set it and forget it

Warren Buffett's investment approach led him to buy Coca-Cola decades ago, and he has happily kept the consumer staples giant in the portfolio ever since. Coca-Cola is one of the best-known beverage companies in the world with industry-leading distribution, marketing, and R&D strengths. And it is large enough to act as an industry consolidator, allowing the company to keep pace with changing consumer tastes by adding new brands to its portfolio.

A great business, however, can be a bad investment if you overpay, a lesson Buffett learned from his mentor Benjamin Graham. What makes Coca-Cola attractive right now is that it appears attractively priced again. For starters, the yield is 3%, more than twice the level of the S&P 500 index. And perhaps more importantly, the stock's price-to-sales and price-to-earnings ratios are both below their five-year averages, further hinting at an attractive valuation.

A great company like Coca-Cola at a fair to perhaps slightly cheap price is probably worth buying. A $1,000 investment will net you roughly 14 shares. Note that Coca-Cola is a Dividend King, with more than six decades of annual dividend increases behind it. That helps to make it a set-it-and-forget-it type investment for dividend lovers.

Image source: Getty Images.

Chevron: Built to survive

Chevron is one of the largest energy companies on the planet, with a focus on oil and natural gas. These two fuel sources are vital to the normal functioning of the world and most investors should probably have some exposure to the sector. Chevron is one of the ways Buffett has chosen to get his exposure and even conservative dividend investors may want to follow his lead. The key is that Chevron is built to survive in what is a highly volatile sector (thanks to the inherent volatility of energy prices).

There are two big reasons to like Chevron. First, it has a diversified business model with a global portfolio and a business that has exposure across the energy value chain. This helps to soften the hit from the peaks and valleys energy prices go through. The company also has a rock-solid balance sheet, with a very low debt-to-equity ratio of around 0.2 times. That gives management ample leeway to add debt during industry downturns so it can continue to support its business and dividend. The dividend has been increased annually for 38 years.

All in, if you want to follow Buffett into the energy patch, Chevron is a very attractive choice. The dividend yield today is also attractive at around 4.6%, which is well above the energy industry average of 3.2%. A $1,000 investment in Chevron will get you about six shares of the stock.

Pool: Growth is built into the business model

Pool is probably going to be the hardest sell here. It has a modest yield of just 1.7%. The retailer's business has strategic investment risk, since building new pools tends to drop off during recessions. And the stock has fallen roughly 50% from its 2021 highs. But don't skip by without giving some real consideration to this specialty retailer.

Pool sells products that are used to build and maintain pools. Although new pool construction can vary dramatically from year to year, every new pool that gets built has to be maintained (or will turn into a nasty backyard swamp). That gives Pool's business an inherent growth bias, since roughly two-thirds of its sales comes from maintenance products. Adding to the growth story is the fact that Pool is still growing its geographic reach, giving it two levers for a long-term improvement in its business.

If you have a strong constitution, Pool looks like it has interesting turnaround appeal. A $1,000 investment will allow you to buy three shares of what is a fairly high-priced stock.

Don't just follow Buffett's lead

Given Buffett's long-term success, looking at Berkshire Hathaway's portfolio is a great starting point for investors. But don't simply buy what Buffett has bought. He does make mistakes and he's owned some stocks for decades, so they may not be worth buying today even though they were worth buying before.

But it is worth taking some time to get to know Buffett-owned Coca-Cola, Chevron, and Pool. You might just find that they present an attractive investment opportunity and that they fit well with your own personal investment approach.