This 1.4% Yield Dividend Stock Is Poised for Massive 2026 Breakout

Wall Street's sleeping giant just woke up—and it's packing a 1.4% yield that could deliver explosive returns by 2026.

The Dividend Play That Defies Conventional Wisdom

While traditional investors chase flashy tech stocks, this steady performer builds momentum through reliable payouts and strategic positioning. The 1.4% yield represents just the starting point—analysts project significant capital appreciation as market conditions align.

Timing the Perfect Entry

Current valuations create a rare window before the anticipated 2026 surge. The stock's fundamentals suggest it's positioned to outperform broader market indices while maintaining dividend stability.

Because nothing says 'financial genius' like chasing yield in a market that routinely punishes the cautious—except maybe this stock actually making sense for once.

Image source: The Motley Fool.

Novo Nordisk is still thriving financially, but is losing competitive ground

Novo Nordisk's Core specialty is in diabetes, which has served as a gateway to the broader obesity market. GLP-1 agonists, which aid in weight loss by suppressing appetite, have expanded from initially treating diabetes to chronic weight management.

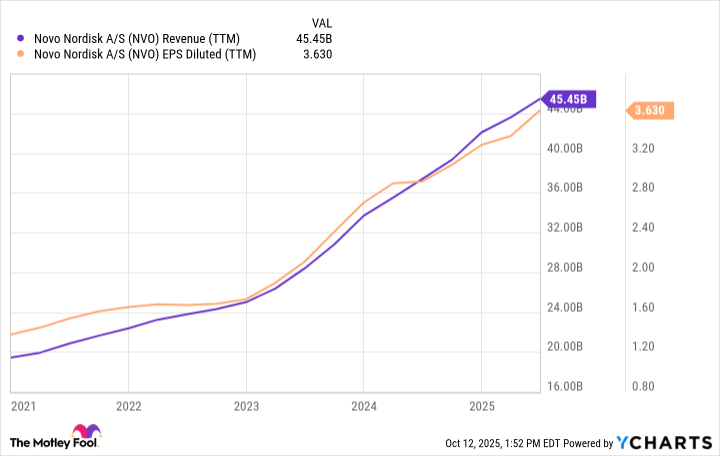

From reading some of the news headlines about obesity drugs, you might guess that Novo Nordisk's depressed stock price indicates the business isn't doing well, but that's simply untrue. As you can see from the chart below, Novo Nordisk's revenue and profits have surged since 2023, when obesity drugs began gaining popularity.

Those concerned about Novo Nordisk's dividend can probably relax. The company's dividend is less than a quarter of its estimated 2025 earnings.

Data by YCharts.

What has weighed on the stock price, though, is that its archrival,, has surpassed Novo Nordisk in the U.S. obesity market.

Novo Nordisk's management team estimates that its obesity drug, Wegovy (semaglutide), has approximately 282,000 total prescriptions in the United States, representing roughly 40% of the total market for branded drugs. Eli Lilly's Zepbound (tirzepatide) surpassed it over the past year, with an estimated 419,000 prescriptions.

How Novo Nordisk plans to fight back against copycat competitors

Additionally, competition has sprung up from telehealth companies selling compounded versions of semaglutide. Novo Nordisk and Eli Lilly struggled to meet the initial demand for their weight loss drugs, allowing other companies to sell compounded versions under an FDA loophole.

After the shortage ended, some telehealth companies continued selling these compounded drugs, claiming it was medically necessary due to their ability to customize dosages for patients. Compounded GLP-1 products have become a controversy, but regulators have not yet taken sufficient steps to remove compounded GLP-1 drugs from the market.

Novo Nordisk acknowledges that compounding is costing it business, and the company even ousted its CEO over the issue earlier this year. While Novo Nordisk may eventually win this battle in court, a faster solution may be to launch a superior product.

Currently, all the popular weight loss drugs and their compounded versions require injections. Novo Nordisk is racing to launch a Wegovy pill, its successful key active ingredient, semaglutide, in tablet form. A tablet WOULD likely appeal to patients more than a needle, and they are generally easier and cheaper to produce and store.

In theory, it could get patients to switch from compounded treatments to the Wegovy pill. Novo Nordisk recently announced that patients experienced an average weight reduction of 16.6% after 64 weeks in a phase 3 trial, and hopes to receive FDA approval to sell the Wegovy pill by the end of this year.

Prediction: sentiment toward Novo Nordisk will take off next year

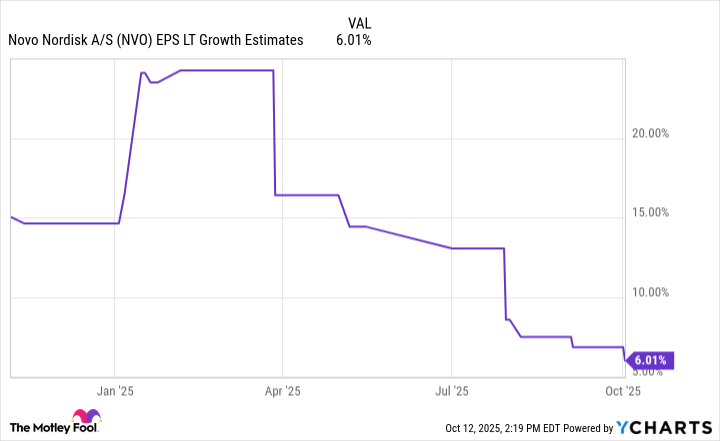

As Novo Nordisk's market share in the obesity drug market slipped over the year, analysts have sharply lowered their long-term growth estimates. Such a steep decline in expectations has dragged the company's share price down with it:

Data by YCharts.

But the funny thing about expectations is that they can change in the blink of an eye.

Novo Nordisk isn't without risks. The company, with its new CEO, must stop ceding market share in the obesity drug market. Eli Lilly is also developing an oral weight loss tablet, likely meaning continued competition.

That said, mid-single-digit earnings growth seems awfully pessimistic, considering the obesity drug market could grow as much as tenfold over the next decade. It's hard to envision Novo Nordisk not growing faster unless the company completely fell out of the market.

Even if Novo Nordisk and Eli Lilly both win regulatory approval for their obesity drug tablets, they might still be the only two companies with oral obesity drugs on the market. These drugs went into shortage once before, so the pie seems plenty large enough to feed two mouths.

More importantly, an oral tablet would be a tremendous boon to Novo Nordisk's efforts to counter telehealth companies selling compounded injectables.

It just seems that Wall Street has gotten too pessimistic. Ultimately, time will tell whether that's true or not. Don't rush to write off Novo Nordisk, though. The stock could soar off its low expectations next year if the Wegovy pill instills confidence in the company.