ETF Blunders Costing You 50% Returns? Here Are the 3 Crypto Alternatives Beating Traditional Finance

Traditional ETFs are bleeding gains while digital assets surge—three critical missteps are sabotaging investor portfolios.

The Diversification Delusion

Spreading across multiple traditional ETFs creates illusionary safety while crypto portfolios delivered 200% returns during recent market cycles.

The Timing Trap

Waiting for perfect entry points cost ETF investors 50% in missed gains—meanwhile, dollar-cost averaging into Bitcoin captured 80% of major rallies.

The Regulatory Runaround

SEC approvals and paperwork delays create friction that decentralized protocols eliminate instantly—because who needs permission to build wealth?

Traditional finance keeps playing checkers while crypto plays 4D chess—your move, Wall Street.

Image source: Getty Images.

1. You have to consider the cost of an ETF

The first exchange-traded fund ever created was the(SPY -2.67%). It tracks the index, as its name implies. There's an alternative from Vanguard that does the exact same thing, called(VOO -2.68%). Since both of these ETFs do the same thing, they are interchangeable, right? Nope.

SPDR 500 ETF has an expense ratio of 0.09%, while Vanguard S&P 500 ETF has an expense ratio of 0.03%. The Vanguard option is materially less expensive to own, given that the SPDR ETF's expense ratio is 3 times higher. But that's just an example using the most basic of investment approaches.

Some ETFs get pretty esoteric and use that to justify higher costs. For example,(YBIT -2.79%) has an expense ratio of 0.99%, which is hugely expensive for an ETF. Sure, the objective of this ETF is unique: "YBIT seeks to generate current income via a synthetic covered call strategy on one or more select U.S.-listed Bitcoin ETPs." I'm pretty sure you would want to do a deep read of the prospectus to do a cost/benefit analysis before buying this particular ETF. But you really need to make sure the costs are worth what you pay when you buy any ETF, or fees could be eating away at your future return potential.

2. What goes up often comes back down

Another big issue to consider is the risk of the investment you are making. Just because something is turned into an ETF doesn't instantly make it a low-risk investment. In fact, there are a lot of fairly aggressive ETFs out there. Take, for example,(QQQ -3.47%). It tracks theindex.

The Nasdaq-100 tracks the 100 largest nonfinancial stocks that trade on the Nasdaq exchange. That does not lead to a diversified portfolio, as you might expect with an ETF. Today, this ETF has roughly 60% of its assets in technology stocks and around 50% of the portfolio in just its top 10 holdings. It is a highly concentrated ETF despite being based on a commonly followed index.

But there are even more focused ETFs out there that can push you into some very high-risk approaches. YieldMax bitcoin Option Income Strategy ETF is one example, but there are a lot more. For example, you can buy an ETF that is focused on GLP-1 inhibitors, a new class of weight loss drugs, with(OZEM -2.03%). That's super focused. But the most interesting ETF story right now is probably(MEME -4.92%), which is also referred to as the Roundhill Meme Stock ETF.

Roundhill Meme Stock ETF isn't actually new. It was first introduced when meme stocks were all the rage on Wall Street a few years ago. It was shut down when that investment theme flamed out. But with meme stocks again in the news, Roundhill has resurrected the ETF, so you can easily invest in "retail-driven, viral meme stocks." It turned out to be a bad risk before, and it seems highly likely that it will be again, as the entire concept is to buy stocks being driven higher solely by investor sentiment.

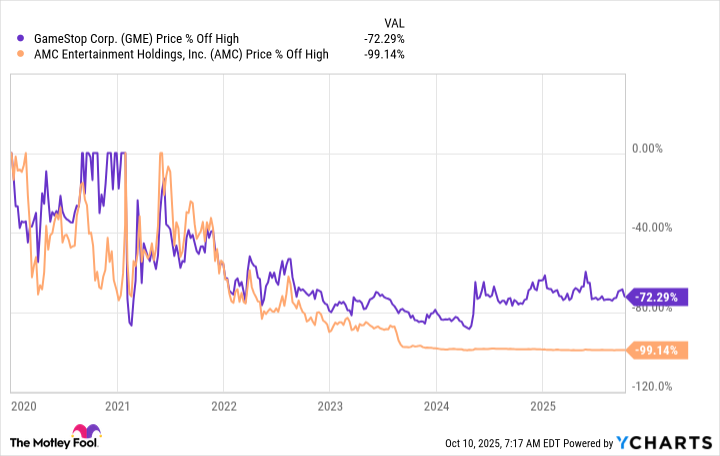

Data by YCharts.

As the chart above highlights, former meme stock darlings andare down more than 50% from their meme-stock peaks. Buy Roundhill Meme Stock ETF at the wrong time and you could end up losing a lot of money, given how volatile meme stocks proved to be the first time around.

3. Diversification matters when you invest for the long term

The last point is a really big picture issue. When you build a portfolio, you should typically try to create a diversified list of holdings. The point is to avoid putting all your eggs in one basket. ETFs can help you do this, but they can also lull you into a belief that you are diversified even when you aren't. Invesco QQQ Trust is a good example where you may not be as diversified as you think when you buy an ETF. But there's another level here to consider.

You need to purposefully build a diversified portfolio, not just try to find the best ETF ideas you can. That means adding ETFs like(IXUS -2.27%) to the mix. This ETF will give you exposure to foreign stocks, which you will likely be short on if you don't purposely look to add them. Foreign stocks often perform differently from U.S. stocks and at different times, which is why they enhance overall portfolio diversification.

One of the key benefits of an ETF is that you can buy a portfolio of stocks with a single trade. If your ETF selection process ignores portfolio-level diversification, you could end up owning a lot of very similar ETFs even though you think you are diversified. If all those ETFs go down in unison, you could end up with material losses you didn't see coming.

Investing in ETFs is easy, but that doesn't mean investing is easy

You have to understand the tools you are using when you invest or you could end up hurting your returns. Exchange-traded funds are no different from any other tool in your investment toolbox. Yes, they make investing easy. But you still need to be careful. If you aren't, you could easily overpay, invest in risky stocks, and ignore basic investment principles such as diversification.