Trump’s China Tariffs Spark These 3 American Crypto Gems to Watch

Washington's trade war just lit a fire under domestic crypto innovation.

Three homegrown digital assets are positioned to capitalize on the new economic landscape as tariffs reshape global finance.

Made-in-USA Blockchain Solutions

These tokens bypass traditional financial gatekeepers while offering tangible utility in cross-border payments and decentralized finance. Each represents American blockchain development at its most ambitious.

Market analysts note these assets have shown remarkable resilience during recent volatility—unlike some traditional stocks that still think blockchain is just something you use to secure your bicycle.

As regulatory clarity improves and institutional money keeps flowing, these three could redefine what 'American-made' means in the digital age.

An 11-bagger performance

Netflix has produced seriously eye-popping returns. This streaming stock has surged 996% in the last decade (as of Oct. 7), meaning investors who bought $10,000 of shares back then WOULD have a position worth nearly $110,000 today. The overall market's return doesn't even come close.

Impressive fundamentals have driven shares higher

It's no surprise that Netflix shares have performed so well, given the company's strong fundamentals. For instance, the business counted 54.5 million paying subscribers on its platform at the end of 2014. At the end of 2024, this figure had exploded to 301.6 million with the streaming service available in more than 190 countries.

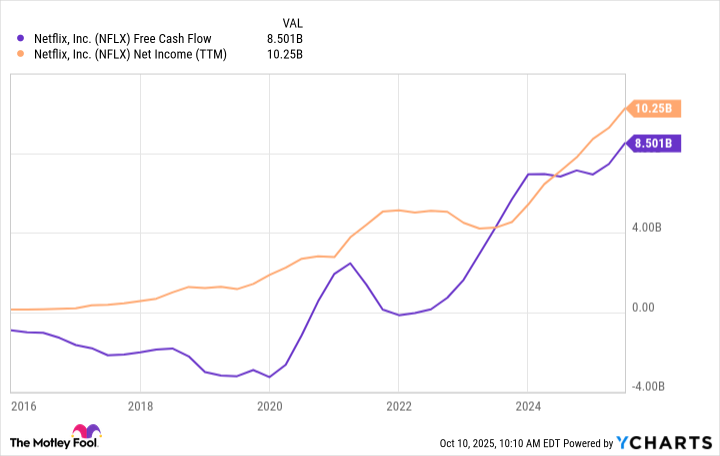

Meanwhile, after struggling with profitability for years due to the company's heavy investments in content, Netflix is now reporting impressive free cash FLOW and net income growth.

Data by YCharts.

Revenue has also soared, and the growth continues to this day with the top line increasing at a double-digit pace for seven straight quarters.

Though investors who buy Netflix stock today shouldn't expect to see another 11-bagger performance over the next 10 years, the company's dominant industry position and rising profitability can still make it a market-beating investment going forward.