The Next Trillion-Dollar Titan: This 470% Gainer Eyes Elite Club With Nvidia, Apple by 2026

A sleeping giant awakens—and Wall Street's elite club is about to get crowded.

The Unstoppable Ascent

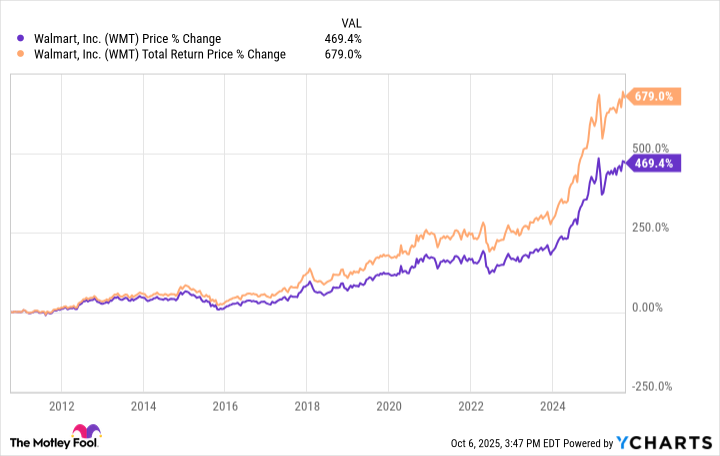

While traditional investors chase yesterday's winners, this stock-split veteran has quietly delivered 470% returns over fifteen years. Now it's positioning to smash through the trillion-dollar barrier within eighteen months.

Joining the Titans

The company isn't just knocking on the door—it's preparing to sit alongside Nvidia, Apple, Microsoft, Amazon, Alphabet, Meta, and Tesla in the most exclusive valuation club in modern finance. Because apparently, what the world needs is another tech behemoth while small caps starve for attention.

Market momentum suggests this isn't mere speculation but calculated domination. The trillion-dollar threshold represents more than just a number—it's the ultimate validation in a market that rewards scale above all else.

WMT data by YCharts.

Stocks that post strong long-term gains, as Walmart stock has, often decide to undergo stock splits, bringing the price per share down due to a higher number of shares overall. Walmart has done this many times in its history, including a 3-for-1 stock split in 2024.

As of this writing, Walmart has a market cap of $820 billion. Therefore, to reach $1 trillion in 2026, it WOULD need to appreciate by about 22% in less than 15 months. Is this really possible? It's not a sure thing, but it may be easier than some investors think.

How Walmart can reach $1 trillion

At a high level, stocks tend to go up when profit potential goes up. Perhaps profit potential goes up because a business is about to reach a new scale thanks to new locations or an acquisition. Or perhaps profit potential goes up because management is about to unlock some operating leverage. But either way, for Walmart stock to go up another 22%, one would expect improvement to its operating income over the next year or so.

Walmart is known for selling millions of products. But retail sales aren't driving growth for the company's operating income. In the earnings call to discuss financial results for its fiscal second quarter of 2026, CFO John Rainey said: "Contributions to operating income are increasingly influenced by a diverse set of interrelated drivers, including improved e-commerce, economics, and business mix, most notably from higher margin areas like advertising and membership fees."

Rainey attributes much of Walmart's operating income growth to e-commerce, an area of the business that's absolutely booming. In Q2, e-commerce revenue was up a strong 25% year over year globally, far outpacing the company's overall revenue growth of about 5%. If e-commerce continues to boom in 2026, it could drive operating income, and the stock price, higher.

Walmart's e-commerce growth provides it with another opportunity: Digital advertising. The company has troves of consumer shopping data and strong relationships with top consumer brands. With more customers transacting digitally, it gives the retailer an opportunity to generate high-margin digital advertising revenue.

Additionally, Walmart recently completed its acquisition of connected-TV company Vizio. This is another channel with which the company can leverage its data and scale to advertise to consumers, which again drives operating income growth.

For what it's worth, Walmart's Q2 advertising revenue was up 46%. Granted, some of the growth was inorganic from the recent addition of Vizio. But the company is growing this revenue stream nonetheless.

In other words, Walmart's fastest-growing revenue streams also happen to be the ones that are driving growth in operating profit. Assuming these trends continue, which I do, Walmart's profits should continue to climb in 2026, providing a boost for the stock price.

To be clear, Walmart might not grow enough over the next 15 months to warrant a $1 trillion valuation before the end of 2026. But directionally, the business appears to be headed for the trillion-dollar club. It doesn't seem to be a matter of if, but rather of when.