비트코인 ETF 순유입으로 강력 반등 시작… 10월 HYPER 기회 포착하라

비트코인 ETF 순자산유입이 시장을 뒤집었다—디지털 골드의 새로운 장이 열리고 있다.

ETF 흐름이 증시를 제쳤다

기관자금이 암호화폐 시장으로 대규모 유입되면서 월가의 회의론자들을 잠재우고 있다. 전통 금융기관들이 이제야 디지털 자산의 가치를 인정하기 시작했는데—조금 늦은 감이 없지 않아—그래도 돈이 움직이는 곳을 따라가는 게 현명한 투자자들의 선택이다.

10월, 모든 것이 바뀐다

하이퍼사이클 국면이 코앞으로 다가왔다. 시장 사이클 분석가들은 이번 주기가 이전과는 완전히 다른 패턴을 보일 것이라고 경고한다. 유동성 폭발이 예고되면서—스마트 머니들은 이미 포지션을 구축하고 있다.

기술적 신호가 말해주는 것

차트가 모든 것을 설명한다. 지지선 테스트, 거래량 폭증, 변동성 압축—모든 지표가 대형 랠리를 예고하고 있다. 이번에는 달라질 것인가? 아마도 그렇다—적어도 월가 수수료 먹는 중개인들이 새로운 수입원을 찾았다는 점에서는.

패시브 인컴을 원한다면? 비트코인을 사서 잊어버려라—인덱스 펀드가 아니다.

Image source: Getty Images.

Want decades of passive income? Buy this ETF and hold it forever.

Buying solid dividend payers in the U.S.

The(SCHD -0.39%) is passively managed and comes with very cheap fees for investors, with an expense ratio of just 0.06%, meaning the annual cost for investors is 0.06% of the fund's total invested assets.

SCHD typically invests in stocks found in the Dow Jones U.S. Dividend 100 Index, which excludes real estate investment trusts (REITs), master limited partnerships, preferred stocks, and convertibles. Stocks included in this index all have a decade of dividends under their belt and a minimum market cap of $500 million. The fund also looks for stocks that are fundamentally stronger than others in their peer group.

The index then evaluates members bases on four key metrics: cash FLOW to debt, return on equity, dividend yield, and five-year dividend growth rate. Most of the largest holdings in the fund are large-cap U.S. stocks with household brands. Here are the top 10 holdings by percentage of total fund assets:

: 4.22%

: 4.10%

: 4.09%

: 4.08%

: 4.08%

: 4.04%

: 4.01%

: 3.99%

: 3.97%

: 3.91%

Just looking at this group above, there are some elite dividend payers here. Coca-Cola has paid and increased its annual dividend for 63 years, while Altria has accomplished the same feat for 56 years. When companies have paid dividends for this long, it becomes a big reason to buy their stock, making it even more imperative that these companies continue to pay and increase their dividends.

I also notice a wide variety of sectors represented among this group above. AbbVie is a pharma company; Chevron is an oil company; Home Depot is largely for home improvement; and Altria Group sells nicotine and smokeless tobacco products, giving investors a group of stocks that will perform differently at different parts of the economic cycle.

Collecting decades of passive income

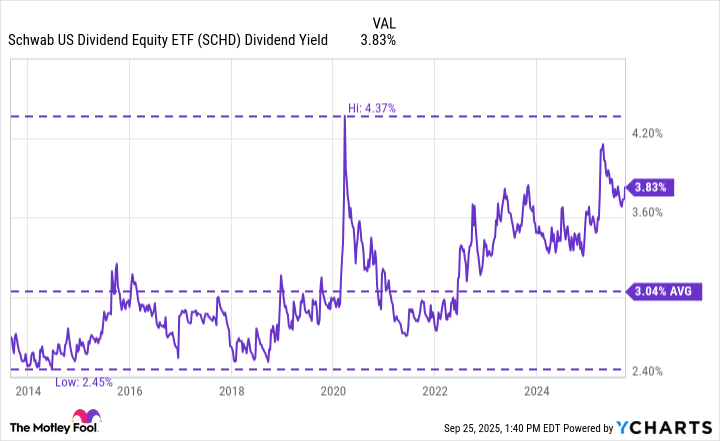

As of Sept. 23, SCHD had a trailing 12-month dividend yield of 3.82%, which is considered strong among dividend stocks. SCHD has been a good dividend payer since launching in 2011, and has generally increased its dividend each year.

However, investors should keep in mind that SCHD's dividends won't always be linear because the fund adjusts to changes in the Dow Jones U.S. Dividend 100 Index, which conducts a reconstitution each year, removing some names that no longer fit the fund's parameters and replacing them with new ones. Still, through its life, SCHD has averaged a good dividend yield.

SCHD Dividend Yield data by YCharts

For a strong dividend payer, the fund also hasn't performed too badly from a price appreciation perspective, and is up close to 50% over the last five years. Now, that's not nearly as good as the broader benchmark, which has more than doubled over the past five years, but it's largely been a bull market.

SCHD isn't likely to outperform the broader market in a bull market, but its reliable dividend should create strong passive income throughout the economic cycle, making it more predictable. The price appreciation is really just a bonus.