GBC Mining: 240% Returns Through Cloud Mining as Bitcoin Eyes $110K Target

Cloud mining operation GBC Mining projects staggering 240% returns while Bitcoin targets the elusive $110,000 milestone.

The Passive Profit Play

GBC's cloud mining model eliminates hardware headaches—no noisy rigs, no electricity nightmares, just pure algorithmic extraction. Their platform claims to turn digital scarcity into tangible wealth while you sleep.

Bitcoin's Ascent Continues

With analysts projecting Bitcoin's march toward $110,000, mining operations stand positioned to capture unprecedented margins. The mathematics becomes simple: higher Bitcoin valuation equals exponential mining profitability.

The Fine Print Reality

Of course, Wall Street would charge you 2-and-20 for returns like these—if they could even deliver them. Meanwhile, crypto mining operations actually generate real yield from verifiable blockchain activity.

Timing the Digital Gold Rush

As institutional adoption accelerates and Bitcoin's supply mechanics tighten, cloud mining represents one of the last accessible entry points for retail investors seeking crypto exposure without direct price speculation.

Image source: Getty Images.

Why does Wall Street see Palantir as a top AI stock?

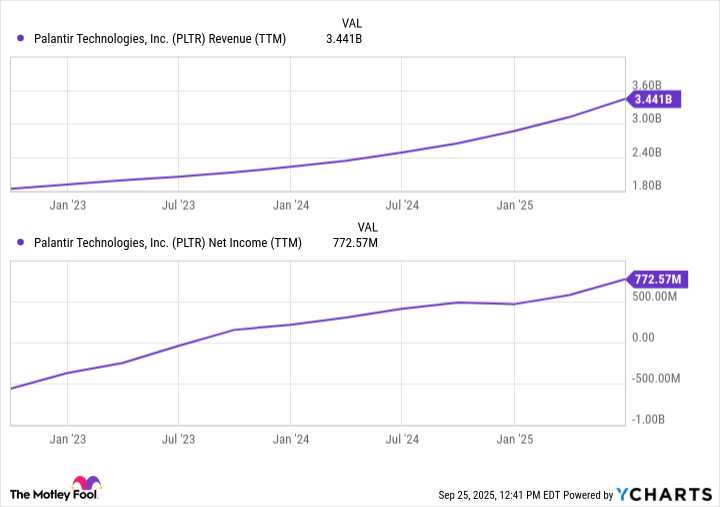

The steepening slopes of both revenue and profit growth are enough to capture investor attention when it comes to Palantir. Generating robust sales is one thing, but sustaining increasingly profitable unit economics places the data mining specialist in rare territory within the software-as-a-service (SaaS) industry.

PLTR Revenue (TTM) data by YCharts

Compelling financials are only part of the story, though. What truly excites Wall Street is where growth is coming from. Palantir's AI suite -- Foundry, Gotham, and Apollo -- has been the backbone of several headline-grabbing contracts this year:

- A deal with the U.S. Army worth up to $10 billion over the next decade

- A $795 million expansion of its Maven Smart System with the U.S. Military, bringing the total deal value to $1.3 billion

- Partnerships with NATO, including a $1.5 billion investment partnership with the United Kingdom

Deals of this magnitude provide Palantir with enviable revenue visibility and long-term cash FLOW durability, qualities that often command a premium valuation to begin with.

What makes Mora's price target increase stand out is her reasoning that, "if it works, it's not expensive." This remark may have been a subtle response toCEO Marc Benioff, who recently criticized Palantir's software as being overly pricey.

In some ways, Mora's justification echoes that of Jim Cramer -- who recently argued that Palantir stock is cheap when measured on its Rule of 40 score.

Palantir's valuation: Breaking down growth expectations

For investors, the takeaway is that some analysts view Palantir's unique blend of financial momentum with accelerating contract wins as enough validation to support a historically elevated multiple.

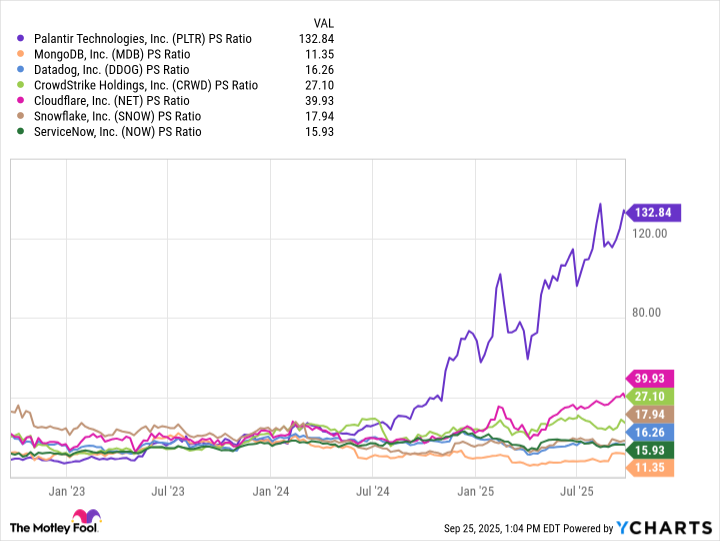

The key observation from the chart below is that Palantir currently trades at a price-to-sales (P/S) ratio of 133 -- a level that towers above its peers in the SaaS sector. On the surface, this simply indicates that Palantir stock commands a premium multiple relative to comparable software businesses.

PLTR PS Ratio data by YCharts

Digging deeper, however, the narrative doesn't change much. Based on Wall Street's consensus revenue estimates over the next couple of years, I've calculated implied forward P/S multiples:

| Revenue | $5.6 billion | $7.6 billion |

| Implied forward P/S multiple | 76.8 | 56.6 |

Data Source: YCharts

Even if Palantir executes perfectly and meets its growth forecasts, its forward valuation still sits well above where its peers trade today.

Is Palantir stock a buy now, or is it priced to perfection?

Viewed through this valuation lens, Palantir's current market capitalization of roughly $430 billion looks stretched. For investors, this raises a critical question: How much of Palantir's future growth is realistically priced into the stock?

If you ask billionaire money manager Stanley Druckenmiller, the answer might be all of it. His fund, Duquesne Family Office, recently liquidated its entire position in Palantir -- likely a MOVE to lock in gains as the stock continued its parabolic climb.

From my perspective, a prolonged pullback feels inevitable. No stock rallies in a straight line forever, and when Palantir eventually undergoes a valuation rerate, its share price could normalize well below today's levels -- with no guarantee of a quick rebound.

In my eyes, Palantir stock is priced to perfection. While momentum traders might be tempted to continue riding the wave higher and stomaching sharp volatility, long-term investors understand that there are more reasonable price points to build a position.