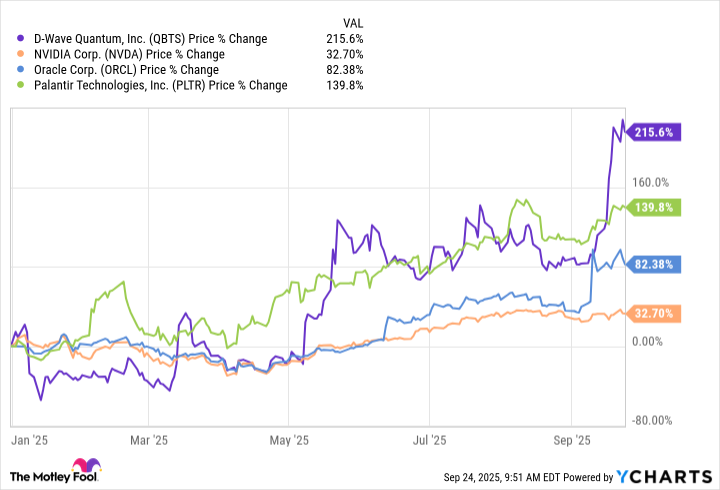

Quantum Computing Titan Obliterates Nvidia, Oracle, and Palantir in Market Performance

While traditional tech giants chase incremental gains, this quantum computing powerhouse continues its relentless market domination.

The Unstoppable Ascent

Quantum computing isn't just theoretical anymore—it's delivering earth-shattering returns that leave established players in the dust. While Nvidia struggles with GPU saturation and Oracle battles cloud competition, this quantum stock keeps defying gravity.

Beyond Conventional Limits

Traditional computing metrics no longer apply when quantum entanglement enters the equation. Processing power that would take classical computers millennia gets solved in hours—and investors are taking notice with their wallets.

Wall Street's Quantum Dilemma

Analysts can't decide whether to upgrade their price targets or their entire financial models. Meanwhile, hedge funds that dismissed quantum as 'science fiction' now face their own superposition of regret and FOMO. Because nothing says 'I told you so' like outperforming every legacy tech stock on the market.

QBTS data by YCharts

With D-Wave rapidly becoming a lightning rod for investor debate and the broader narrative around quantum mechanics, the key question is straightforward: Does D-Wave's meteoric rise represent the dawn of a transformational opportunity, or is it just another bubble waiting to burst?

D-Wave's growth is real, but there's a catch

While quantum computing has captured intrigue, the reality is that its practical utility for AI remains limited today. Put simply, despite enthusiasm that quantum AI could one day revolutionize industries such as energy, financial services, and logistics, the technology is still largely in a research and development stage rather than delivering on its bold commercial ambitions.

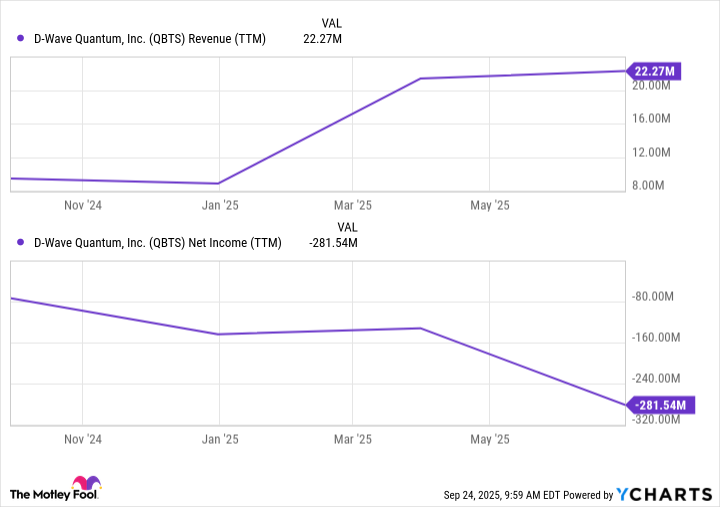

QBTS Revenue (TTM) data by YCharts

These dynamics are on full display in the financial profile above. Over the past year, D-Wave Quantum generated just $22 million in revenue -- with the vast majority of those sales concentrated in a single quarter. Such inconsistency highlights that market demand for quantum AI services remains thin and sporadic.

At the same time, losses continue to mount -- accelerating at a pace that far outweighs the company's modest top-line growth.

This matters because when management touts headline-grabbing growth rates -- such as annual revenue expansion in the triple-digit range -- the figures are inflated by a minuscule baseline. In other words, the law of small numbers is obscuring the reality of D-Wave's fragile fundamentals.

Image source: Getty Images.

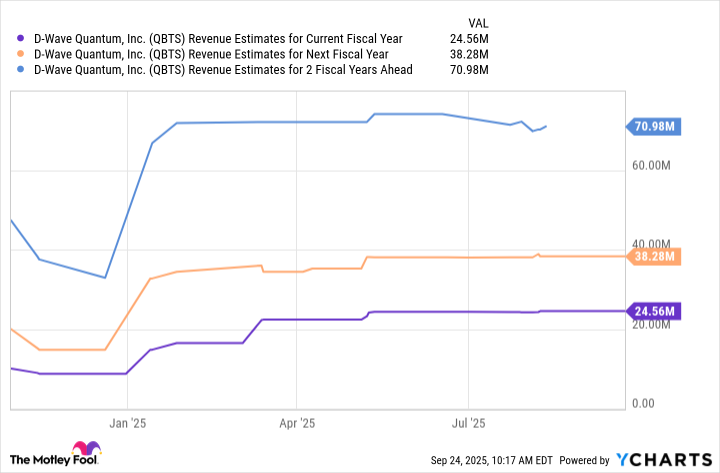

Smart investors understand D-Wave's valuation is unsustainable

In the chart below, I've outlined Wall Street's consensus revenue estimates for D-Wave over the next few years. Even if the company meets its 2027 projection of $71 million in sales, D-Wave WOULD still be trading at an implied forward price-to-sales (P/S) ratio of 130, based on its current market capitalization of $9.2 billion.

QBTS Revenue Estimates for Current Fiscal Year data by YCharts

A multiple of this magnitude is unsustainably high, particularly for a company with persistent cash burn and no tangible path to profitable unit economics. So, what's really happening here?

Much like many penny stocks that get caught in speculative cycles, D-Wave has become swept up in a momentum-driven rally fueled by HYPE over fundamentals. Even the slightest whiff of positive news tied to the broader quantum computing narrative -- such as government funding initiatives -- sparks frenzied buying from retail traders chasing hope rather than sustainable, compounding earnings power.

How can you invest in quantum AI?

While D-Wave will likely continue to attract its share of fanfare, investors seeking durable exposure to the quantum computing opportunity should look elsewhere.

The reality is that hyperscalers like,, andare all actively developing proprietary quantum processors -- positioning themselves to benefit from the upside of commercialization once the technology matures. Meanwhile, Nvidia has extended its CUDA software architecture to run in hybrid classical-quantum environments, further reinforcing its technological moat.

For investors preferring a more passive, diversified approach, exposure to quantum AI is also possible through established blue chips like,, or-- each of which own equity stakes in Quantinuum, a $10 billion quantum computing start-up.

The bottom line is clear: Quantum mechanics remains largely experimental, and investors need not chase hype-driven small caps to participate. There are far more credible avenues to gain exposure to this emerging frontier of AI as opposed to carrying the outsize risk of getting caught holding the bag in unproven, speculative contenders.