Nvidia’s $100 Billion Data Center Bet: The Path to Becoming History’s First $10 Trillion Stock?

Nvidia just placed the biggest bet in tech history—$100 billion on data center infrastructure that could redefine global computing.

The AI Infrastructure Gold Rush

While Wall Street analysts debate traditional valuation metrics, Nvidia's data center gamble positions it at the epicenter of the AI revolution. That $100 billion investment isn't just building servers—it's constructing the digital highways for tomorrow's economy.

Crypto Parallels in Traditional Finance

Much like Bitcoin's disruptive potential in 2017, Nvidia's move represents a fundamental shift in how markets value infrastructure plays. The company isn't just selling chips anymore—it's building the foundational layer for everything from autonomous vehicles to metaverse applications.

The $10 Trillion Question

Can any single stock realistically reach that valuation? Traditionalists scoff while tech visionaries point to the exponential growth curves we've seen in crypto assets. One thing's certain—in an era where digital transformation accelerates daily, betting against technological inevitability has historically been a losing position.

Wall Street still can't decide if this is visionary genius or corporate hubris—but then again, they said the same thing about Bitcoin at $1,000.

Why Nvidia's partnership with OpenAI matters

On Sept. 22, Nvidia announced a letter of intent to supply 10 gigawatts of computing infrastructure to power OpenAI's next generation of models as the company pursues "superintelligence." Put simply, OpenAI requires unprecedented quantities of GPU clusters to train and scale its large language models -- and Nvidia has both the hardware and software that is needed.

Image source: Nvidia.

Building a moat against AMD and hyperscalers

While Nvidia still has first-mover advantages in the GPU market, competition in that area has steadily intensified.offers lower-cost alternatives, while hyperscalers such as,,, andare investing heavily in designing their own custom AI accelerator chips. Yet the OpenAI deal illustrates how Nvidia's competitive moat continues to expand despite these pressures.

The deal underscores Nvidia's dominance in AI infrastructure -- securing long-term demand, revenue visibility, and ecosystem lock-in. By aligning itself closely with OpenAI, Nvidia further embeds itself at the center of generative AI adoption.

In many ways, the agreement functions like a FORM of vertical integration -- ensuring that OpenAI's most advanced models continue to be built upon and optimized for Nvidia's platform well into the future.

The path to a $10 trillion valuation

Because it's a private company, it's difficult to peg the true value of OpenAI. Media reports suggest it could generate around $20 billion in annual recurring revenue by December -- with projections as high as $125 billion by 2029.

Sustaining that type of growth is ambitious, especially given rising competition from Perplexity, Anthropic, xAI, and Gemini. Moreover, achieving these targets will require astronomical expansions in its processing power -- hence the rationale behind OpenAI's deepening alliance with Nvidia.

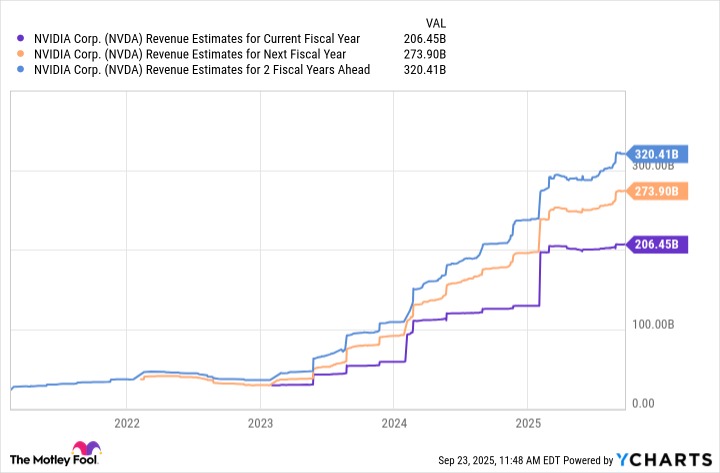

NVDA Revenue Estimates for Current Fiscal Year data by YCharts.

Wall Street currently expects Nvidia to generate $320 billion in annual revenues in 2027. Yet with the Intel and OpenAI deals in hand, that forecast already looks outdated. If Nvidia were to capture even 30% of OpenAI's projected annual recurring revenue, it could add nearly $40 billion of incremental revenue annually.

Perhaps even more significant than the figures above is the underlying signal of these deals: By committing its next-generation systems to Nvidia's backbone, OpenAI -- one of the most influential brands in the AI arena -- is effectively telling the market that Nvidia remains the Gold standard for advanced computing. This endorsement is likely to echo across enterprises, cloud providers, and even government agencies, reinforcing Nvidia's platform as the default choice for AI infrastructure.

This halo effect could push Nvidia's revenues far beyond the current analyst consensus, potentially into the neighborhood of $500 billion by 2030. Applying its three-year average price-to-sales ratio of 28 to that figure implies that by that year, its market cap could be well north of $10 trillion.

Ultimately, precise time frames and dollar figures matter less than the broader takeaway: Nvidia stock continues to look like a durable, profitable, long-term holding for investors seeking exposure to the AI megatrend.