Starbucks Shutdown Strategy: Will Store Closures and Job Cuts Actually Rescue the Stock?

Another day, another corporate restructuring—this time it's your morning coffee ritual getting the axe.

THE PURGE BEGINS

Starbucks slashes stores and positions in a desperate bid to stop the bleeding. The coffee giant's massive restructuring hits main streets and malls nationwide as executives scramble to appease Wall Street.

NUMBERS DON'T LIE (BUT CEO SPEECHES DO)

Store closures stack up while pink slips pile higher. The corporate math seems simple enough—fewer locations plus reduced payroll equals happy shareholders. Because nothing says 'premium brand experience' like boarded-up storefronts and former baristas.

WALL STREET'S BITTER BREW

Analysts sip their lattes while debating whether this surgical strike will actually move the needle. Because if there's one thing finance bros love more than pumpkin spice, it's watching companies cannibalize themselves for quarterly targets.

Will trimming the fat actually save the bacon? Or is this just another case of corporate rearranging deck chairs on the Titanic—with extra whipped cream?

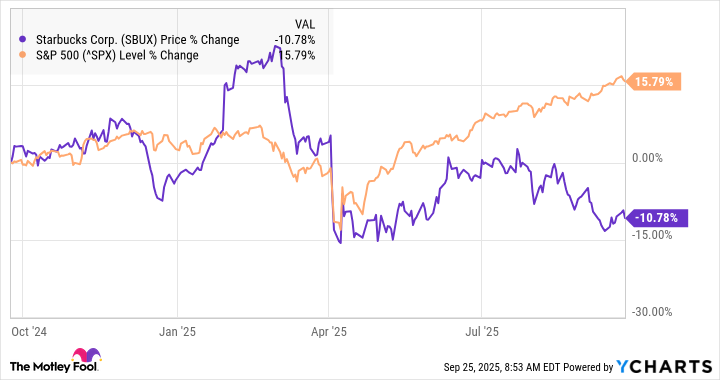

Data by YCharts.

Niccol has done a good job of communicating his strategy, called Back to Starbucks, to investors, and it's received plenty of press coverage. He's tried to bring a human touch back to customer service, encouraging baristas to write messages to customers, making stores more inviting with improved designs and store cleanliness, and even serving coffee in ceramic mugs. He's also focused on solving the bottleneck from the influx of online orders Starbucks gets in the mornings, giving priority to in-store customers.

Those efforts have yielded mixed results thus far, and on Thursday, the company announced the latest update to its turnaround plan. It's closing some stores and laying off some corporate staff.

Image source: Starbucks.

What is Starbucks doing?

In line with the Back to Starbucks plan, Niccol said the company had reviewed its portfolio of coffeehouses and will be closing those that don't "create the physical environment our customers and partners expect, or where we don't see a path to financial performance." He didn't say how many stores the company WOULD close, but the net effect with store openings is a loss of about 200 stores this year, leaving Starbucks with close to 18,300 locations at the end of the fiscal year in North America.

Along with the store closure plan, Starbucks also plans to refurbish over 1,000 locations to "introduce greater texture, warmth, and layered design." Additionally, the company will eliminate 900 non-retail jobs and close many of its open positions.

Niccol expressed Optimism for the store refreshes, saying early results from other "coffeehouse uplifts" have been positive, and adding labor during busy hours is also paying off.

A move Howard Schultz would appreciate

The store-closing and refresh plan is not unlike what Founder Howard Schultz did in 2008 when he returned to the CEO chair. Schultz closed 600 stores, arguing that the chain had overexpanded and some of its locations were stale, not offering the welcoming "third place" the brand was known for.

That move paid off and helped set the stage for Starbucks' next round of growth, resetting the brand and getting its focus back to the things that have differentiated it like customer service, being a comfortable third place, and treating customers to an affordable luxury.

It's unclear if this round of store closures will work the same magic. Starbucks is much bigger and more mature now. It faces a wide range of competition, including from the fast-growingchain.

Can Starbucks turn it around?

What is clear after a year with Niccol at the helm is that any turnaround is going to take time as same-store sales are still declining. Additionally, the company is facing headwinds from weak discretionary spending in the U.S. and a slowing job market.

Niccol seems to be making the right moves, but investors will have to be patient, especially if the economy doesn't cooperate. The stock also still seems to be pricing in a turnaround -- its price-to-earnings ratio is now over 30, which is expensive for a restaurant chain that has been struggling for at least a few years.

In Starbucks' recent earnings report, Niccol expressed optimism for 2026, saying, "We'll unleash a wave of innovation that fuels growth, elevates customer service, and ensures everyone experiences the very best of Starbucks."

At this point, a quick improvement is unlikely. Starbucks investors will have to be patient as Niccol's strategy plays out.