Alphabet’s Biggest Fear Relieved - Is Its Stock Primed for a Massive Rally?

Alphabet just dodged its biggest bullet. Now the real question emerges: will investors finally reward the tech giant?

The Regulatory Overhang Lifts

For years, Alphabet operated under the shadow of regulatory uncertainty. That cloud has now dissipated—clearing the runway for what could be the company's most explosive growth phase yet.

Market Mechanics Favor the Bold

With institutional money circling and retail sentiment shifting, Alphabet's fundamentals appear stronger than ever. The stock's technical setup suggests pent-up demand could unleash a buying frenzy that traditional analysts would call 'irrational'—but crypto natives recognize as standard market behavior.

The Institutional Floodgates

Wall Street's traditional valuation models consistently underestimate tech disruption. Meanwhile, decentralized finance protocols have been pricing in Alphabet's dominance for months—proving once again that blockchain markets often see what legacy finance misses.

Alphabet's rally isn't just probable—it's practically inevitable. The only question is whether traditional investors will recognize the opportunity before algorithmic traders vacuum up all the gains. Typical finance professionals will likely spend the entire rally debating whether it's 'fundamentally justified' while missing the entire move.

Image source: Getty Images.

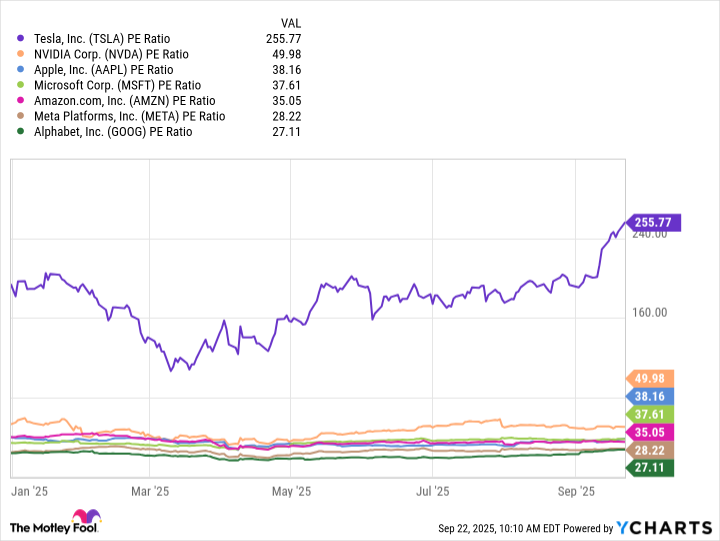

Alphabet is among the cheapest stocks in the "Magnificent Seven"

For a while now, Alphabet has been trading at a discounted valuation relative to its earnings. It hasn't been uncommon for it to trade at a price-to-earnings (P/E) multiple below 20, which is low when you consider the average stock on thetrades at more than 25 times its trailing earnings.

Alphabet has routinely been one of the most undervalued "Magnificent Seven" stocks, and although it has been rallying recently, it's still the cheapest stock based on its P/E multiple, which currently sits at around 27.

PE Ratio of Magnificent Seven data by YCharts.

Alphabet's relatively modest valuation could attract interest from investors who are looking for potentially underrated artificial intelligence (AI) stocks, especially when you consider its growth potential.

A terrific company with stellar growth prospects

Many investors have been worried about Alphabet's growth outlook, fearing the potential of AI chatbots to divert traffic away from websites and search products, which WOULD cut into its ad revenue. Yet despite the rise of this new tech, its business has continued to generate solid results. Through the first half of 2025, Alphabet generated revenue of $186.7 billion, an increase of 13% from the same period last year. And its net income rose by 33% to $62.7 billion.

What's most exciting about the business, however, is what lies ahead. Its own AI chatbot, Gemini, has around 400 million monthly users. The huge advantage the company has over others in the AI space is that it can train its models on YouTube videos. Its video-generation model, Veo 3, features cutting-edge capabilities that make it easy to make AI-powered videos that are virtually indistinguishable from real videos. AI isn't a risk for Alphabet -- it's a massive opportunity.

And then there are its self-driving Waymo vehicles. Alphabet continues to expand its autonomous taxi business into new markets. Earlier this year, Waymo hit 10 million robotaxi trips, and there's a lot more growth to come. I've taken a couple of Waymo rides and can see that there's tremendous potential for this business.

Alphabet has a wealth of growth opportunities, which is why I believe that even if it had to sell off some parts of its business, that wouldn't necessarily be a bad thing for shareholders. Such a result could help it unlock a lot of value, and might result in investors looking more closely at the true worth of its individual business units.

Alphabet's market cap recently hit $3 trillion, and year to date, its shares are up over 30%. But there could be far more upside for the tech company in the long run, given how plentiful its growth opportunities are and how relatively undervalued it still is. For long-term investors, Alphabet should be a no-brainer growth stock to load up on right now.