Alphabet’s Checkmate Move Against OpenAI Just Changed Everything

Google's parent company just dropped an AI bomb that reshuffles the entire artificial intelligence deck.

The Strategic Gambit

Alphabet deployed its latest artificial intelligence breakthrough with surgical precision—targeting OpenAI's core weaknesses while leveraging its own massive infrastructure advantage. The move demonstrates how legacy tech giants can still outmaneuver even the most agile startups when they play their cards right.

Infrastructure Warfare

Google's distributed computing network—spanning data centers across 25 countries—gives Alphabet an edge that makes OpenAI's resources look almost quaint. Meanwhile, Wall Street analysts are already pricing in the 'AI premium' while retail investors scramble to understand what just happened.

The New AI Landscape

This isn't just about better algorithms—it's about scale, distribution, and the kind of market dominance that makes regulators nervous. The chess pieces have been rearranged, and the game just entered its middle phase.

Of course, the real winners will be those who bought Alphabet stock before the AI hype cycle peaked—because nothing fuels innovation quite like watching your portfolio hit new all-time highs.

Analyzing Alphabet's financial fortress

In the table below, I've summarized Alphabet's advertising revenue from Google Search over the past year:

| Google Search revenue (in billions) | $49.4 | $54.0 | $50.7 | $54.2 |

| Growth (YOY) | 12% | 12% | 10% | 12% |

Data source: Alphabet. YOY = year over year.

Given the profile above, there is little evidence that ChatGPT or other large language models (LLMs) represent material headwinds for Google's dominance across the internet. The figures above suggest that advertisers continue to view Google as one of the most effective channels for capturing engagement and attention online.

What's even more critical to recognize is that Alphabet's advertising business operates at exceptionally high profit margins. This profitability provides the company with a powerful buffer. What I mean by that is if LLMs eventually chip away at Google's market share, Alphabet is still well-positioned to absorb the impact by reinvesting this cash FLOW into next-generation products -- a strategy the company is already executing today.

In recent years, Alphabet has poured significant resources into expanding its cloud infrastructure platform to better compete withAzure andWeb Services (AWS). At the heart of Google Cloud Platform (GCP) is its custom-built hardware, Tensor Processing Units (TPUs). These are specialized chips designed to handle advanced artificial intelligence (AI) workloads such as machine learning and DEEP learning.

In a striking development, OpenAI signed on as a major GCP client. The irony here is hard to dismiss: Even if ChatGPT diverts some internet traffic that might otherwise Flow to Google, Alphabet still benefits financially on the back end by powering the very company allegedly threatening its leadership position.

Image source: Getty Images.

Turning Google into an LLM

Alphabet's defensive posture extends well beyond monetization. The company has also integrated its own AI model, Gemini, across its ecosystem.

Within Google Search, users can now toggle into "AI Mode" -- effectively transforming the search experience into an LLM-powered interface. By embedding a ChatGPT-like experience natively into Google, the company layers its own generative AI capabilities into the familiar query box.

This approach delivers two major advantages. First, it preserves ingrained user habits -- making switching to other platforms less appealing. Second, it allows Alphabet to maintain robust advertising economics -- albeit in a reimagined format.

Together, these moves underscore a dual positioning: defending the Core search business while simultaneously profiting from the very companies seeking disruption. Put differently, Alphabet isn't treating LLMs as a binary threat. Instead, the company has created a hedge that few can match -- making money whether users type a query into Google or send a prompt to ChatGPT.

Is now a good time to buy Alphabet stock?

While OpenAI currently commands much of the cultural and technological AI spotlight, Alphabet's response is more than simple defensive insulation. The company is actively reshaping its narrative -- repositioning itself as a business woven together by AI-powered services.

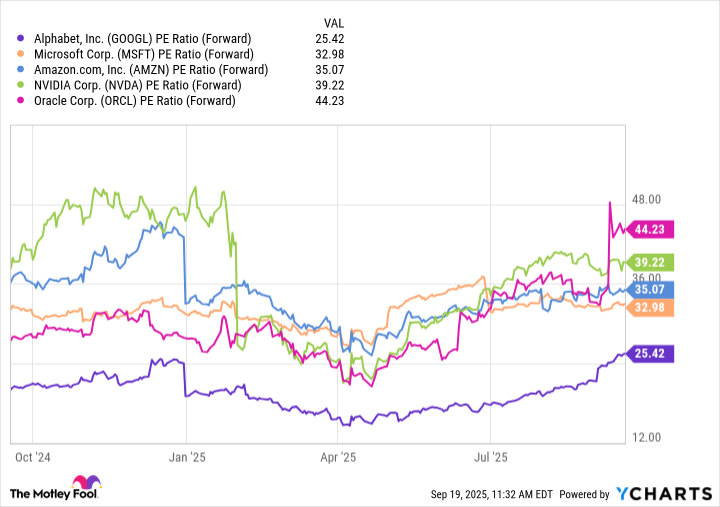

GOOGL PE Ratio (Forward) data by YCharts

The valuation expansion outlined above suggests that investors are now just beginning to recognize the breadth of Alphabet's AI story. Yet, based on forward earnings, the market has not assigned the same premium to Alphabet as other beneficiaries of the AI revolution.

Alphabet may not have declared a "checkmate" against OpenAI, but it has clearly moved past a stalemate. With its shares trading at a steep discount to its peers, I see Alphabet stock as a compelling opportunity as the company's AI investments continue to bear fruit.