ASML vs. Nvidia: Which AI Stock Dominates in 2025?

The AI arms race heats up as chip titans clash for supremacy.

Silicon Showdown

ASML's extreme ultraviolet lithography machines print the brains behind AI revolution—while Nvidia's GPUs give those brains consciousness. One builds the factories, the other operates them. Both stocks surged over 200% since 2023, but Wall Street still can't decide if you should bet on the pickaxe seller or the gold miner.

Supply Chain Sovereignty

Geopolitics reshapes the battlefield. Export controls force AI developers to choose sides—ASML's Netherlands-based tech faces restrictions, while Nvidia designs custom chips to bypass sanctions. The dichotomy creates bizarre alliances where tech giants simultaneously partner and compete with both companies.

Valuation Vortex

Analysts whisper about 'AI bubble' metrics—Nvidia trades at 40x sales while ASML's equipment backlog stretches to 2026. Both stocks priced for perfection, yet either stumble could trigger the classic tech-sector 'valuation correction' (read: mass panic selling).

The verdict? In AI's gold rush, both shovel-makers are getting rich—until investors realize not every startup claiming AI integration actually needs $50,000 chips to automate spreadsheet functions.

Image source: Getty Images.

Reasons to consider ASML stock

Nvidia has captured many headlines, but ASML possesses strengths that make it an attractive AI investment. For starters, it has a monopoly on EUV lithography technology. This tech is what allows Nvidia's chips to hold billions of transistors, which deliver superior computing power and speed.

Netherlands-based ASML generated 28.3 billion euros in 2024, and expects sales to grow 15% in 2025. The company predicts revenue growth for years to come, potentially doubling its 2024 total by 2030, when it estimates sales to reach between 44 billion and 60 billion euros.

Not only does ASML forecast years of revenue growth, it's doing so amid government limitations on sales to China. The China market is expected to contribute around 25% to ASML's 2025 revenue, down from 36% in 2024 due to the export restrictions.

ASML's ability to grow despite geopolitical pressures demonstrates its formidable position in the AI semiconductor chip industry. Its monopoly on the technology needed for the most powerful AI chips means the company is well-positioned to achieve its goal of revenue growth out to 2030.

A look into Nvidia

Nvidia's AI chips have enjoyed incredible success. Sales to data centers, where AI systems are housed, helped the company's revenue soar 56% year over year to $46.7 billion in its fiscal second quarter, ended July 27.

The chipmaker's impressive sales growth is still in its early days, according to CEO Jensen Huang. He sees AI demand increasing over time, stating: "Countries around the world are recognizing AI as essential infrastructure -- just like electricity and the internet."

AI models require massive computing power and speed to perform inference, which represents an AI's ability to analyze and draw conclusions from data. Nvidia meets this need with its latest offering, called Blackwell.

The Blackwell platform sports a superchip, which fuses multiple semiconductor chips together to produce the necessary performance and speed demanded of today's AI systems. It's housed in a rack weighing over one TON that acts as a single, giant computer processor. Mr. Huang noted, "demand is extraordinary" for Blackwell.

But Nvidia's revenue took a hit this year when U.S. government restrictions prevented sales to China, costing the semiconductor giant a hefty $4.5 billion write-off in fiscal Q1 due to unsold inventory. Despite the company's efforts to comply with federal regulations, news outlets now report the Chinese government has blocked the purchase of its chips, effectively locking out Nvidia from the China market indefinitely.

Still, the company expects fiscal Q3 revenue to grow to $54 billion, and that figure excludes sales to China. The result WOULD be a substantial increase from the record sales of $35.1 billion it made in the prior fiscal year.

Choosing between Nvidia and ASML

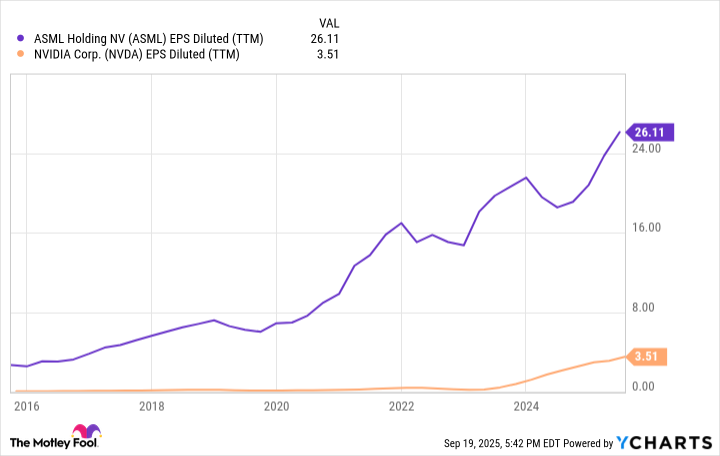

Both Nvidia and ASML boast strengths that make them attractive AI stocks, and that makes deciding between them difficult. One factor to consider is diluted earnings per share (EPS) growth. As the chart below shows, ASML's EPS has grown spectacularly over the years. Meanwhile, Nvidia's EPS has only recently taken off thanks to the emergence of AI.

Data by YCharts.

ASML is poised to continue its EPS growth trend. The company projects gross margin to reach between 56% and 60% by 2030. Its fiscal Q2 gross margin was 53.7%, an increase from the previous year's 51.5%. Nvidia's fiscal Q2 gross margin was 72.4%, but that was a decline from the prior year's 75.1%.

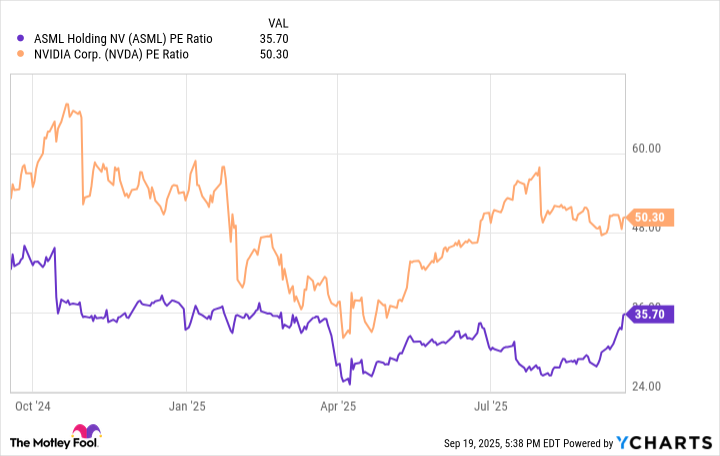

Another consideration is share price valuation, which can be assessed using the price-to-earnings (P/E) ratio. This metric reflects how much investors are willing to pay for each dollar of a company's earnings based on the trailing 12 months.

Data by YCharts.

The chart above reveals that ASML's P/E multiple is lower than Nvidia's, indicating its shares are the better value. This along with its revenue and EPS growth, combined with its tech monopoly, make ASML the superior AI stock to buy.