Why ASML, Applied Materials, and Lam Research Are Absolutely Soaring on Nvidia’s Blockbuster Intel Deal

Nvidia just cut a game-changing deal with Intel—and the entire semiconductor supply chain is exploding upward.

Chip equipment giants ASML, Applied Materials, and Lam Research are riding the tsunami of demand. This isn't just another partnership—it's a fundamental reshaping of the computing landscape.

The Domino Effect

When Nvidia moves, markets tremble. Their latest Intel collaboration sends a clear signal: advanced chip manufacturing capacity is about to get stretched to its absolute limits.

Every major player needs next-generation equipment now. ASML's EUV machines become even more priceless. Applied Materials and Lam Research see order books swelling.

Wall Street's Cynical Take

Analysts scramble to upgrade price targets while quietly wondering if this is another 'build it and they will come' fantasy. The semiconductor cycle giveth, and the semiconductor cycle taketh away—but for now, the party's just getting started.

This partnership doesn't just enable progress—it forces the entire industry to accelerate or get left behind. The real question isn't why these stocks are soaring, but how high they can possibly go before gravity—or the Fed—intervenes.

Image source: Getty Images.

Mechanized manufacturing

Modern chip production includes a lot of moving parts. Nvidia uses a mix of proprietary tools and electronic design automation (EDA) software made by companies liketo develop its chips. Nvidia then passes its design to a foundry liketo manufacture the chip. Inside foundries, you'll find advanced equipment made by companies like Applied Materials, Lam Research, and ASML. These incredibly precise machines are instrumental in transforming a silicon wafer into an engineering marvel.

Applied Materials specializes in the first step, which is depositing material onto chips. Epitaxy is a type of crystalline film that is deposited and grown on top of the silicon wafer to protect it and provide the base LAYER upon which the device is built. The wafer is then coated with light-sensitive photoresist. Lam Research also makes deposition equipment, but it isn't as dominant as Applied Materials.

ASML's DEEP ultraviolet (DUV) and extreme ultraviolet (EUV) lithography machines print circuit designs layer by layer onto the silicon wafer to build out the 3D microchip structure.

Lam Research etching systems remove material from exposed areas to FORM the desired 3D circuit pattern on the wafer. Applied Materials also has etching equipment, but Lam Research is the leader in plasma etching.

Applied Materials and Lam Research also make polishing machines that flatten the wafer like a new floor on a multilayer transistor skyscraper.

After a lot of back-and-forth between deposition, printing, etching, and polishing, the transistors are interconnected. Applied Materials and Lam Research also make the machines that do this step (metal deposition).

ASML is best in class

Fabs and semiconductor equipment makers benefit from the advancement of semiconductor innovation and production demand. For example, Nvidia's and's (AVGO -0.04%) top hyperscaler customers are building data centers in response to surging AI demand, leading Nvidia and Broadcom to ramp up orders from fabs and develop their next-generation chips. This means that fabs need to expand and open new locations with the latest equipment from ASML, Applied Materials, and Lam Research. Therefore, it makes sense why the stock prices of equipment makers WOULD surge following the Intel/Nvidia deal.

ASML is my top buy of the bunch because of its monopoly on EUV machines. The lithography step is arguably the most important in the chip manufacturing process. And while there are other companies that make DUV machines, no company in the world comes close to the level of sophistication in ASML's EUV machines. EUV systems reflect light using mirrors rather than refracting light using lenses. Demand for EUV machines is growing because their precision is essential for fulfilling orders of particular AI chips. EUV machines enable nodes below 3 nanometers, meaning billions of transistors can fit onto a single microchip.

ASML's EXE platform takes the precision a step further with a 2-nanometer Logic node that will reduce process steps and boost efficiency for high-volume manufacturing. ASML expects these high-numerical-aperture (high-NA) machines to be instrumental in the future of chip manufacturing. However, its sales mix is still dominated by DUV machines. In its latest quarter, the second quarter of 2025, ASML sold 76 lithography systems, but just one was high-NA -- the first-ever delivery of a TWINSCAN EXE:5200B system. In the first quarter of 2025, ASML shipped its fifth-ever high-NA system.

ASML stands out as the best semiconductor equipment supplier for investors who believe AI demand will continue to drive semiconductor production. The company is very early in the product lifecycle of high-NA, which presents a compelling opportunity for operating margin expansion and accelerated growth for decades to come.

Building a complete AI semiconductor portfolio

While the chip designers like Nvidia and Broadcom are the stars of the show, it's a mistake to overlook the supporting cast of equipment suppliers. ASML, Applied Materials, and Lam Research play integral roles in the value chain. Without them, fabs would be unable to fulfill complex orders.

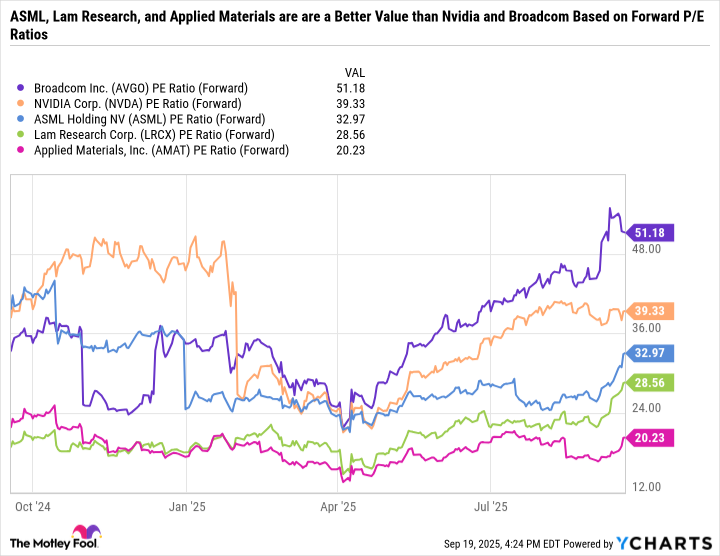

Equipment makers tend to offer good value. Based on forward price-to-earnings valuations, ASML, Lam Research, and especially Applied Materials are cheaper than Nvidia and Broadcom.

Data by YCharts.

All three equipment makers also pay dividends, with ASML and Lam Research yielding 0.8% and Applied Materials yielding 1%. It's not a lot, but it adds a pinch of passive income flavor to strong underlying investment theses.

All told, investors may want to consider building out their AI portfolios with equipment makers rather than just focusing on the glitz and glam of "Ten Titans" stocks like Nvidia and Broadcom.