What China’s Nvidia Chip Ban Really Means for the AI Arms Race

Silicon blockade: Beijing's latest move just rewired the entire artificial intelligence battlefield.

The Hardware Hammer

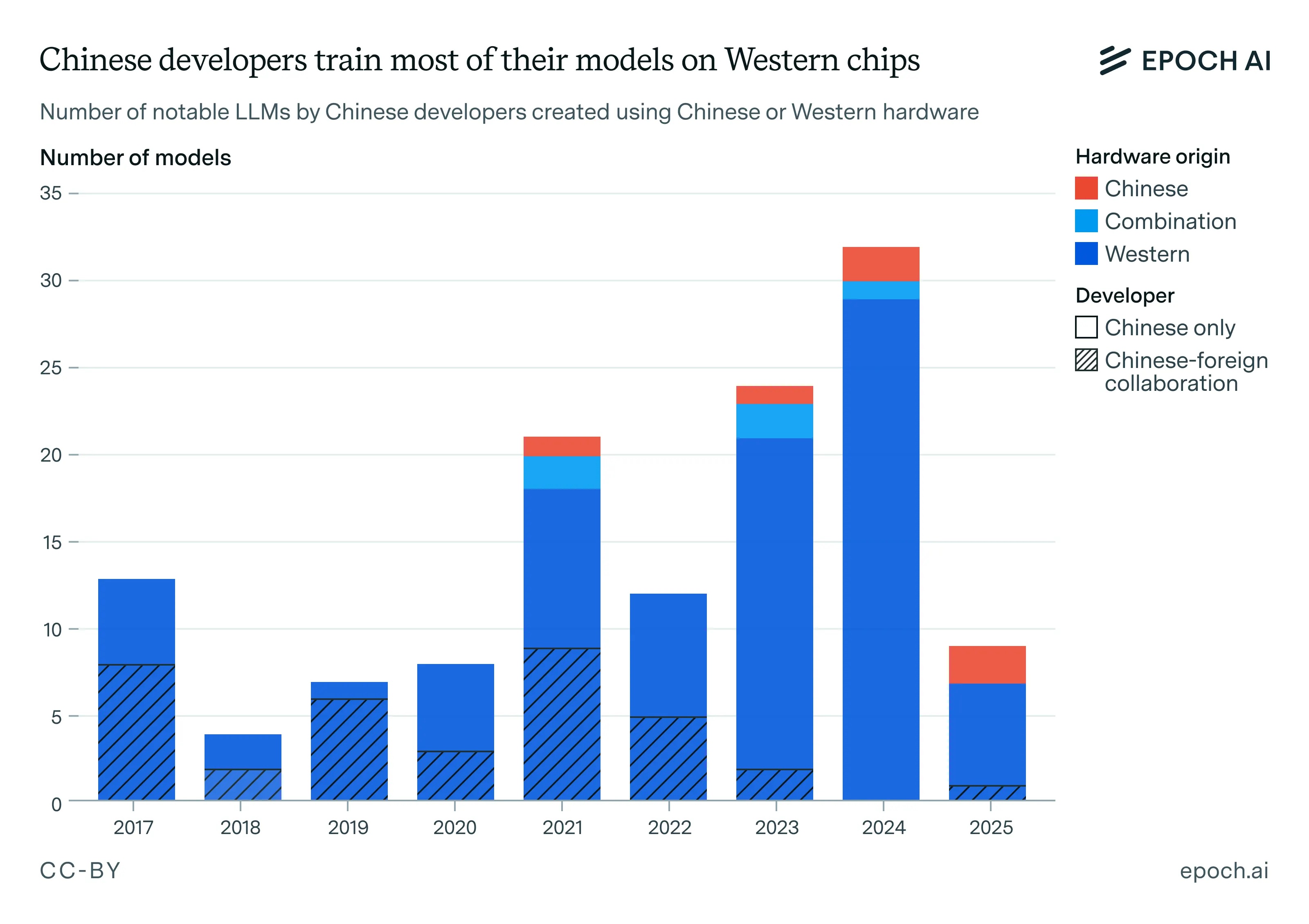

Cutting off access to Nvidia's advanced processors forces China's tech giants into overdrive—developing domestic alternatives or finding shadowy supply chains. No more easy upgrades. No more cutting-edge imports. Just pure, unadulterated innovation pressure.

Global Ripple Effects

Western AI firms gain breathing room as Chinese competition scrambles. Supply chains twist. Chip stocks wobble. And somewhere, a hedge fund manager is shorting the entire semiconductor sector while drinking a $40 latte.

The New Cold War’s Chip Front

This isn’t just trade—it’s tech warfare. Who builds the next generation of AI now hinges on who builds the best silicon. No pressure.

Image: Epoch AI

Image: Epoch AI

The reported directive arrives as Chinese companies had tens of thousands of Nvidia units on order, forcing an abrupt halt to verification work with suppliers. The RTX Pro 6000D is Nvidia's last significant product permitted in the Chinese market by the Donald TRUMP administration.

For Nvidia, the ban eliminates what remained of a market that once generated up to 17% of total revenue. The company’s stock dropped around 4% today, and analysts had previously calculated potential losses of $8 billion to $16 billion annually from trade restrictions in China. The company's China market share for AI data center chips has already plummeted from 90% to 50% as domestic competitors gain traction.

"We can only be in service of a market if the country wants us to be," Nvidia CEO Jensen Huang said Wednesday in London. "I'm disappointed with what I see. But they have larger agendas to work out between China and the US, and I'm understanding of that."

The timing reveals Beijing's growing confidence in its semiconductor sector. Chinese chipmakers plan to triple AI processor output next year, with Huawei's Ascend 910 series leading the charge. While individual Chinese chips don't match Nvidia's most advanced offerings, their cost efficiency allows companies to cluster multiple units for comparable performance—a different architectural approach that sidesteps the need for cutting-edge manufacturing processes China can't yet achieve.

"The message is now loud and clear," an executive at one affected tech company told the Financial Times. "Earlier, people had hopes of renewed Nvidia supply if the geopolitical situation improves. Now it's all hands on deck to build the domestic system."

China vs America: The battle for AI dominance

The ban accelerates what many viewed as inevitable: a bifurcated global AI ecosystem where Chinese and Western companies develop along separate technological tracks, carrying major costs for both sides.

Just for reference, training OpenAI’s AI model GPT-3 consumed an estimated 1,287 MWh (megawatt-hours) of electricity, roughly equivalent to the energy consumption of an average American home for 120 years. Estimates by the coding platform Baeldung show that the company’s latest model, GPT-5, may have taken 3,500 MWh, “equivalent to the annual energy consumption of around 320 average American homes,” the platform argued.

Chinese companies using less powerful domestic chips may face higher electricity costs and longer training timelines for large language models. Conversely, western companies lose access not just to China's market but to the massive datasets and real-world AI applications being developed there.

The country's AI research community, the world's largest by publication volume, has increasingly focused on efficiency rather than raw computing power—developing techniques that extract more performance from available hardware rather than requiring the most advanced chips.

This is how DeepSeek R1 was born, and this is how a model created with a fraction of the investment costs thrown by western AI behemoths like OpenAI, Google, or Anthropic, was able to release and open source a model capable of beating their state-of-the-art products, offered at premium prices.

We are living in a timeline where a non-US company is keeping the original mission of OpenAI alive - truly open, frontier research that empowers all. It makes no sense. The most entertaining outcome is the most likely.

DeepSeek-R1 not only open-sources a barrage of models but… pic.twitter.com/M7eZnEmCOY

— Jim Fan (@DrJimFan) January 20, 2025

Taking the fight to the software front

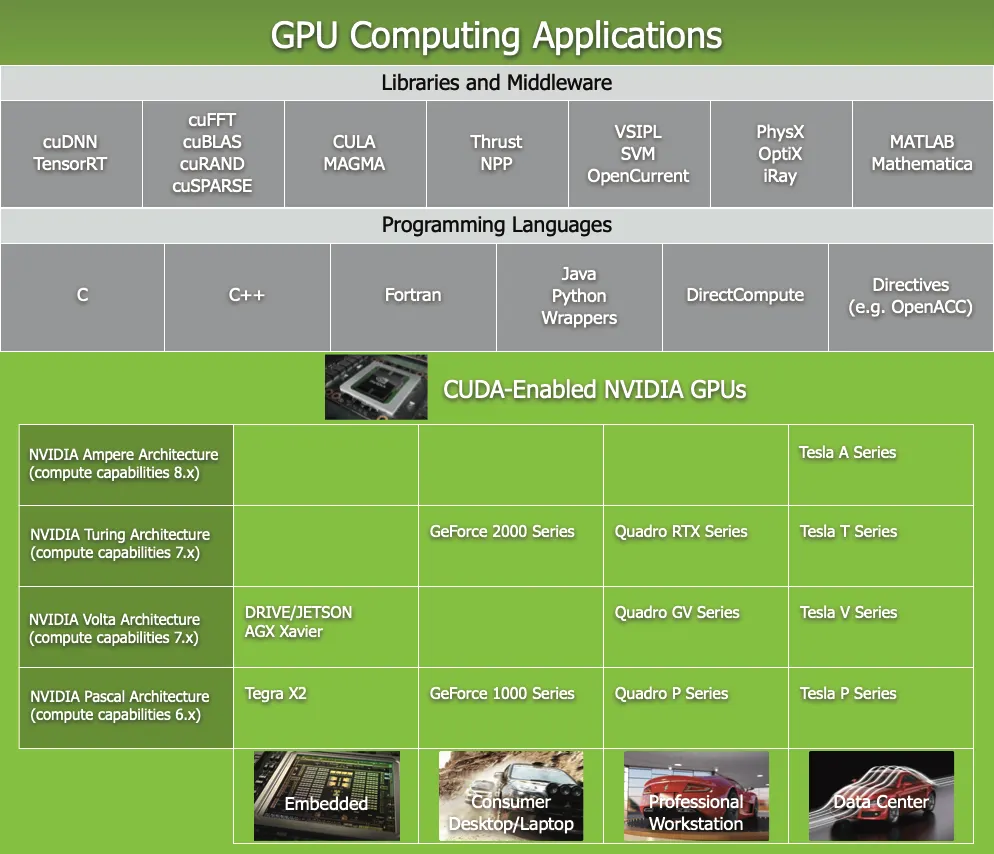

The split also impacts the broader technology stack. AMD's ROCm platform and other alternatives are challenging CUDA's dominance by offering open-source alternatives that work across different hardware architectures.

CUDA is a parallel computing platform and programming model created by Nvidia, allowing software to use the massive processing power of its own GPUs for tasks like artificial intelligence and scientific computing, making these operations much faster and more efficient. It is currently the standard used for AI training, with developers working with this tech by default.

China's emphasis on developing CUDA alternatives could accelerate the creation of hardware-agnostic AI frameworks, potentially benefiting the entire industry by breaking Nvidia's software lock-in that has left technically superior hardware like AMD's GPUs underutilized in AI applications.

Right now, if your card doesn’t run CUDA (meaning, it’s not Nvidia) you better go back to gaming and leave AI training to the grown ups—or know you’ll deal with AI at painstakingly slow speeds.

The country's massive AI research output has created a foundation for rapid iteration and improvement. Chinese universities like Tsinghua and Peking have emerged as global AI research powerhouses, with Tsinghua ranking eighth globally in AI research output ahead of institutions like Facebook AI Research and Princeton, according to Peking University.

"The top-level consensus now is there's going to be enough domestic supply to meet demand without having to buy Nvidia chips," an industry insider told the Financial Times.

Nvidia warned analysts to exclude China from financial projections going forward, essentially writing off what had been one of its fastest-growing markets. The company continues exploring options but acknowledges that political dynamics now override commercial considerations.

The ban goes beyond earlier regulatory guidance from the government, which simply encouraged companies to move away from Nvidia. Before the ban, Trump agreed to let Nvidia sell its nerfed chips in exchange for 15% of its profits from those sales.