Bitcoin Search Interest Plummets to 11-Month Lows While Gold Prices Soar - What This Divergence Really Means

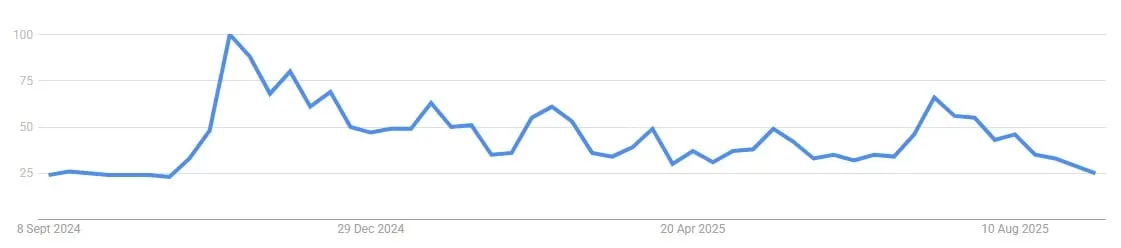

Bitcoin's Google search volume just cratered to levels not seen in nearly a year—right as gold continues its relentless climb upward.

The Search Divergence

While gold captures traditional investors' attention with its steady ascent, Bitcoin searches hit their lowest point in eleven months. That eleven-month search low tells its own story—one of shifting attention rather than declining relevance.

Market Signals vs. Search Trends

Search metrics rarely tell the full story. Remember—Bitcoin has always moved contrary to mainstream attention cycles. Retail interest wanes while institutional infrastructure keeps building behind the scenes.

Gold's Traditional Allure

Gold's climb represents the safe-haven play—the predictable, comfortable choice for investors who still think digital gold can't compete with the physical kind. Meanwhile, Bitcoin's underlying network activity tells a completely different story than search trends would suggest.

The Real Story Behind the Numbers

Eleven months of declining search interest might look bearish—until you realize Bitcoin has historically rallied hardest when everyone stopped watching. The market has a funny way of rewarding those who look beyond surface-level metrics.

Because nothing says 'sophisticated investment strategy' like chasing the asset that's already hit headlines—gold's performance almost makes you forget its centuries of underperformance compared to… well, everything else.

U.S. Google Trends data for "Bitcoin." Image: Google

U.S. Google Trends data for "Bitcoin." Image: Google

The performance between the two assets reflects this diverging trend, with Gold up 38% since the start of 2025 compared to Bitcoin’s 18%.

“This divergence reflects a fundamental shift in investor psychology toward safety over speculation amid heightened macroeconomic uncertainty,” Derek Lim, head of research at Caladan, told Decrypt.

Bitcoin has stagnated since May 2025, trading around $111,565, according to CoinGecko data. Gold, on the other hand, hit $3,613.48 today.

Search interest is "cyclical” and driven by “retail attention spikes," Shawn Young, chief analyst at MEXC, told Decrypt. “Macro drivers such as the Fed rate-cut expectations, dollar weakness, and central-bank buying are powering gold to fresh records,” he explained.

Lim highlighted Bitcoin's 15% lag below its all-time high in gold terms, underscoring the precious metal’s edge in risk-off environments, which are driven primarily by its "established narratives" and "universal acceptance."

Gold hits record high: what next for Bitcoin?

Analysts have previously highlighted a lead-lag dynamic, where gold rallies precede Bitcoin's outsized moves.

"Gold often moves first and then Bitcoin follows and outperforms," Lawrence Lepard, co-founder of Equity Management Associates LLC, posted in an August tweet.

VanEck’s head of digital asset research, Matthew Sigel, echoed this sentiment in a tweet Saturday, stating that, "every gold rally sparks the same pattern: bitcoin breaks out bigger."

Every gold rally sparks the same pattern: Bitcoin breaks out bigger. pic.twitter.com/ylzi2BAxP8

— matthew sigel, recovering CFA (@matthew_sigel) September 6, 2025

Leopard predicted a gold breakout above $3,500 as a "prelude to $140,000 Bitcoin."

Experts are cautiously optimistic. They expect Bitcoin and gold’s lead-lag pattern to persist if macro catalysts align.

Lim identified Fed rate cuts as a key trigger that could renew risk appetite and favor Bitcoin's "higher-beta characteristics."

Young requires sustained reflation expectations including moderated central bank gold purchases, as well as on-chain signals, to "flip marginal allocation from bullion back to Bitcoin."

Both see rotations accelerating in risk-on shifts.

The consensus is bullish for Bitcoin's inflation-hedge narrative, with Lim forecasting a $120,000 to $150,000 target in 2025, with outliers to $200,000 in rotation scenarios.

Young projects $125,000 to $250,000 in a moderate bull case, driven by ETF trends and policy.

Lepard, however, envisions $250,000 alongside $10,000 gold amid fiat erosion, positioning Bitcoin as an "escape hatch" for growth cycles.

Traders on prediction market Myriad, launched by Decrypt's parent company DASTAN, are less optimistic; almost 60% expect gold to outperform Bitcoin in 2025.