Will Bitcoin ETF Inflows Break BTC’s September Curse?

Bitcoin faces its historical September slump—can institutional ETF flows rewrite the script?

The Seasonal Struggle

September traditionally hammers crypto returns. Bitcoin's track record this month reads like a horror story—multiple double-digit declines that make traders flinch. The pattern persists year after year, creating a self-fulfilling prophecy of cautious sentiment and sell pressure.

ETF Cavalry Arrives

Enter spot Bitcoin ETFs. These financial vehicles channel institutional money directly into BTC, creating a counterforce to retail panic. Massive inflows—billions pouring in weekly—provide structural support that simply didn't exist in previous cycles. This isn't your 2017 bull run; this is Wall Street meets crypto.

The Tug-of-War

Will ETF demand outweigh seasonal selling? The numbers suggest a showdown. Historical outflows during September periods now face unprecedented institutional accumulation. It's algorithmic traders versus diamond-handed funds in a battle for Bitcoin's monthly close.

Market Irony

Nothing makes traditional finance types happier than packaging decentralized assets into regulated products—they'll commoditize rebellion itself if it prints fees. Yet this very institutionalization might be what saves Bitcoin from its annual autumn blues. The ultimate irony? Wall Street rescuing crypto from itself.

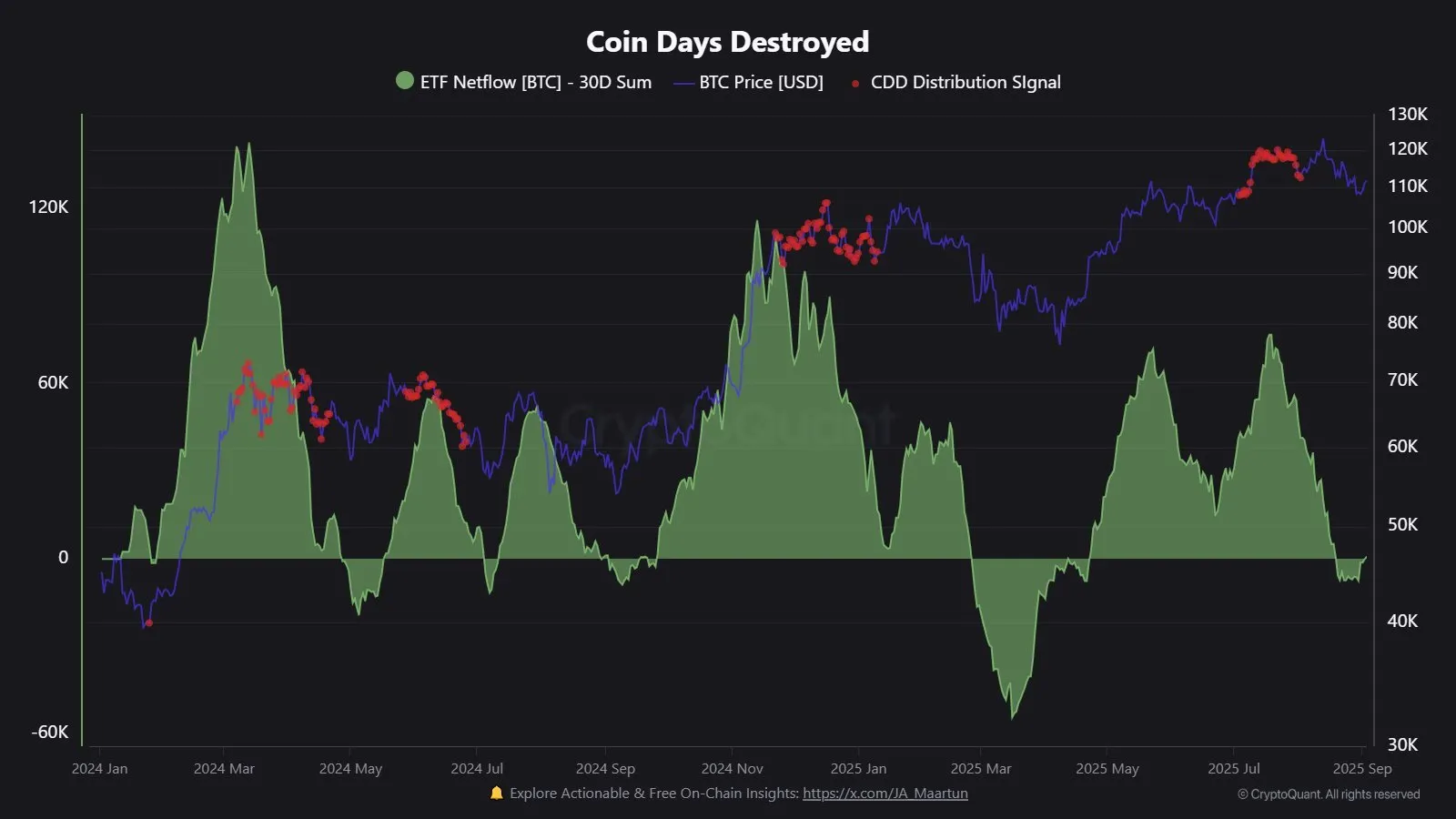

Source: Cryptoquant/JA_Maartun

Source: Cryptoquant/JA_Maartun

“Visually, the chart makes it clear that there is a major redistribution taking place: bitcoin is moving from long-term holders into new addresses managed by ETFs,” he told Decrypt. “As ETFs create demand, supply is being provided by old holders.”

Bitcoin ETFs, first approved by the SEC in January 2024 after more than a decade of denials, allow investors to gain exposure to BTC without the need to buy, hold, and store Bitcoin directly, avoiding the complexity of crypto exchanges and wallets. BlackRock's Bitcoin ETF alone now holds over $83 billion in assets under management.

Recently, though, Bitcoin ETFs have been rebounding after lagging compared to Etheruem ETFs. BTC funds have just recorded two consecutive days of inflows exceeding $300 million, totaling $633.3 million across both sessions—the strongest two-day performance since early August.

And if a lot of that is being fueled by longtime HODLers converting their Stacks into ETF shares, as Maartunn hypothesizes, it’s pretty unusual.

“This redistribution is quite unique,” he said. “We’ve already seen three such periods—summer 2024, fall 2024, and summer 2025. In previous cycles, this usually happened only once.”

He added that ETF flows could be a strong predictor of whether Bitcoin manages to escape a Red September—even if it did just see a Red August. A month (or any other period time) is considered red if an asset ends at a lower price than it started.

Over the past 12 years, September has been a down month for Bitcoin eight times. But the past three years, the crimson shifted to August, and September was green.

“ETF flows will be decisive,” Maartunn said. “As long as strong new inflows are lacking, I don’t expect anything spectacular. Demand needs to pick up, otherwise there’s a risk that new holders may add selling pressure—either if their average purchase price comes under strain, or simply because too little is happening.”

But there’s other big market players to consider, like Bitcoin treasury companies, according to Rick Maeda, a research analyst at Presto Research. He’s especially interested in ones like Japan’s Metaplanet, which has sworn off ever selling its BTC stash.

“If we do get a Red September I WOULD expect Metaplanet to lean into it, not step back,” he told Decrypt. “They have said they will never sell, and CEO Simon Gerovich has repeated that point. Their acquisition cadence is programmatic. Even after the 25–30% drawdown in Q1, their buys did not slow.”

In the past week, though, Metaplanet has faced headwinds. On Monday, the company’s shareholders approved an $884 million capital raising proposal, although the firm’s stock dropped 60% since mid-June.

During the same meeting, the company announced it had acquired 1,009 BTC for approximately $112.2 million, bringing its treasury to exactly 20,000 Bitcoin. At current prices, the BTC stockpile is worth roughly $2.2 billion.

On Myriad, a prediction market created by Decrypt’s parent company Dastan, users are still skewing pessimistic about which price milestone Bitcoin hits next: $125,000 or $105,000. The odds flipped several times in August, but now show that 65% of users think Bitcoin will drop to$105,000 before it rallies above its all-time high.

And last month, only one in four of the 1,900 investors polled by Binance Australia estimated that Bitcoin will top $150,000 in the next six months.

Half of those polled said that BTC will maintain between $100,000 and $150,000 over the same time period. Half the users—who were polled between the end of July and August 10—told the exchange they intend to increase their Bitcoin holdings.

But there could be a shift in sentiment in two weeks’ time, Gadi Chait, head of investment at Xapo Bank, told Decrypt.

“The Federal Reserve's September meeting is a dominant macro catalyst,” he said, alluding to the September 16 and 17 Federal Open Markets Committee meeting. “With a potential US rate cut on the horizon, liquidity conditions could ease, increasing demand for risk assets and potentially boosting Bitcoin by 5-10%.”