Bitcoin Hash Rate Shatters Records While Price Stagnates - Here’s Why It Matters

Bitcoin's network power just hit unprecedented levels while its price remains stuck in neutral—creating a fascinating divergence that has crypto analysts buzzing.

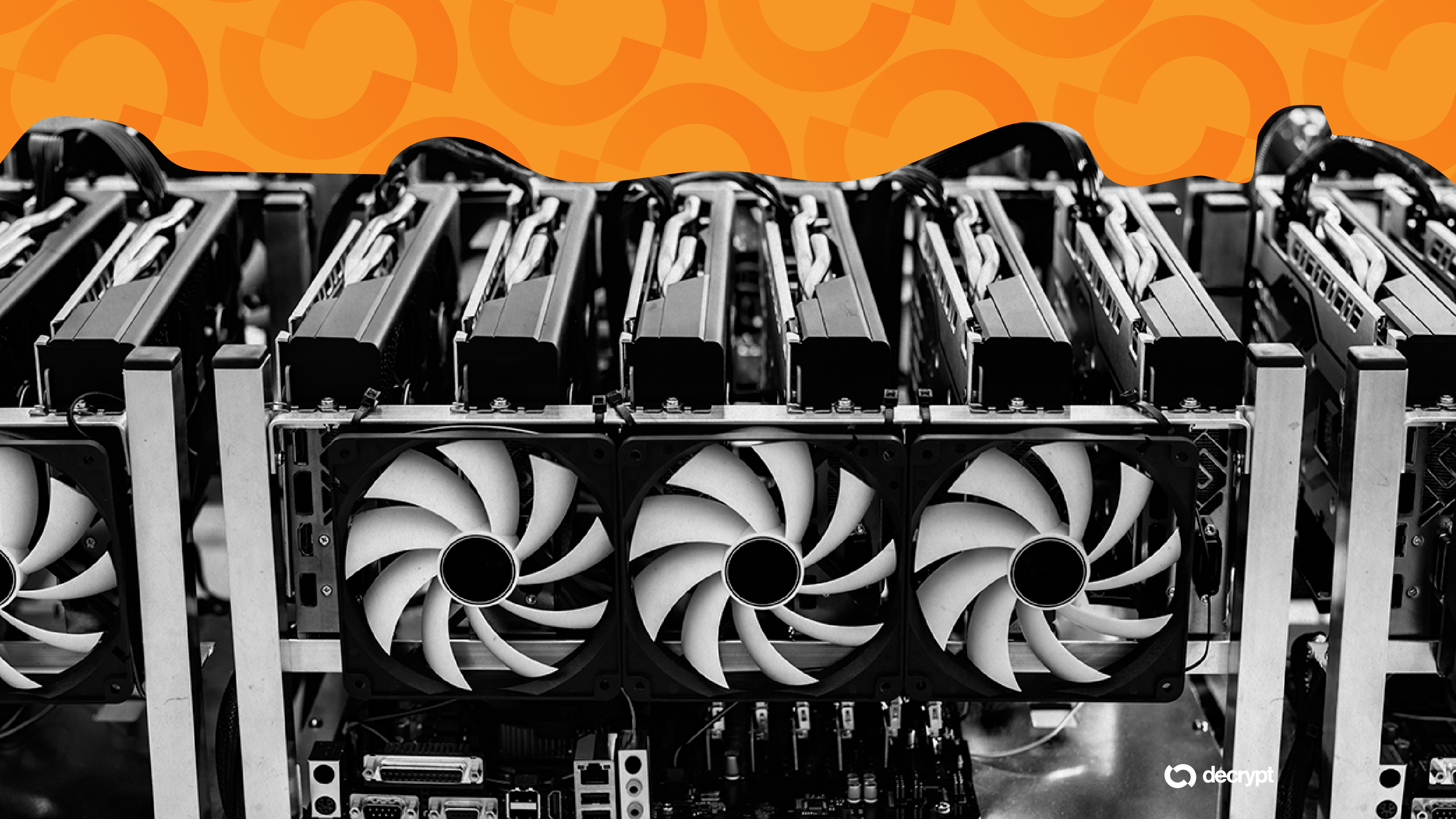

The Hash Rate Surge

Mining operations worldwide are pouring unprecedented computational power into securing Bitcoin's blockchain. This record-breaking hash rate signals massive institutional confidence in Bitcoin's long-term viability, even as short-term price action disappoints retail speculators.

Network Security Overdrive

Higher hash rates mean exponentially greater security against attacks—making Bitcoin's blockchain practically impregnable. Miners are betting big on future appreciation, absorbing current operational costs despite stagnant prices.

The Price Paradox

While traditional finance pundits focus solely on price movements, savvy crypto veterans understand that hash rate often leads price action. Historical patterns suggest these infrastructure investments typically precede major bullish breakouts.

Wall Street's favorite pastime? Watching digital gold being forged while complaining about the furnace temperature. Meanwhile, Bitcoin's foundation grows stronger by the minute.