Ghost Month Returns - Will Bitcoin Buck the Trend? Here’s What You Need to Know

Bitcoin stares down spooky season as crypto's ultimate stress test begins.

Ghost Month's Back—And Traders Are Spooked

The lunar calendar's most feared period hits markets just as Bitcoin flirts with key resistance levels. Forget technical analysis—superstition drives more portfolio decisions than most fund managers admit.

Historical Patterns Versus Digital Reality

Traditional assets typically bleed during Ghost Month, but crypto's 24/7 global nature laughs at regional superstitions. Still, Asian trading volumes dip noticeably—proving old habits die harder than bear markets.

Institutional Money Doesn't Believe in Ghosts

BlackRock's IBIT keeps sucking up coins regardless of lunar cycles. Wall Street's quantitative models override centuries of tradition—though you'd never know it from their panic during Fed announcements.

The Ultimate Contrarian Play

Buying during superstition-driven selloffs beats chasing FOMO pumps every time. Ghost Month might be finance's last remaining discount not arbitraged away by algorithms—for now.

Whether you're stacking sats or shorting sentiment, remember: the only real ghost in this market is the 'risk management' your broker promised.

👻 Ghost Month Returns: Will Bitcoin Buck the Trend?

Ghost Month begins in 3 days.

And historically, that’s been bad news for Bitcoin.

📌 What Happened

The 7th lunar month, known as Ghost Month, kicks off this weekend (Aug 23 – Sep 20).

In many Asian cultures, it’s a time when spirits are believed to roam the earth - and when investors traditionally avoid making big financial moves.

This superstition has bled into markets, and the data backs it up:

So far in 2025, Bitcoin has already slid about from its $124K peak, with open interest dropping sharply. And notably, it’s sold off during the Korean open (~7 pm ET) every day this week.

📝 By The Numbers

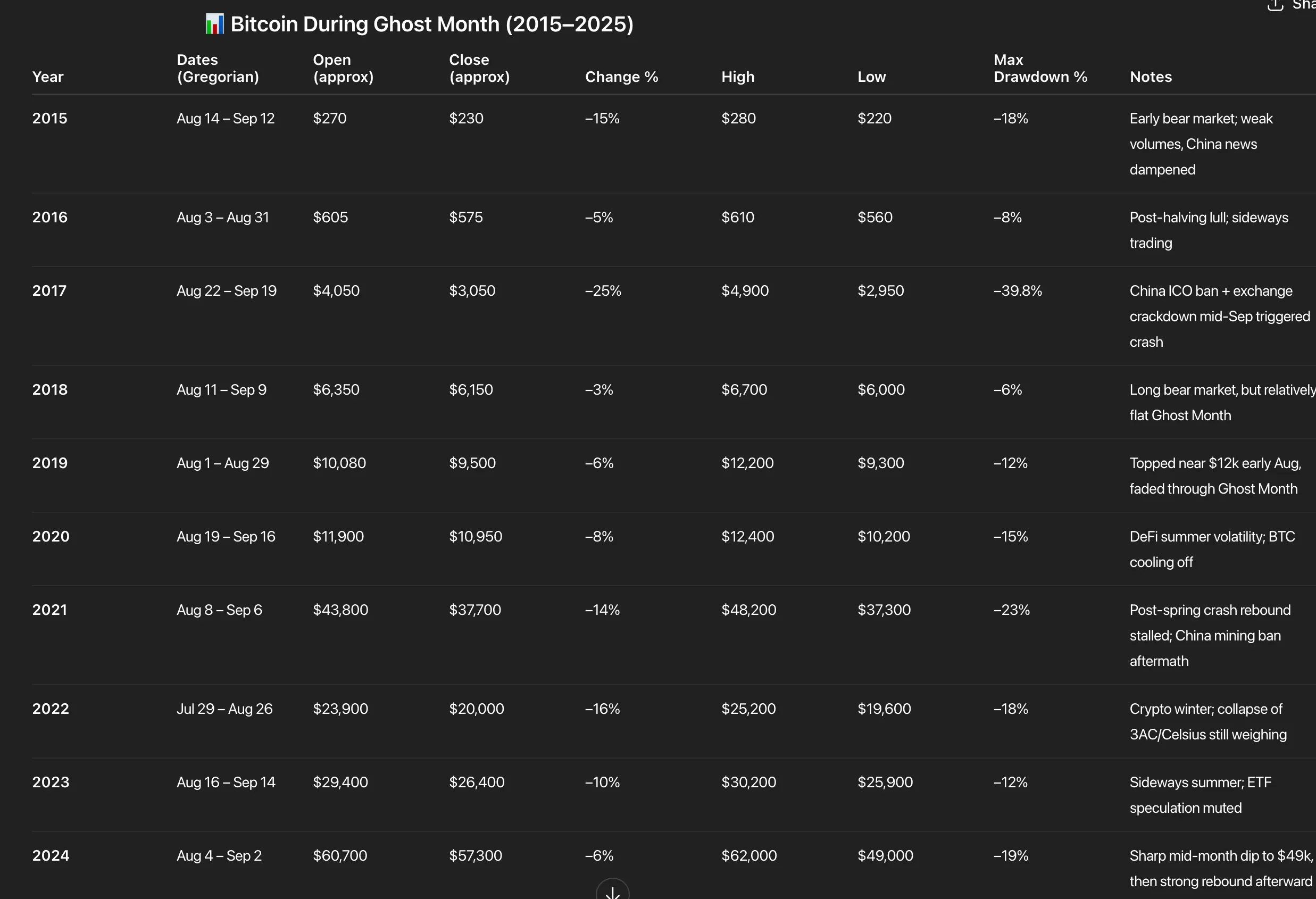

Here’s a year-by-year breakdown of Bitcoin’s performance during Ghost Month since 2015.

Yeah - it’s not great.

🧠 Why It Matters

Of course, past performance is not representative of the future.

But… a 10-year sample size with similar outcomes seems telling.

The wildcard this year - Powell speaks at Jackson Hole just a day before Ghost Month kicks off.

If he signals rate cuts are coming in September, then this might be the best Ghost Month in Bitcoin’s history.

If he’s overly hawkish - there’s a good chance Ghost Month plays out.

That means choppy price action and more dips.

But there’s also a silver lining.

History suggests that while Ghost Month often delivers pain in the short term, it can also set the stage for powerful rebounds once sentiment clears (i.e. 2017 and 2021).

So these Ghost Month dips are for buying.

Now let’s just hope things don’t get too spooky…

🌎 Macro Crypto and Memes

A few crypto and Web3 headlines that caught my eye:

💰 Token, Airdrop & Protocol Tracker

Here's a rundown of major token, protocol and airdrop news from the day:

🤖 AI x Crypto

Section dedicated to headlines in the AI sector of crypto:

🚚 What is happening in NFTs?

Here is the list of other notable headlines from the day in NFTs: