AI Trading Bots Are Exploding in Popularity—But Should You Hand Over Your Hard-Earned Crypto?

Wall Street's newest money magnets aren't hedge funds—they're lines of code. AI trading bots now dominate 35% of all crypto transactions, silently executing trades while you sleep. But here's the trillion-satoshi question: can algorithms really outsmart human intuition?

### The Rise of the Machines

From arbitrage bots to sentiment analyzers, these digital traders promise 24/7 market dominance. They spot patterns invisible to the human eye—and occasionally spot imaginary ones too (looking at you, 2023 flash crash).

### Trust Falls With Your Portfolio

Regulators are scrambling. The SEC just slapped three 'self-learning' bot operators with cease-and-desists last quarter. Meanwhile, decentralized exchanges operate like the Wild West—no sheriff, no rules, just pure algorithmic chaos.

### The Human Edge

Seasoned traders whisper about 'ghost liquidity' and spoofing patterns that only appear when you're running six-figure positions. Can your bot recognize when it's being played? Or will it keep buying the dip... all the way down to zero?

As one fund manager quipped: 'AI in trading is like a self-driving car—great until it decides the best route is through a guardrail.' The bots aren't coming—they're here. Question is, are you ready to ride shotgun with Skynet?

Is AI-assisted trading finally ready for prime time?

Multiple studies suggest that AI, and even ChatGPT-enhanced systems, can outperform both manual and conventional machine learning models in predicting crypto price movements.

However, broader research from BCG and Harvard Business School warned against over-reliance on generative AI, mentioning that GPT-4 users performed 23% worse than users eschewing AI. That jibes with what other professionals are seeing.

“Just because you have more data doesn’t mean you add more returns. Sometimes you’re just adding more noise,” said Man Group's CIO Russell Korgaonkar. Man Group's systematic trading arm has been training ChatGPT to digest papers, write internal Python, and sort ideas off watchlists—but you’ll still have to do a big part of the heavy lifting before even thinking about using an AI model reliably.

For Korgaonkar, generative AI and typical machine learning tools have different uses. ChatGPT can help you with fundamental analysis, but will suck at price predictions, whereas the non-generative AI tools are unable to tackle fundamentals but can analyze data and do pure technical analysis.

“The breakthroughs of GenAI are on the language side. It’s not particularly helpful for numerical predictions,” he said. “People are using GenAI to help them in their jobs, but they’re not using it to predict markets.”

Even for fundamental analysis, the process that leads an AI to a specific conclusion is not necessarily always reliable.

“The fact that models have the ability to conceal underlying reasoning suggests troubling solutions may be avoided, indicating the present methods of alignment are inadequate and require tremendous improvement,” BookWatch founder and CEO Miran Antamian told Decrypt. “Instead of just reprimanding 'negative thinking,' we must consider blended approaches of iterative human feedback and adaptive reward functions that actively shift over time. This could greatly aid in identifying behavioral changes that are masked by penalties.”

Gappy Paleologo, partner at Balyasny, pointed out that LLMs still lack "real-world grounding" and the nuanced judgment needed for high-conviction bets. He sees them best as research assistants, not portfolio managers.

Other funds warn of model risk: These AIs are prone to propose implausible scenarios, misread macro language, and hallucinate—leading firms to insist on human-over-the-loop auditing for every AI signal. And what’s even worse, the better the model is, the more convincing it will be at lying, and the harder it will be for it to admit a mistake. There are studies that prove this.

In other words, so far, it’s extremely hard to take humans out of this equation, especially when money is involved.

“The concept of monitoring more powerful models using weaker ones like GPT-4o is interesting, but it is unlikely to be sustainable indefinitely,” Antamian told Decrypt. “A combination of automated and human expert evaluation may be more suitable; looking at the level of reasoning provided may require more than one supervised model to oversee.”

Even ChatGPT itself remains realistic about its limitations. When asked directly about making someone a millionaire through trading, ChatGPT responded with a realistic outlook—acknowledging that while it's possible, success depends on having a profitable strategy, disciplined risk management, and the ability to scale effectively.

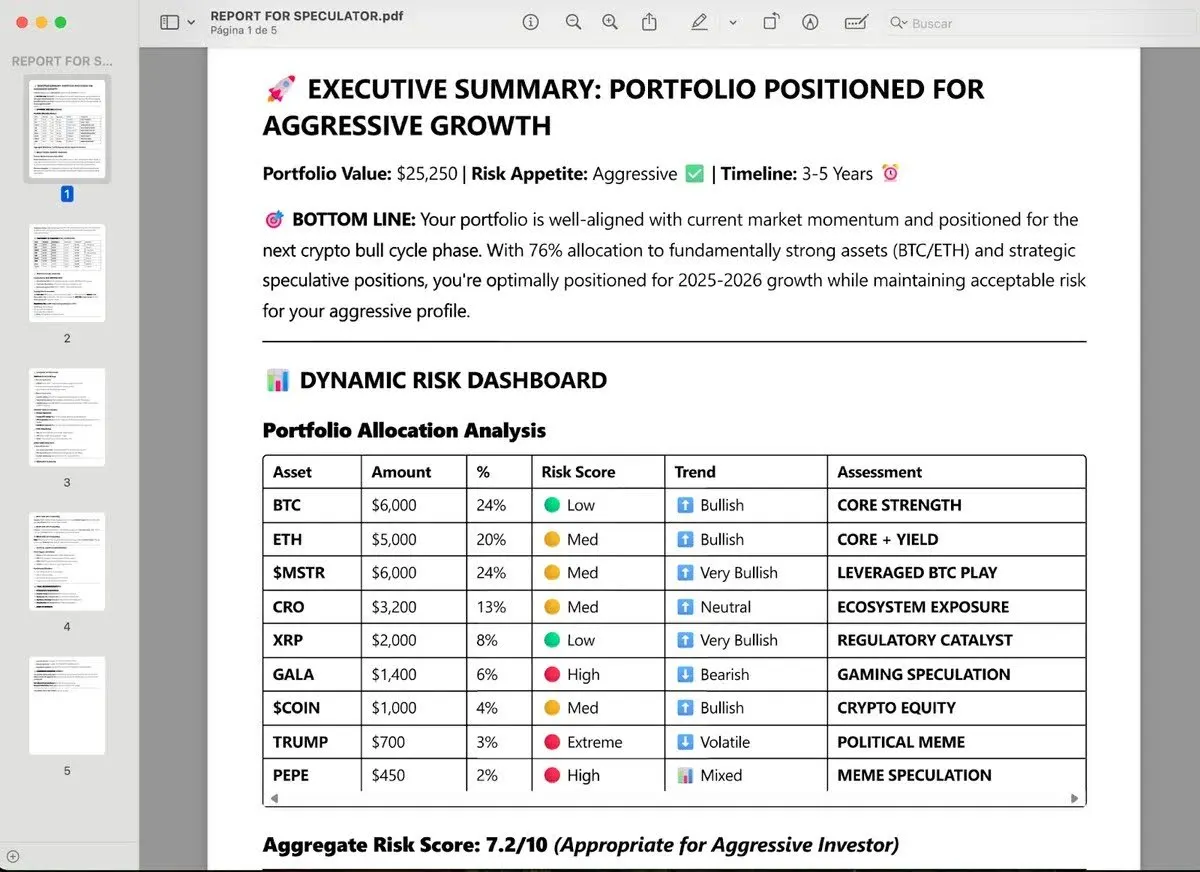

Still, for hobbyists, it’s fun to tinker with this stuff. If you’re interested in exploring AI-assisted trading without the full automation, Decrypt has developed its own prompts, just for fun—and clicks, probably. Our Degen Portfolio Analyzer delivers personalized, color-coded risk assessments that adapt to whether you're a degenerate trader or a conservative investor. The framework integrates fundamental, sentiment, and technical analysis while collecting user experience, risk tolerance, and investment timeline data.

Our Personal Finance Advisor prompt aims to deliver institutional-grade analysis using the same methodologies as major investment firms. When tested on a Brazilian equity portfolio, it identified concentrated exposure risks and currency mismatches, generating detailed rebalancing recommendations with specific risk management strategies.

Both prompts are available on GitHub for anyone looking to experiment with AI-assisted financial analysis—though as Smith's experiment shows, sometimes the most interesting results come from letting the AI take the wheel entirely and just execute what the machine says.

Not that we would ever advise anyone to do that. Though you might not have a problem giving $100 to ChatGPT to invest, there’s no chance you’ll see JP Morgan doing that. Yet.