BTCC

/

BTCC Square

/

decryptCO

/

Crypto Titans Double Down: 21’s Bitcoin Bet, XRP Derivatives War, and Solana Treasury Mania

Crypto Titans Double Down: 21’s Bitcoin Bet, XRP Derivatives War, and Solana Treasury Mania

Published:

2025-04-25 20:46:08

Wall Street’s latest love affair? Solana-based treasury plays—because nothing says ’innovation’ like chasing last cycle’s winners. Meanwhile, XRP futures markets heat up as exchanges jockey for position, and Twenty One makes its Bitcoin move—because when volatility dips, the sharks start circling.

Forget ’slow and steady’—2025’s crypto plays are all about high-stakes positioning. Just don’t mention the 17 identical ’institutional adoption’ press releases clogging your inbox.

Source: Nasdaq

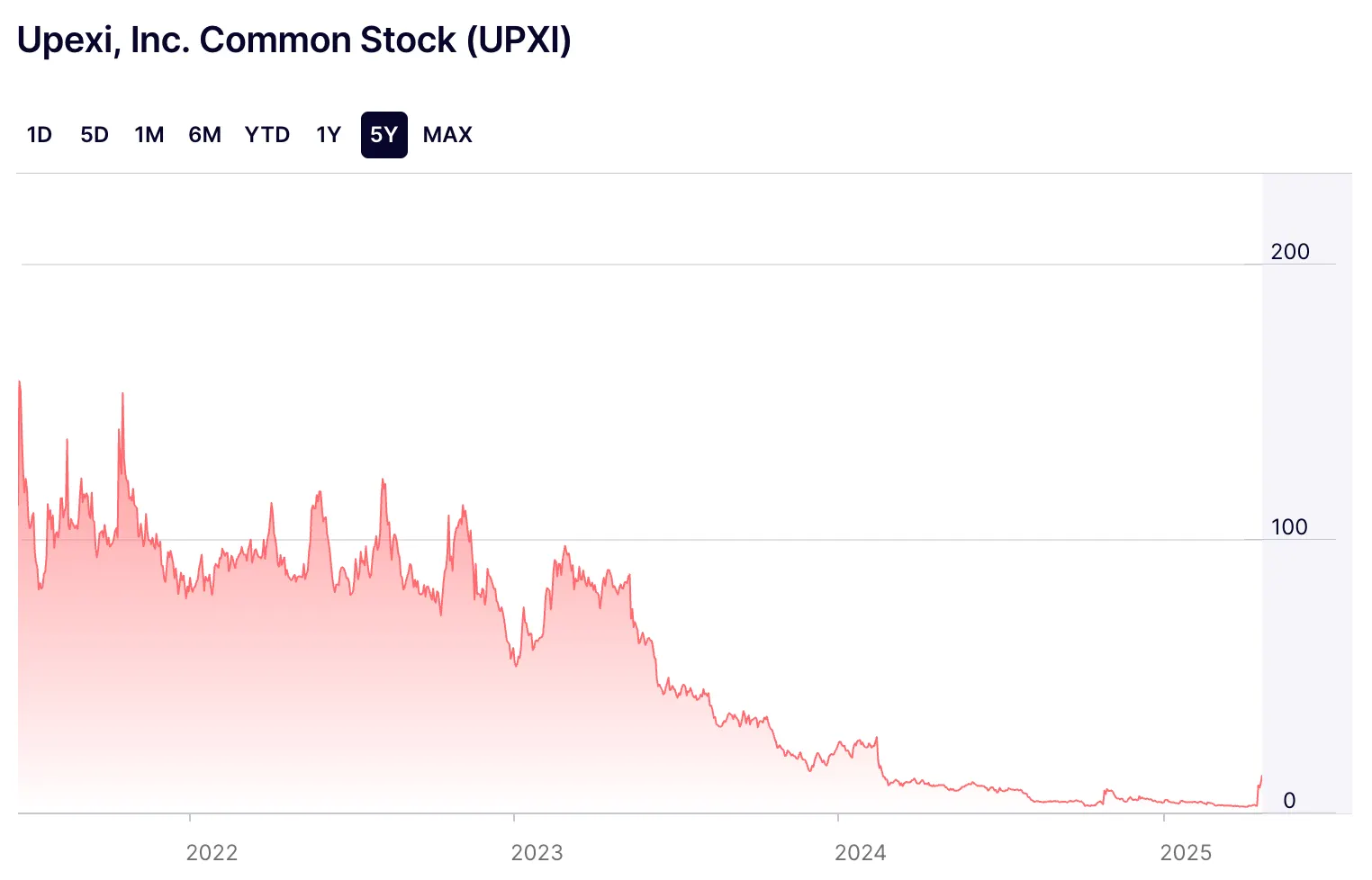

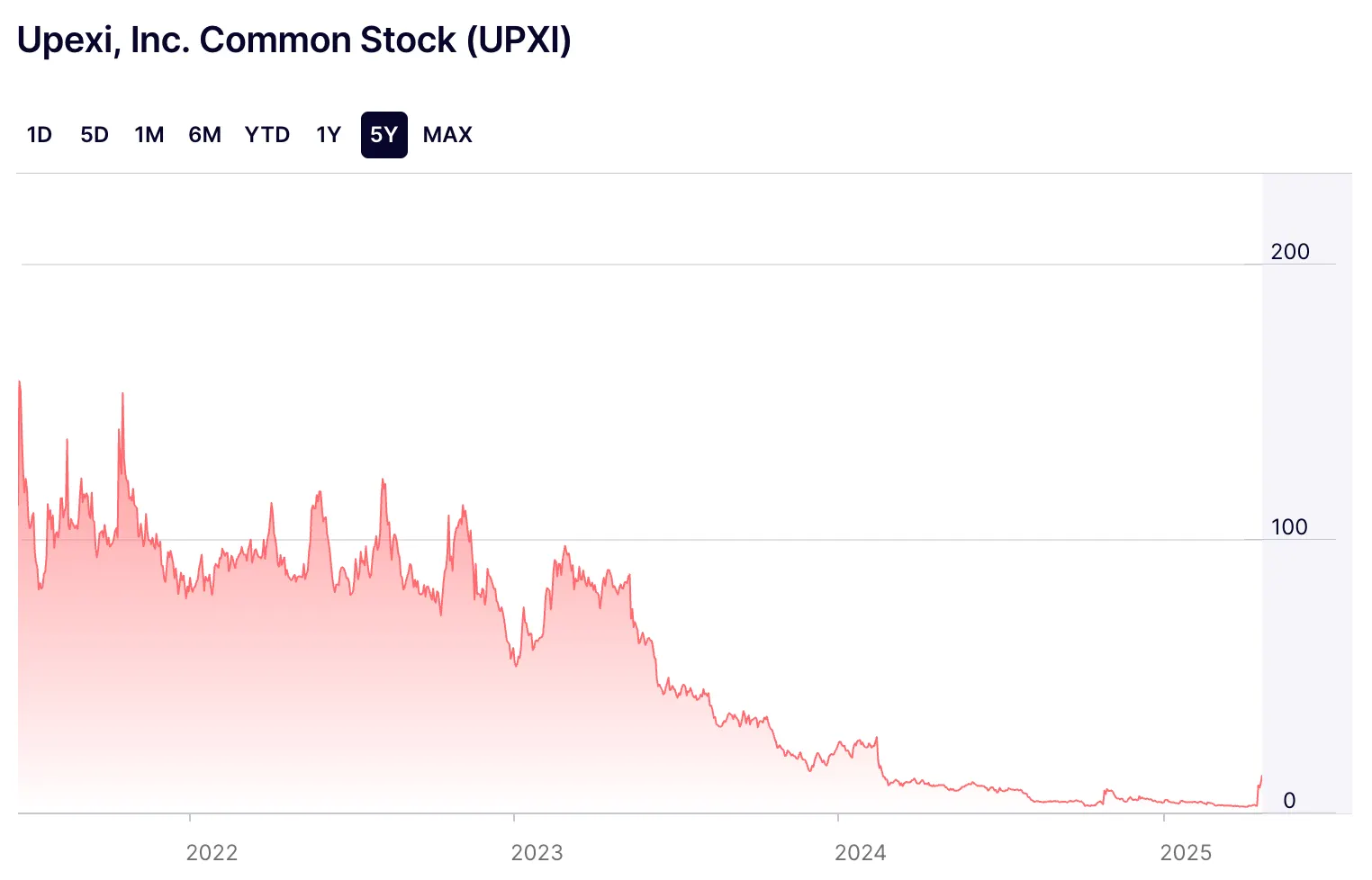

The news has revived a company that was otherwise sliding into obscurity.

As a business, Upexi wears many hats. It owns and operates several brands, like LuckyTail, Cure Mushrooms, and PRAX, which sells paraxanthine-based energy supplements.

Other Keys

- Waiting on deets from Riot: Bitcoin miner Riot Platforms just secured a $100 million line of credit from Coinbase. “This credit facility is a key part of our efforts to diversify sources of financing to support our operations and strategic growth initiatives,” CEO Jason Les said in a statement. Decrypt reached out to Riot for details about what those key strategic initiatives may be, but did not immediately receive a response.

- Coinbase gets buy from Benchmark: Investment bank Benchmark set a $252 price target for Coinbase, which trades on the Nasdaq under the COIN ticker, and gave it a buy rating earlier this week. “We believe most investors have yet to recognize or focus on the extent to which stablecoin and market structure legislation could cause significant expansions in COIN’s valuations,” they wrote, noting that the bills could broadly “reignite crypto market activity.”

- Door’s open for Semler doubters: Eric Semler, chairman of Bitcoin treasury company Semler Scientific, is as bullish as ever after the company announced it has upped its BTC stash to $314 million. "You can sell or stop if you don’t like what we’ve done with Bitcoin," Semler said during an interview Thursday at Bitwise’s Bitcoin Standard Corporation Investor Day event in New York. Not many investors took him up on that. Just before the closing bell, SMLR had gained 7% over yesterday’s close and was trading for $36.80.

Edited by Guillermo Jimenez.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.Your EmailGet it!Get it!

By:

|Square

Get the BTCC app to start your crypto journey

Get started today

Scan to join our 100M+ users

Source: Nasdaq

Source: Nasdaq