Bybit Slams Brakes on Japan: New User Registrations Halt October 31

Bybit pulls the emergency brake on Japanese expansion as regulatory walls close in.

The Compliance Shutdown

Come October 31, fresh faces get locked out of Bybit's Japanese operations. The exchange isn't just slowing down—it's building a concrete barrier against new account creation. Existing users? They're sweating bullets wondering if they're next.

Global Domino Effect

Watch how other exchanges scramble when Japan's Financial Services Agency flexes its muscles. This isn't just about one platform—it's a warning shot across the entire crypto industry's bow. Regulatory bodies worldwide are taking notes while traders groan about 'protective measures' that feel more like financial handcuffs.

Another day, another exchange learning that when regulators come knocking, even crypto can't hide behind decentralization forever.

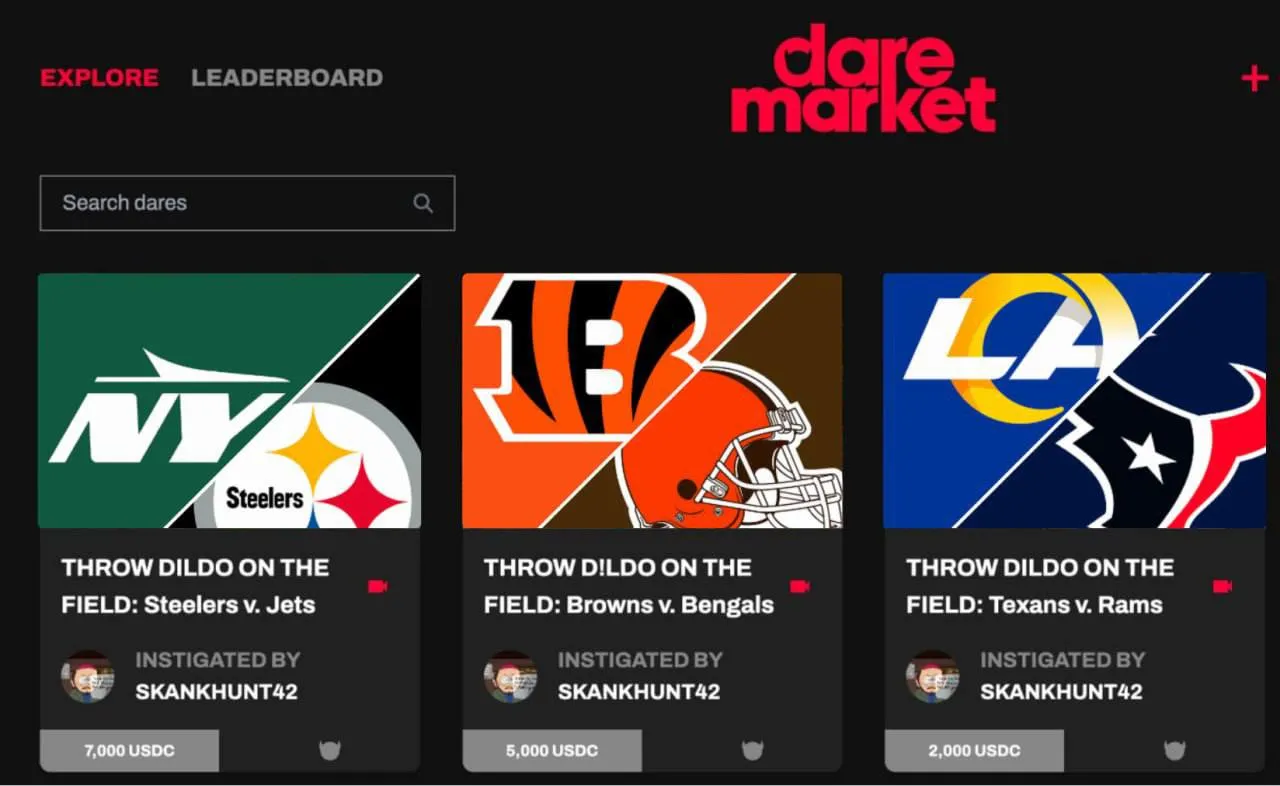

Screenshot of dildo markets. Image: Dare Markets.

Screenshot of dildo markets. Image: Dare Markets.

“I like to call [Dare Market] the inverse of Polymarket, in a way. Because with Polymarket, Kalshi, or traditional prediction markets, you’re betting on the outcomes of scenarios using capital. They’ve proven themselves as great truth marketplaces,” Perfito explained, labeling a dare as the inverse of a truth thanks to the popular party game truth or dare.

“Now it makes more sense than ever, because attention is one of the most scarce resources on the internet—everyone is fighting for it. It’s one of the most difficult things to earn, and almost impossible to keep,” Perfito told Decrypt. “Dare Market fixes that.”