Bitcoin Crushes Ethereum in Trump Trade War Fallout - Dominance Resurgent

BITCOIN REIGNS SUPREME AS TRUMP TRADE SPAT INTENSIFIES

The King's Comeback

Bitcoin isn't just leading the crypto pack—it's leaving Ethereum choking on digital dust. While traditional markets wobble over Trump's latest tariff tantrum, BTC flexes its dominance muscles like a heavyweight champion. The original cryptocurrency reminds everyone why it wears the crown.

Flight to Quality

Investors aren't just rotating—they're fleeing to safety. Bitcoin's proving it's the digital gold standard while altcoins stumble. The Trump trade war escalation becomes crypto's unexpected stress test, and BTC aces it while others barely pass. Funny how geopolitical chaos becomes Bitcoin's best marketing campaign.

Ethereum's Reality Check

ETH gets relegated to silver medal position as traders seek shelter in Bitcoin's proven track record. The 'flippening' talk grows quieter by the hour. Wall Street analysts suddenly remember why they called Bitcoin 'digital gold' in the first place—while quietly ignoring their own previous Ethereum hype cycles.

MARKETS NEVER LIE—BUT ANALYSTS OFTEN DO

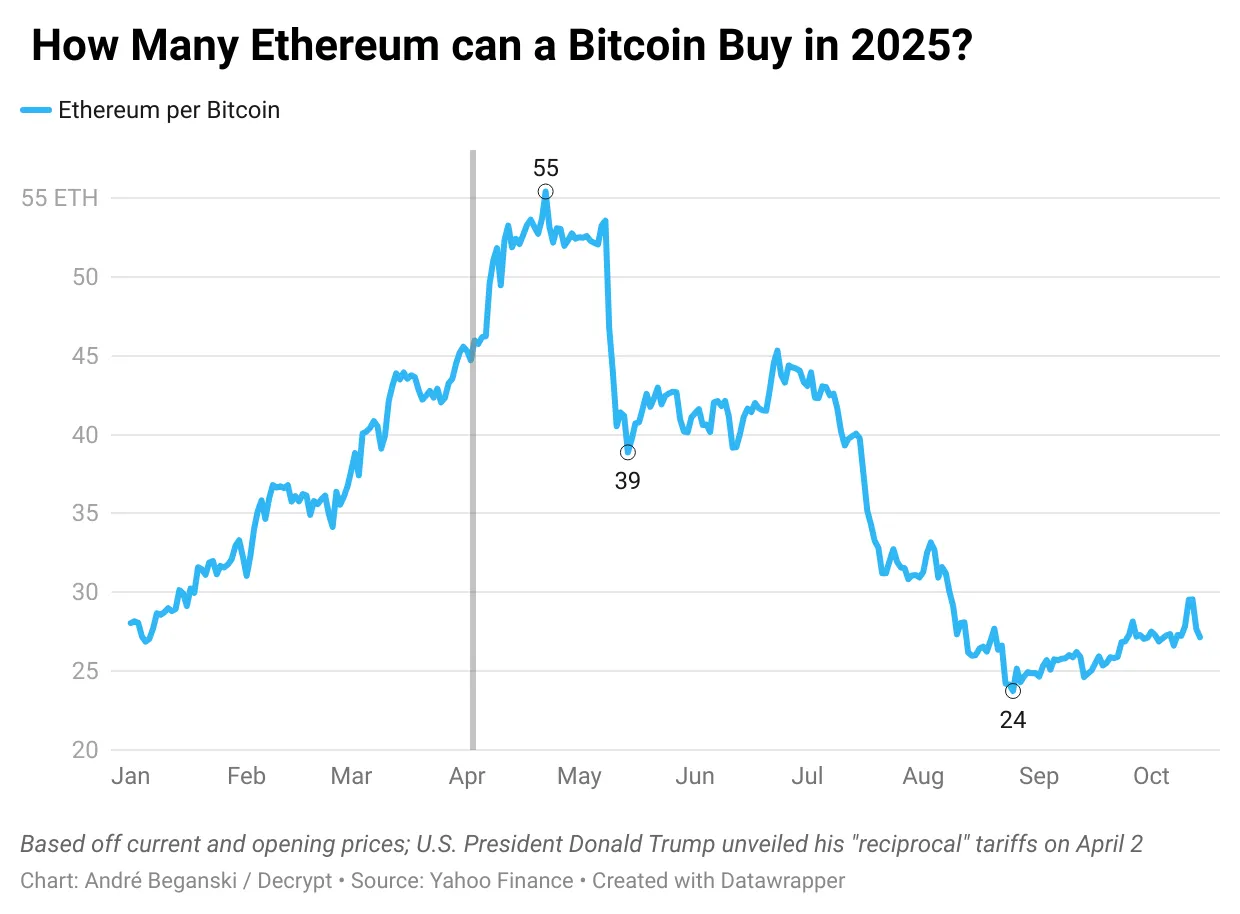

Throughout most of April, however, a single Bitcoin was worth at least 50 ETH, reflecting one of its strongest periods against the smaller asset this year, while the TRUMP administration managed expectations around “reciprocal” tariffs.

At the time, Bitcoin was the only digital asset that appeared to benefit from perceived shifts in the global geopolitical order or risk, with some analysts comparing its performance to gold.

Between the Federal Reserve’s calculus on interest rate cuts and an ongoing government shutdown, the Trump administration’s trade moves are just one factor shaping markets. But there are also developments specific to the crypto industry that one should consider, according to Juan Leon, senior investment strategist at Bitwise.

He said Ethereum’s recent run stems from investor excitement toward the emergence of Ethereum treasury firms and the passage of stablecoin legislation. Along with a supportive regulatory environment, he said the setup “holds promise for an altcoin rally” into next year.

Bitcoin has outperformed Ethereum for several years, but the smaller asset’s price has increased relatively more this year, despite losing most ground gained against Bitcoin in recent weeks.

In market cycles past, Bitcoin’s peak has been followed by a sustained period of strength for cryptocurrencies like Ethereum, often called an “altcoin season.”

TD Cowen analyst Lance Vitanza told Decrypt that he’s “never been a believer in this or any ‘altcoin season,’” arguing that only a handful of tokens are likely to survive as legitimate tech.

That said, he believes Ethereum “represents real technology” and is likely to play a meaningful role in decentralized finance, such as the potential tokenization of trillions of dollars in assets. As a result, he said Ethereum “could appreciate meaningfully over time.”

Vitanza said that Ethereum will always be more volatile than Bitcoin, and there may be some months where the smaller asset performs better. But Vitanza said “would be surprised if the outperformance, if any, were to persist” more than a few months.