XRP Defies Market Jitters: Holds Strong at $3 Support With Neutral Funding Rates

XRP bulls dig in as the token weathers stormy markets—holding firm above the $3 psychological support level. Funding rates stay eerily calm, hinting at a coiled spring rather than panic.

The $3 Floor: Rock or Sand?

While altcoins bleed, XRP's resilience at $3 sparks whispers of accumulation. No extreme long/short skew in funding rates suggests traders aren’t overleveraged—yet. A rare moment of equilibrium in crypto’s casino economy.

Neutral Funding Rates: The Calm Before the Storm?

Perpetual swaps show neither greed nor fear dominating. For once, derivatives traders aren’t treating the market like a roulette wheel—probably because they’re all waiting for the SEC’s next move.

XRP’s stalemate won’t last forever. When the dam breaks, will it flood the market with liquidations or liquidity? Wall Street’s ‘risk managers’ are too busy shorting memecoins to care.

Ripple price key technical points

- Key Support: $3 order block and value area high holding as strong demand.

- Market Structure: Higher lows continue to confirm a bullish trend.

- Next Target: $3.55 high-time-frame resistance if support remains intact.

XRP’s current price action demonstrates notable resilience as it trades around the $3 support, which is also aligned with the value area high of the entire range. This level has become a pivotal line in the SAND for buyers, offering the foundation needed to sustain bullish momentum. The fact that price has reclaimed and held above the value area high further highlights market demand and strengthens the probability of rotation toward higher levels.

Structurally, XRP continues to post consecutive higher lows, a hallmark of bullish market conditions. Establishing another higher low near the $3 zone would solidify this upward pattern and add conviction to the case for further upside. Each prior retest of support has attracted renewed buying, indicating that market participants remain committed to defending this level. Adding to this momentum, Spanish bank BBVA has partnered with Ripple to offer institutional-level crypto custody services, reinforcing confidence in the asset’s long-term adoption.

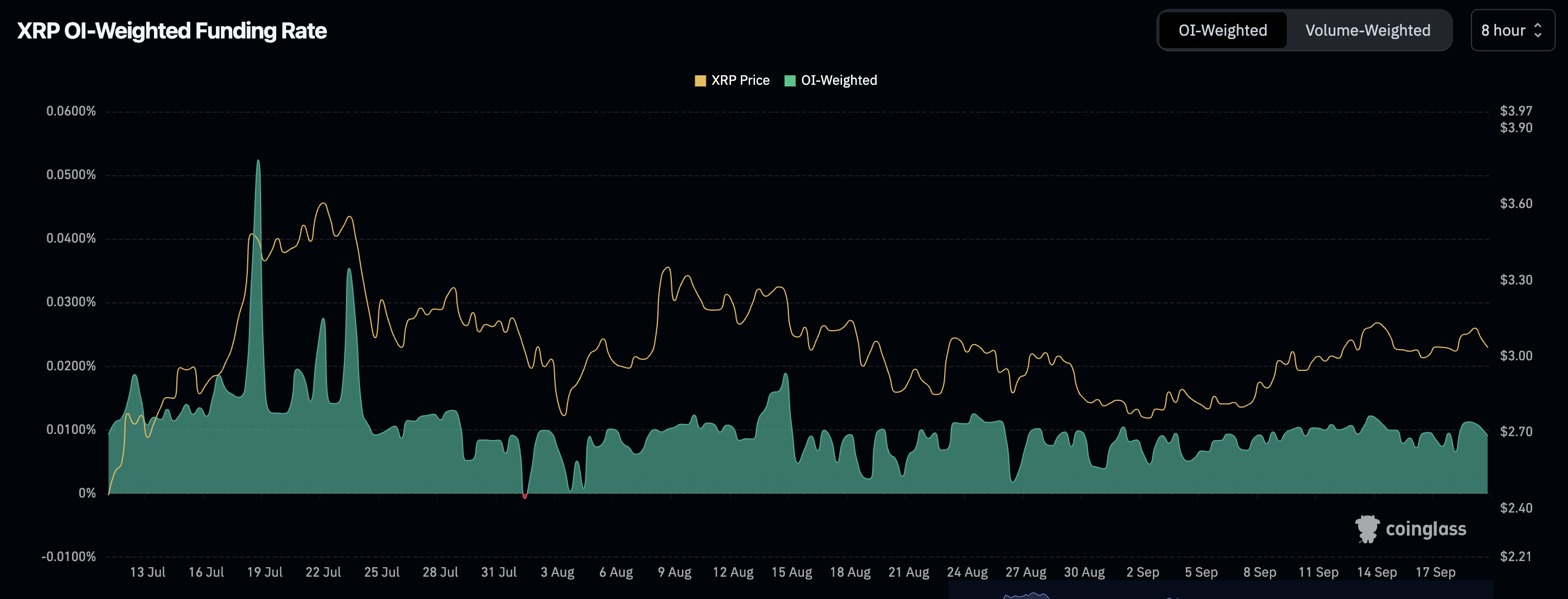

From a funding perspective, XRP sits at approximately 0.02%, signaling neutrality between long and short traders. This balanced environment suggests that neither side is overleveraged, reducing the likelihood of abrupt squeezes and pointing toward steady, sustainable price action. Neutral funding at critical highs can often precede larger continuation moves, as the market consolidates before resolving in the direction of the prevailing structure.

Volume behavior also reinforces this outlook. The acceptance above the value area high suggests genuine spot demand is backing current price levels rather than speculative leverage alone. This confluence of structural strength, volume support, and neutral sentiment collectively bolsters XRP’s bullish case.

What to expect in the coming price action

If the $3 level continues to hold, XRP is well-positioned to attempt another move toward $3.55 resistance in the NEAR term. Consolidation may occur first as funding rates remain neutral, but as long as higher lows persist, the bullish trajectory remains intact. A clean break above $3.55 could open the door to further expansion into higher resistance zones.