BNB Chain Shatters Records with Explosive Monthly User Growth

BNB Chain just hit unprecedented adoption levels as on-chain activity rockets to new heights.

Network activity surges past previous benchmarks

User numbers smash through previous ceilings as transaction volumes explode across DeFi, gaming, and NFT ecosystems. The chain's infrastructure handles the massive throughput spike without major congestion—proving scalability under real-world pressure.

Institutional players quietly accumulate positions while retail FOMO kicks into overdrive. Meanwhile, traditional finance still can't decide whether crypto is a scam or the future—so they'll probably buy in at the next ATH.

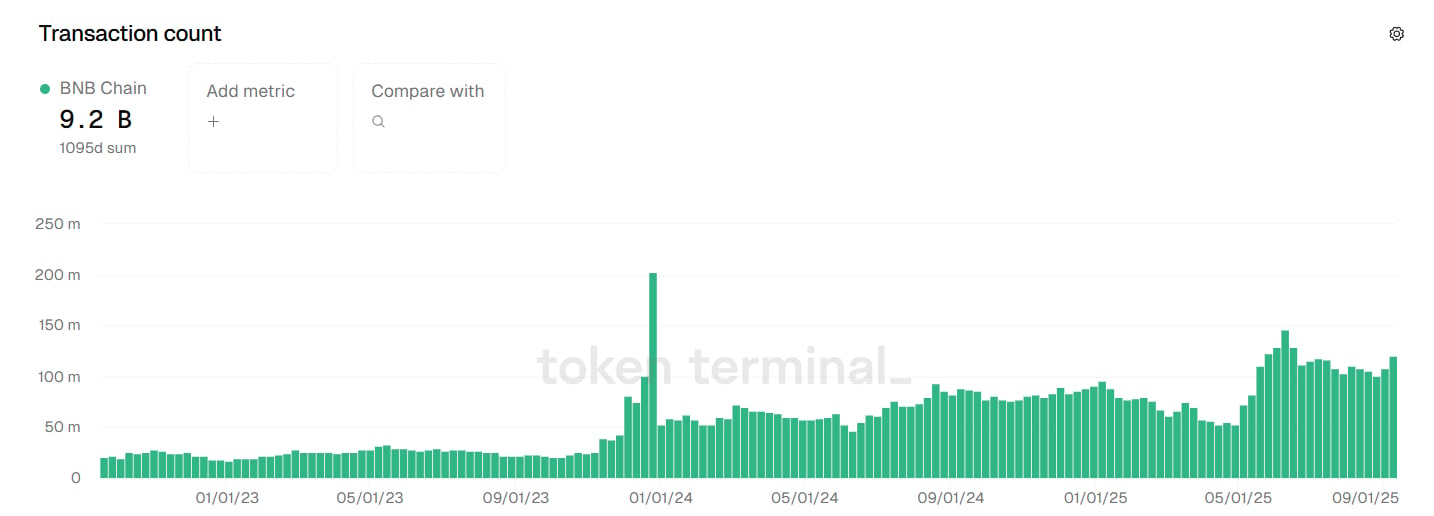

BNB Chain’s active users monthly | Source: Token Terminal

BNB Chain’s active users monthly | Source: Token Terminal

The surge in activity comes alongside growth in network metrics, as over the past 30 days, fees collected on the chain reached $13.2 million, a more than 24% jump compared with the previous period, while revenue reached $1.4 million, up 23%, indicating that more users are interacting with the network.

By transaction count, BNB Chain also keeps reinforcing its position in the top three layer 1 networks, according to Token Terminal. While Internet Computer leads with 412.2 billion transactions, Solana follows it at 354.5 billion, and BNB Chain with the transaction count at 9.2 billion.

As of September, the network supports over 1,095 projects across sectors, including DeFi, gaming, and NFTs, with the total value locked in in BNB Chain standing at $7.68 billion, still down around 65% from 2021’s peak.

Speaking with crypto.news, Marwan Kawadri, DeFi lead and head of EMEA at BNB Chain, attributed the growth to a big user base of 4 million daily active users and more than 625 million unique addresses, as well as DEEP global liquidity with more than $11 billion in TVL and stablecoin circulation.

Kawadri added that the team is now aiming to reach a “CEX-like experience” so that transactions “will be confirmed in under 150 milliseconds.”

“Overall, BNB Chain is targeting to become a settlement LAYER and financial infrastructure for all assets, it will not be specifically limited to any particular trading scenario. The direction and initial form of this chain are still continuously evolving, and we will explore and build this together with the community.”

Marwan Kawadri

The growth in on-chain activity coincides with a rise in BNB’s market value as the token recently hit a new all-time high of $962. Part of this momentum seems to be tied to announcements from Binance founder Changpeng Zhao, who outlined plans for the upcoming BNB Treasury Company in an interview with Leon Lu, founder of B Strategy.

As crypto.news reported earlier, Zhao described BNB as a “true utility coin,” highlighting its multi-chain compatibility and its use across trading discounts, yield generation, launch pools, launchpads, and the Binance Alpha ecosystem. He also emphasized BNB’s role across both centralized and decentralized platforms, including cross-border payments and dApps worldwide, noting that the ecosystem has untapped potential in regions such as Southeast Asia, Europe, the Middle East, and Africa.

Back as CEO

The planned BNB Treasury Company is expected to raise $1 billion with backing from YZi Labs. Zhao said the initiative will target institutional demand, focusing support on strong, well-positioned projects. “We’ve been approached by probably more than 50 companies for BNB specifically…we will only do that to a very small number of DAT companies. Basically, the very top, strong ones,” Zhao said in the podcast.

Speculation about Zhao’s possible return to Binance has also grown. On Sept. 17, the Binance founder updated his X profile, changing it from “ex-@binance” back to “@binance.” Zhao stepped down as CEO nearly two years ago following a $4.3 billion settlement with the U.S. Department of Justice in November 2023 over anti-money laundering violations.

Reports also suggest that the DOJ may soon lift compliance restrictions on Binance, which has fueled rumors about his potential return, though Zhao has stated he does not plan to resume the CEO role.

Data from crypto.news shows BNB hit an all-time high of $1,000 on Sept. 18, setting a new historical milestone for the BNB Chain ecosystem. As of press time, the token is up 3.7% in the past 24 hours, trading around $989, and it has risen over 10% over the past week.