Aster Price Surges Today: Here’s Why and What Comes Next

Aster's token rockets upward as market sentiment shifts—defying broader crypto sluggishness with a stunning 24-hour rally.

Breaking Resistance Levels

Aster smashed through key technical barriers, triggering automated buy orders and fueling further momentum. Trading volume doubled as speculators piled in, chasing the green candles.

Ecosystem Developments Spark Interest

Fresh protocol upgrades and partnership rumors lit the fuse. The team's recent mainnet enhancements reduced transaction costs—just as gas fees elsewhere annoy traders into alternative chains.

Market Dynamics at Play

Whales accumulated quietly before the pump—classic move—while retail traders FOMOed in late per usual. Short squeezes added rocket fuel, punishing skeptics who bet against the surge.

Regulatory Tailwinds—Or Headfakes?

Global regulatory clarity—or the lack thereof—always moves markets. Some jurisdictions softened stance on DeFi, and Aster’s compliance-friendly design positioned it perfectly. Because nothing excites crypto like politicians finally pretending to understand blockchain.

What’s Next: Peak or Plateau?

Momentum looks strong, but sustainability hinges on actual adoption—not just speculative fervor. If the team delivers utility beyond price charts, this rally might have legs. Otherwise, it’s another pump waiting for a dump. Remember: in crypto, 'fundamentals' are often just what people yell before the crash.

Aster price jumps after airdrop and as its key metrics soar

The main reason Aster’s price soared is that it launched its airdrop, which will run until October 17. This airdrop will distribute approximately 704 million tokens, or 8.8% of the total allocation, to eligible participants.

Eligible participants are those who earned Rh or Au points from the Aster Spectra Stage 0 and 1 points program, users who received Aster Gems allocations, and those who traded on Aster Pro during the trading window. Binance’s founder was among the first to congratulate the developers.

Well done! 👏 Good start. Keep building! pic.twitter.com/oMfOxfsBRS

— CZ 🔶 BNB (@cz_binance) September 17, 2025Aster price also jumped because of its strong fundamentals. Data compiled by DeFi Llama shows that its perpetual futures platform has handled over $12 billion in volume this month. It handled $9.78 billion in volume in August and $8.5 billion in July.

Another metric indicates that its trading activity has generated $8.82 million in fees so far this quarter, significantly higher than the $1.8 million it earned in the same period last year. Revenue has jumped from just $11,660 in Q3 2024 to $5.4 million today.

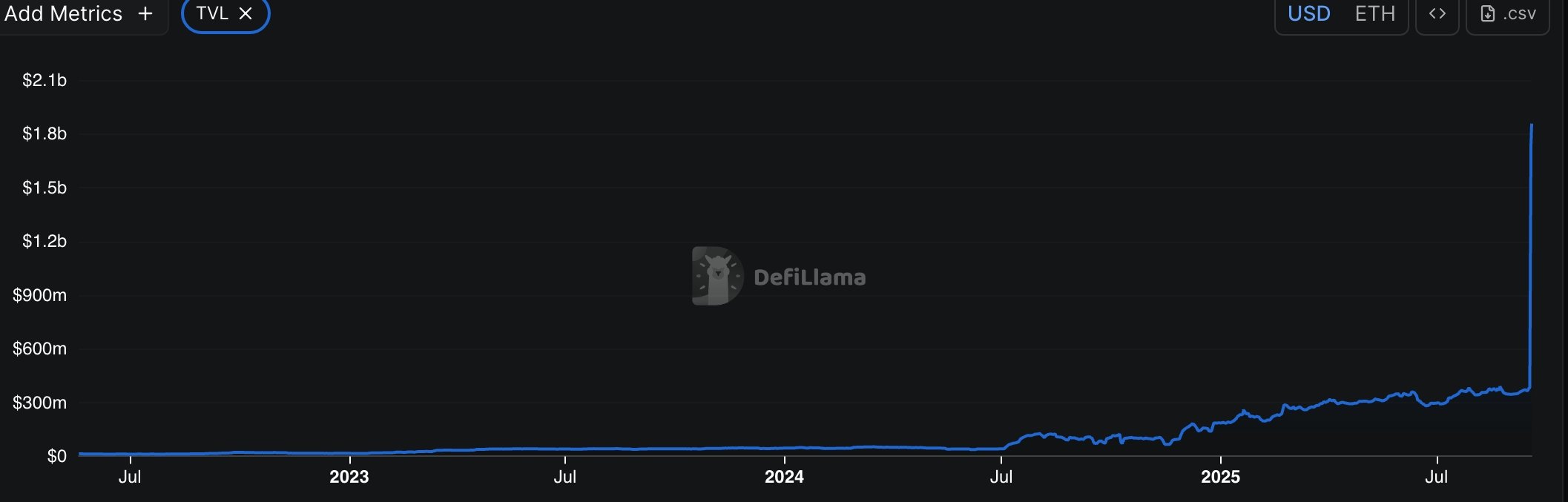

Aster’s total value locked has reached a record high of $1.85 billion, up from $141 million in January.

Will the Aster Coin price rally continue

Aster’s price has jumped sharply after its token generation event and CZ’s mention. This rally could continue as new cryptocurrency exchanges start to list it, as it is currently only available on Aster. It is common for newly minted coins to rise after being listed by major exchanges.

However, the coin will likely take a breather as airdrop recipients start to sell to preserve profits. Many newly listed tokens that jump initially often decline when this happens.

For example, Donald Trump’s World Liberty Finance (WLFI) and OFFICIAL TRUMP (TRUMP) tokens soared initially and then plunged. The same happened with other recently launched tokens like Spark and Avantis.