XRP Eyes $5 Milestone as ETF Hype and Derivatives Frenzy Intensifies

XRP rockets toward unprecedented territory as institutional momentum builds—ETF speculation meets surging derivatives action.

Breaking Through Resistance

Traders pile into call options while open interest spikes—market positioning suggests growing conviction in XRP's upside potential. The $5 target transforms from pipe dream to plausible scenario as volumes explode across major exchanges.

ETF Catalyst Accelerates

Wall Street's growing appetite for crypto exposure fuels speculation that XRP could be next in line for ETF approval—a development that would unleash massive institutional flows. Market makers already position for potential regulatory green lights.

Derivatives Market Goes Berserk

Futures and options activity hits record levels as leveraged bets flood the market—funding rates remain elevated but sustainable, indicating healthy speculation rather than pure euphoria. Professional traders join the frenzy previously dominated by retail.

Just another day in crypto—where fundamentals occasionally matter between bouts of pure speculation.

Derivatives data point to an XRP price rebound

The Ripple (XRP) token could be on the cusp of a strong bullish breakout as open interest and the funding rate rise. CoinGlass data shows that the coin’s open interest in the futures market has continued to rise this week, even as the price remains under pressure.

The futures open interest ROSE to almost $9 billion on Monday, up from this month’s low of $7.4 billion. It has been in a strong uptrend after bottoming at $2.8 billion in March.

Soaring futures open interest is a bullish factor, as it signals that more traders are holding their positions, which signals higher liquidity and demand.

More data from the futures market show that XRP’s funding rate has remained in the green since June, a sign that traders in the futures market expect the price to continue rising in the NEAR term.

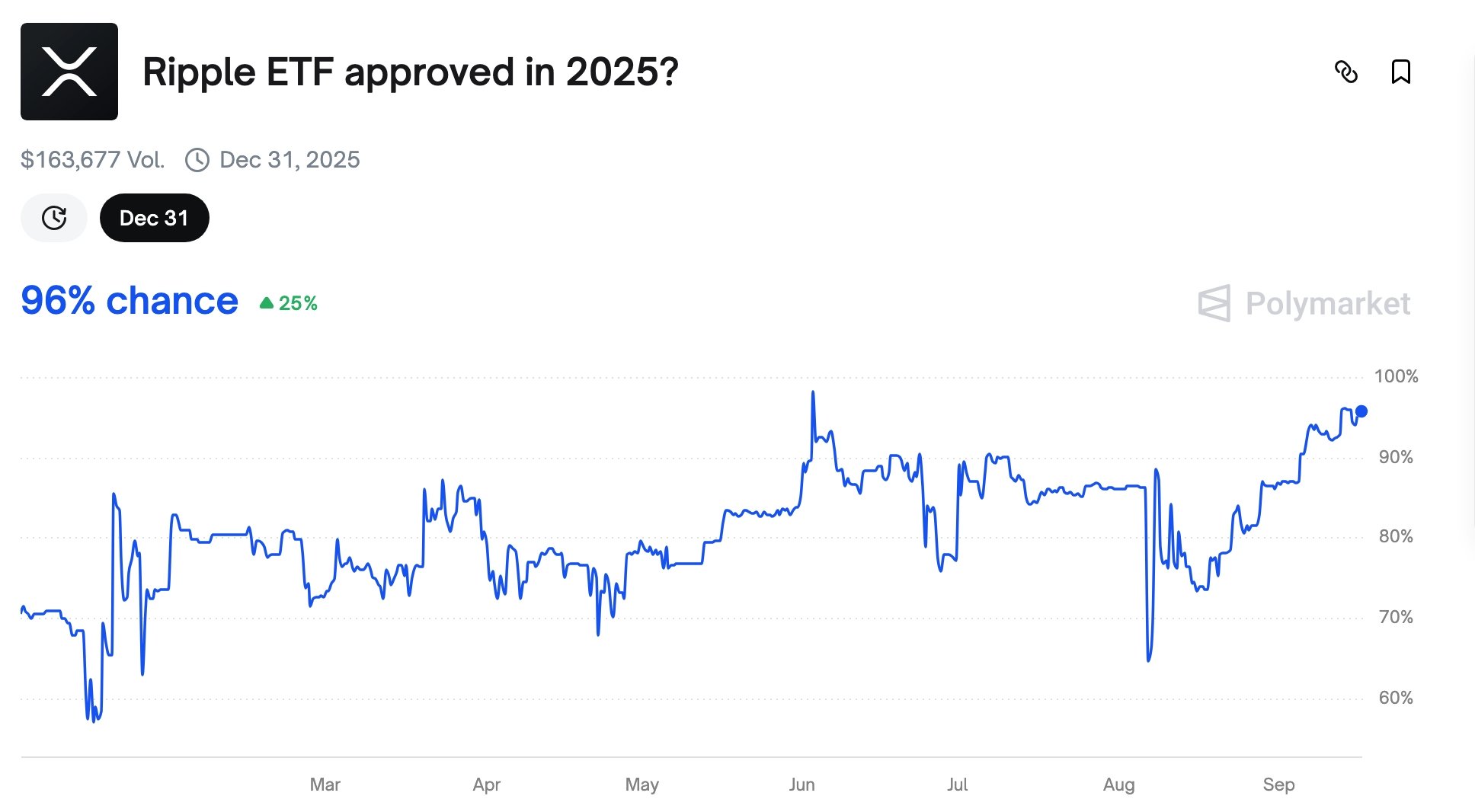

The main reason for the Optimism is that the countdown towards the spot XRP ETF approval has continued. Polymarket data shows that the odds that the Securities and Exchange Commission will approve the funds has jumped to a record high of 96%, much higher than the August low of 64%.

The deadline for most XRP ETFs is in the middle of next month, meaning that many investors will buy the token ahead of the eventual launch.

Recent data show that there is substantial demand for XRP assets. In a recent statement, Crypto.com’s CEO predicted that these ETFs may attract more than $8 billion in inflows in the first year, mirroring a prediction by JPMorgan. Existing XRP ETFs like UXRP and XXRP have continued to see strong demand from investors.

Ripple price technical analysis

Technicals suggest that the xrp price has more upside in the coming weeks, potentially to the resistance level at $5.

Ripple has remained above the 50-day Exponential Moving Average and the upper side of the symmetrical triangle pattern, which is part of the bullish pennant pattern.

Ripple is also attempting to move above the upper side of the Ichimoku cloud indicator. Therefore, the XRP price will likely continue rising as bulls target the year-to-date high of $3.6597, followed by the psychological level at $5.