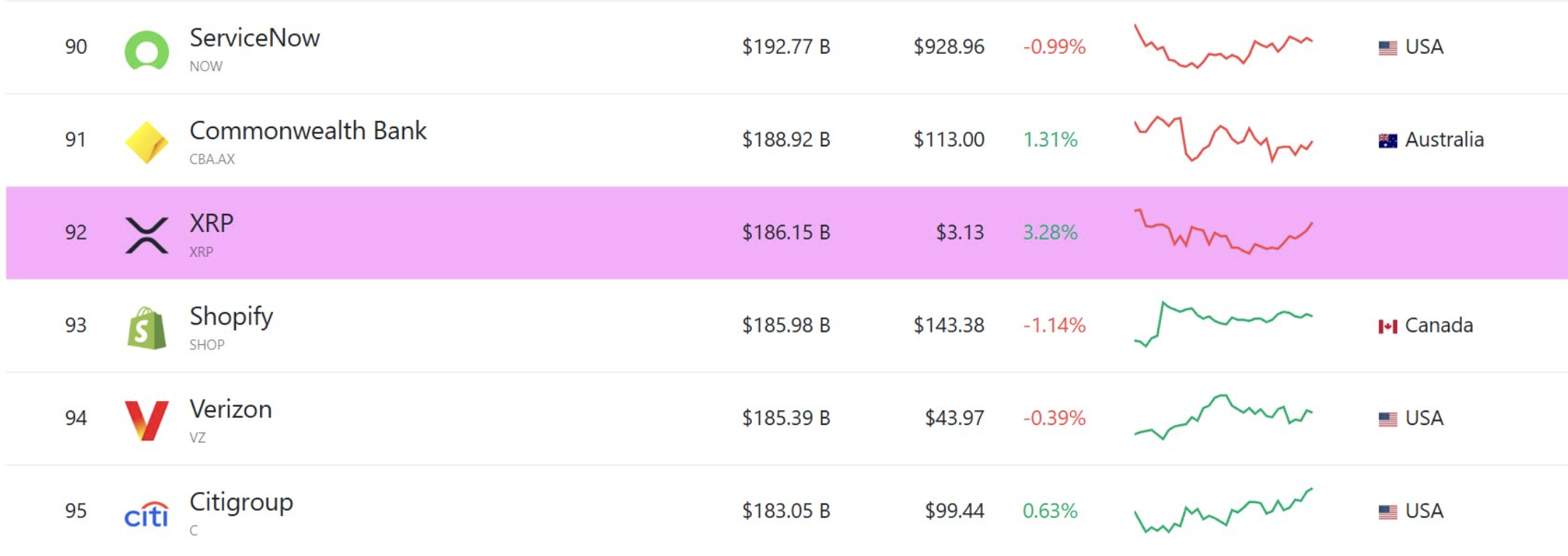

XRP Shatters Banking Giants - Surpasses Citigroup’s Market Cap in Stunning Crypto Upset

Digital asset defies traditional finance expectations as Ripple's native token overtakes one of Wall Street's most established institutions.

The Numbers Don't Lie

XRP's market capitalization now exceeds Citigroup's valuation—a watershed moment that's sending shockwaves through both crypto and traditional finance circles. The token's relentless climb showcases digital assets' growing dominance in the global financial ecosystem.

Banking on Blockchain

While legacy institutions grapple with regulatory overhead and outdated infrastructure, XRP's borderless settlement network continues gaining traction. The contrast couldn't be sharper: traditional banking's slow-moving titans versus agile digital assets rewriting the rules of value transfer.

What This Really Means

This isn't just about market caps—it's about paradigm shifts. When a decade-old cryptocurrency surpasses a century-old banking giant, maybe those suit-wearing analysts should finally update their spreadsheets beyond traditional metrics. The future of finance isn't coming—it's already here, and it doesn't wear a tie.

Source: @stedas

Source: @stedas

Ripple’s On-Demand Liquidity (ODL) service has likely played the key role in this growth, processing $1.3 trillion in cross-border transactions during the second quarter of 2025. ODL utilizes XRP as a bridge currency, enabling real-time settlements and reducing transaction costs by up to 70% compared to traditional systems. This efficiency has attracted partnerships with major financial institutions such as Santander, Standard Chartered, and American Express.

XRP gains traction as ETFs multiply

The growing popularity of XRP-focused ETFs has also contributed to its rising market cap. Notably, 3iQ’s XRPQ ETF recently surpassed CAD 150 million in assets under management, establishing itself as the largest XRP ETF in Canada.

With more ETFs expected to receive approval, investor access to XRP is likely to expand further, supporting continued market growth. REX-Osprey ETFs covering XRP, Bitcoin, and Dogecoin have cleared the SEC’s 75-day review and are expected to list soon. Meanwhile, several other U.S. XRP ETF applications—including those from CoinShares, 21Shares, Canary Capital, and Grayscale—are currently under extended SEC review, with decisions now expected in October.