Altcoin Season Approaches Critical Threshold as Top Tokens Ignite Explosive Rally

Altcoins are knocking on the door of a historic breakout—and this time, the big players are leading the charge.

Market momentum hits fever pitch

Top-tier altcoins aren't just participating—they're driving the entire ecosystem forward. BNB flirts with new ATHs while other major tokens post double-digit gains weekly. Retail FOMO meets institutional accumulation in a perfect storm of demand.

The trigger nobody saw coming

Traditional finance's relentless fee structures and glacial settlement times finally push investors toward crypto's 24/7 markets. Who needs a three-day wait when altcoins settle in minutes? Wall Street's loss becomes crypto's gain—again.

Critical levels loom large

The altcoin market cap teeters at a make-or-break resistance zone. Break through, and we're looking at parabolic moves; reject here, and it's back to consolidation. Smart money already positions for volatility—either direction.

Remember: in crypto, everyone's a genius during bull runs—until they're not. The real test comes when leverage gets liquidated and 'sure bets' crumble. But for now? Ride the wave while it lasts.

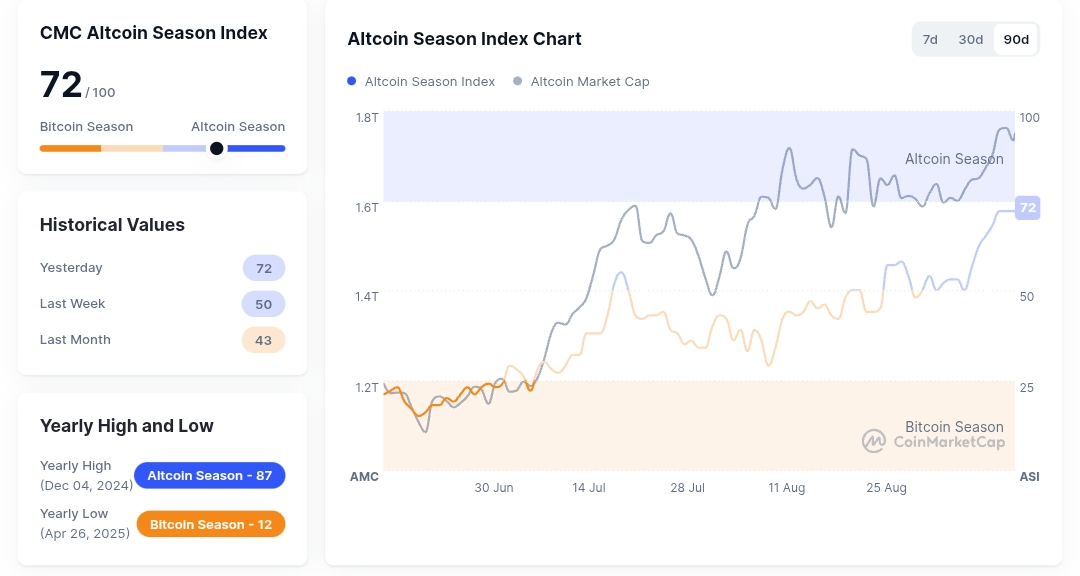

Altcoin Season Index | Source: CoinMarketCap

Altcoin Season Index | Source: CoinMarketCap

Over the weekend, Ethereum (ETH) surged past the $4,600 mark, Ripple (XRP) reclaimed $3.00, Dogecoin (DOGE) is trading above $0.28, and Cardano (ADA) has surpassed $0.90. However, the standout performer has been Solana (SOL), which climbed over 17% in the past week to reach a new peak of $248. Solana’s market cap soared to $135 billion, overtaking Binance Coin (BNB) to become the fifth-largest cryptocurrency.

This bullish move follows Galaxy Digital’s notable accumulation of $6.5 million in SOL, signaling heightened institutional confidence. Meanwhile, small-cap coins are also making waves. MYX Finance (MYX) has recorded a huge increase with others like MemeCore (M) and OKB (OKB) following closely. These price movements point to an increasing risk appetite among crypto investors as momentum builds across altcoins.

Analyst warns of risks amid altcoin season buzz

Despite this surge, analysts are urging caution. CryptoQuant researcher Maartunn recently issued a warning in an X post, highlighting troubling similarities between current market dynamics and those that preceded the major correction of early 2025.

According to him, altcoin speculation soared in December 2024 while Bitcoin’s (BTC) open interest remained flat. This disconnect became a precursor that led to a sharp correction of 30% in early 2025. Following the crash, the market entered a prolonged “chop” phase with sideways price action lasting for three months.

Maartunn notes that similar conditions are unfolding again in September 2025. Altcoin’s Open Interest is soaring while Bitcoin stays flat. This deviation is mounting pressure in the market and may result in a sharp unwind, especially if macroeconomic conditions change or some unexpected regulatory announcement is made.

“We’ve seen this before. It doesn’t mean it will play out the same way, but you should know where your exits are.” Maartunn noted.

He also likened the situation to a game of musical chairs when the music stops, not everyone will be sitting comfortably. While the Altcoin Season Index is at its highest level since December and top tokens like Solana, Ethereum, and Ripple are pushing higher, the market still faces considerable risks.

Compared to past altseasons, the current rally remains relatively modest. A sharp correction remains possible if institutional support weakens or macro volatility returns, and whether the rally bursts in or fades into another “false start” depends on the days ahead.