Bitcoin Inflows Shatter 15-Year Record in -2025 Surge

Digital gold rush accelerates as institutional money floods into Bitcoin at unprecedented rates.

The Bull Run Redefines Historical Patterns

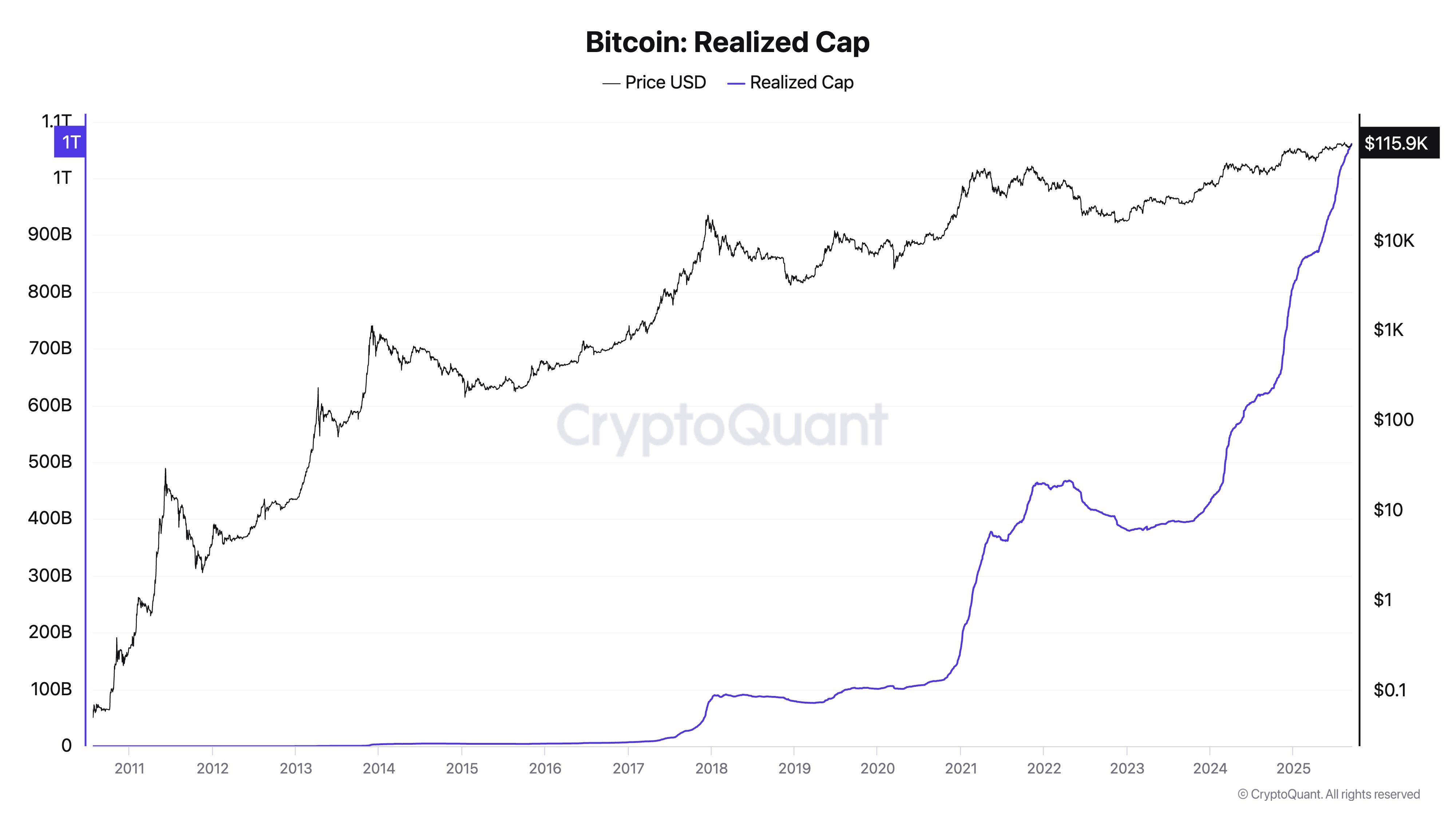

Capital inflows during the 2024-2025 period have officially demolished all previous records set since Bitcoin's inception. The numbers don't lie—this isn't just growth; it's a fundamental shift in how institutional players view digital assets.

Wall Street Finally Gets It

Traditional finance giants, once Bitcoin's biggest skeptics, are now leading the charge. They've discovered what crypto natives knew all along—digital scarcity beats printing presses every time. Better late than never, I suppose.

The New Safe Haven

While traditional markets wobble under inflationary pressures and geopolitical tensions, Bitcoin stands firm. Its performance during recent economic uncertainty has turned heads and opened wallets—even among the most conservative allocators.

Warning: Past Performance Doesn't Guarantee Future Results

But let's be real—if traditional finance's track record with timing markets tells us anything, most of these institutions will probably buy at the top and panic sell at the bottom. Some things never change.

Chart depicting the realized on-chain capital from bitcoin in the past few years | Source: CryptoQuant

Chart depicting the realized on-chain capital from bitcoin in the past few years | Source: CryptoQuant

What is fueling Bitcoin’s high inflows?

One of the main drivers behind this surge in capital being brought on-chain comes from the increase in institutional investors who are now involved in Bitcoin; whether that is through spot Bitcoin ETFs, corporate treasury allocations, sovereign or institutional investors.

According to data from Bitcoin Treasuries, there are about 3.71 million BTC held within treasuries, with the number of entities holding Bitcoin reaching 325. This number is dominated by publicly-listed companies, which make up 190 entities on the sheet. Michael Saylor’s Strategy remains the largest corporate holder of BTC, with 638,460 BTC to date.

Meanwhile, macro tailwind from softer inflation and looming Fed cuts has only amplified this capital rotation, with long-term holders accumulating and illiquid supply at records. This means that many are bracing for the impact of Fed interest rate cuts as they MOVE funds on-chain, using BTC as an investment vehicle.

Aside from that, the rising price of BTC may draw in more capital as traders experience the fear of missing out. At press time, BTC has seen a 93.3% increase in the past year, reflecting the spike in on-chain capital. It has reached consecutive all-time highs throughout its recent rallies this year.

On the technical side, BTC is approaching historically overbought conditions, with the monthly Relative Strength Index sitting NEAR 70. While this suggests strong bullish momentum, it also raises the risk of consolidation or pullbacks as traders take profit. However, the broader trend remains intact, and given the scale of fresh inflows, any retracement could be seen as healthy rather than signaling the end of the cycle.