Fed Rate Cuts & Bitcoin: The Bullish Catalyst You Can’t Ignore

When the Fed cuts rates, Bitcoin traders pop champagne—while traditional finance scrambles for yield.

The Liquidity Floodgates Open

Cheap money sloshes into risk assets faster than you can say 'quantitative easing.' Bitcoin's fixed supply suddenly looks a lot sexier than negative-yielding bonds.

Institutional FOMO Returns

Hedge funds and corporate treasuries—stuck with pathetic bond returns—start eyeing BTC like a starving man eyes a steak. The 'digital gold' narrative gets its steroids moment.

But Here's the Twist

Not all rate cuts are created equal. If the Fed's panicking about recession, crypto might catch a cold too. But let's be real—since when did macro logic ever stop a good crypto rally?

Bottom line: Rate cuts historically kick off risk-on parties. And Bitcoin's the main event—whether Wall Street admits it or not.

Source: CoinGecko

Summary

Source: CoinGecko

Summary

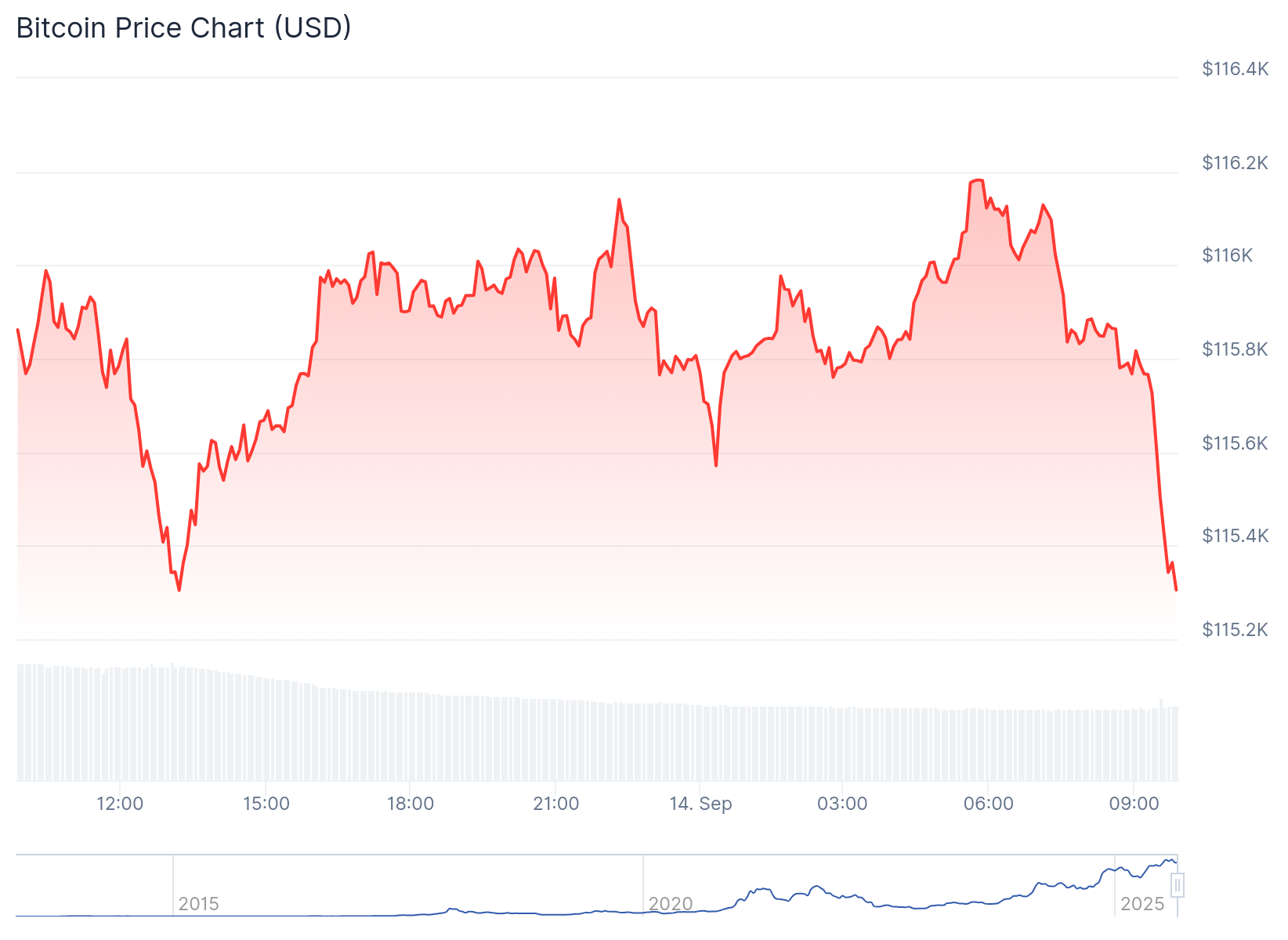

- Bitcoin price has rallied ahead of the Federal Reserve interest rate decision.

- Economists expect the bank to cut interest rates by 0.25%.

- While BTC price may jump, the rising wedge pattern points to a dive.

Federal Reserve to cut interest rates

The most significant macro tailwind this week will be the Federal Open Market Committee (FOMC) interest rate decision on Wednesday.

Kalshi and Polymarket oddsof a 25 basis point cut stand at almost 100%. Similarly, the CME FedWatch Tool confirms this view.

In theory, the start of the Federal Reserve interest rate cuts should be bullish for Bitcoin (BTC) and the crypto market. Historically, these assets have thrived in the era of easy money policies but struggle when the Fed tightens.

For example, Bitcoin price jumped to a record high during the pandemic as the Fed slashed rates and then crashed to below $16,000 as the bank hiked in 2022.

Fueling the bullish case is that the rate cut is coming towards the fourth quarter, which is usually its best-performing ones. CoinGlass data shows that the average bitcoin return in Q4 since 2013 is over 84%.

However, there is a risk that the Fed cut will not boost Bitcoin for two main reasons. First, the rate cut has already been priced in, which WOULD make it a sell-the-news opportunity. This risk will be elevated if the Fed delivers a hawkish cut.

Bitcoin price has formed a risky pattern

The other main risk is that the bitcoin price has formed a nearly-perfect rising wedge pattern on the weekly chart. This pattern consists of two ascending and converging trendlines. With this convergence happening, there is a risk that a breakdown will happen soon.

The other technical risk is that oscillators like the Relative Strength Index and the MACD have formed a bearish divergence pattern. This pattern occurs when the asset price has a downward trajectory despite being rising.

As such, while the Fed cut is highly bullish for Bitcoin and the crypto market, there is also a risk of a potential pullback when it happens.