Linea Skyrockets as Smart Money Buys the Dip - Ecosystem Metrics Rocket Toward Historic Highs

Dip-buying frenzy sends Linea soaring as ecosystem metrics blast off toward unprecedented territory.

Investors Pounce on Opportunity

Smart money isn't waiting around—whales and institutions are loading up on Linea during the recent pullback, treating it like a Black Friday sale for digital assets. The buying pressure's pushing prices north faster than a hedge fund manager chasing performance fees.

Ecosystem Goes Supernova

Network activity isn't just growing—it's exploding. Transaction volumes hit levels that make traditional finance look like it's moving in slow motion. Developer activity's surging too, with new projects deploying weekly as if building during a bull market fire sale.

Record-Breaking Momentum

Every metric that matters is painting the same picture: adoption's accelerating while the suits on Wall Street still debate whether crypto's 'a real asset class.' Daily active addresses scream upward, trading volume punches through previous ceilings, and total value locked makes traditional yield products look downright pathetic.

This isn't just recovery—it's a full-blown renaissance. While traditional finance plays catch-up, Linea's proving that in crypto, the early birds don't just get the worm—they get the whole damn buffet. Just don't tell your financial advisor—they might still be waiting for 'the right entry point.'

Can Linea position itself as the leading L2 by TVL?

Linea jumped to $0.027, up by 30% from its lowest level this week. This jump brought its market capitalization to over $418 million.

Linea price ROSE as key metrics on its ecosystem jumped to a record high, a sign of its improving ecosystem. Its total value locked jumped to over $1.94 billion, much higher than the year-to-date low of $147 million.

Aave (AAVE), the biggest player in decentralized finance, has led this growth. Its TVL soared to over $1.1 billion, while its 24-hour fees in the network jumped to over $90,000. The other top dApps in the network are Renzo, Etherex, and Euler.

This growth aligns with Linea’s goal of becoming the biggest layer-2 in terms of DeFi TVL. To achieve that goal, it will need to pass Base and Arbitrum, which have $7 billion and $4 billion in assets.

2026 Goal: Linea positions itself as the leading L2 by TVL and as the premier destination for ETH capital.

Every major financial institution goes onchain, but on credibly neutral platforms, not corporate chains.

Additionally, Linea is becoming a major player in the decentralized exchange industry. dApps in its network handled volume worth $1.97 billion this month so far, slightly lower than the $2 billion they handled last month. These are big numbers for a network that handled just $258 million in July.

The amount of stablecoins on the network is soaring. Its stablecoins jumped by over 1.5% in the last seven days to $298 million, with USD Coin having the most significant market share.

Linea price analysis

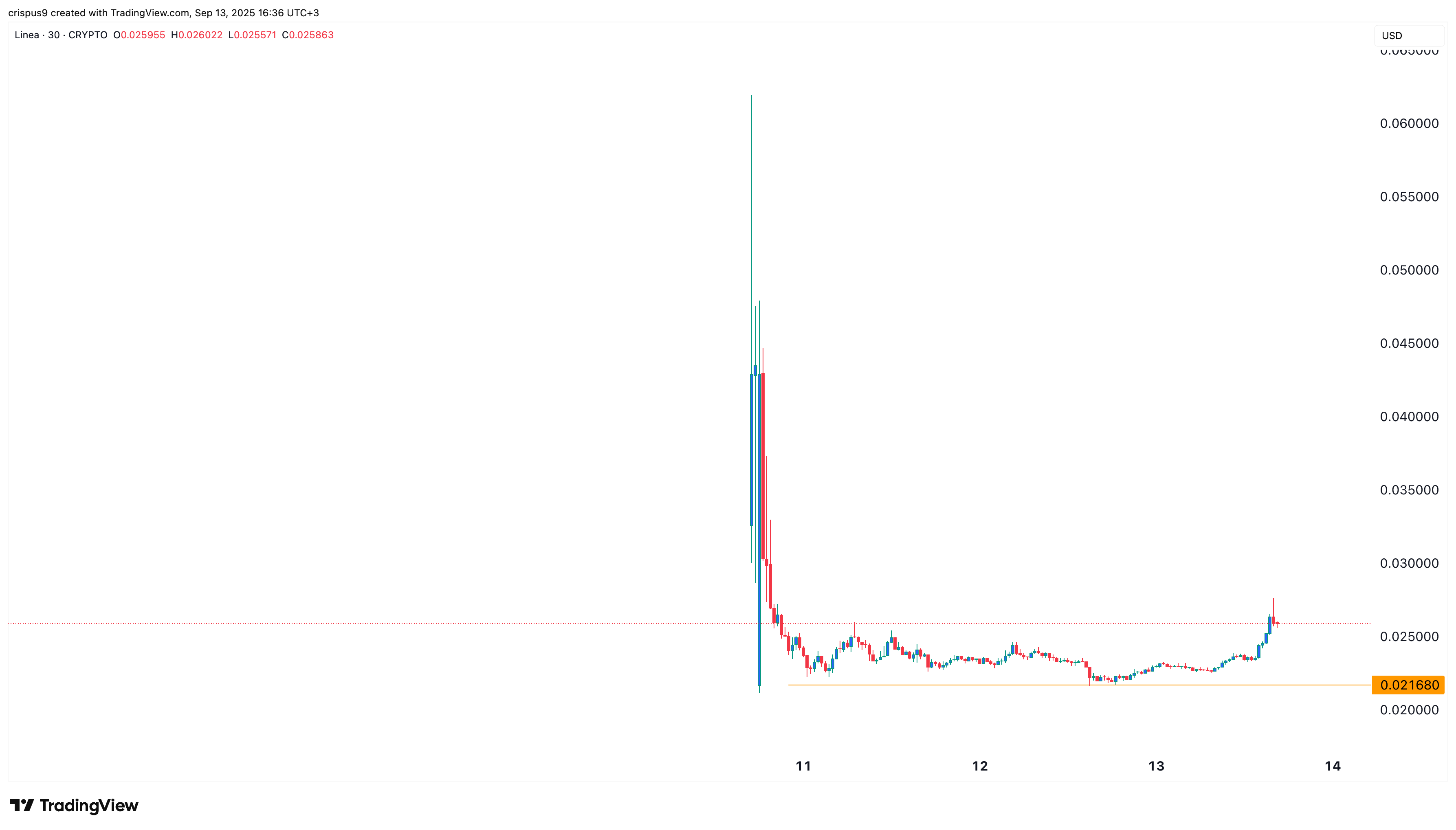

The 30-minute chart shows that the Linea crypto price bottomed at $0.02168, a level it failed to move below after its airdrop. This rebound could be happening as investors buy the dip.

While it is too early to tell, there are signs that it is about to MOVE to the markup phase of the Wyckoff Theory. If this happens, it could jump sharply, potentially to the key resistance level at $0.050, which is about 96% above the current level.