BREAKING: DTCC Greenlights Solana, XRP, and Hedera ETFs as SEC Deadline Looms

Wall Street's backoffice giant just placed its bets—and the timing couldn't be more dramatic.

The Clearing Catalyst

DTCC's move signals institutional readiness right as regulators weigh approvals. No more waiting for custody solutions or infrastructure—the plumbing's already in place.

The Crypto Trinity

Solana brings speed, XRP offers settlement muscle, Hedera adds enterprise governance. Together, they cover the trifecta: scalability, liquidity, and compliance.

The SEC Countdown

With listings live pre-verdict, DTCC essentially forces the regulator's hand. Approvals could trigger instant trading—rejections would make this week's paperwork look performative.

Let's see if the SEC approves these ETFs or just enjoys watching lawyers generate billable hours.

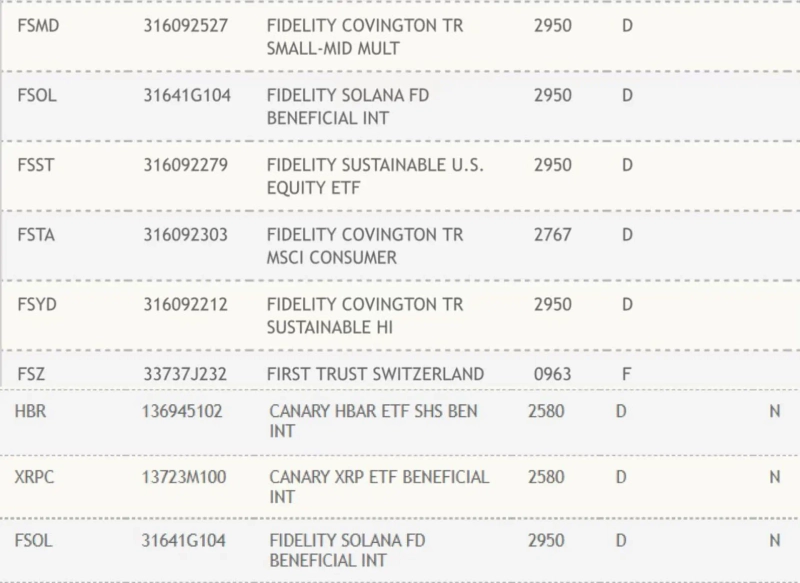

DTCC’s National Securities Clearing Corporation list | Source: DTCC

Are the Solana, Hedera, and XRP ETFs approved?

DTCC’s National Securities Clearing Corporation list | Source: DTCC

Are the Solana, Hedera, and XRP ETFs approved?

For those unaware, the DTCC is a major clearing and settlement provider for U.S. securities that handles post-trade operations for ETF products. However, as it is not a government agency, listing on the platform does not mean that an ETF WOULD be approved for trading.

Getting listed on DTCC is a vital step ahead of an ETF’s launch, but the approval of a fund still hinges on the Securities and Exchange Commission’s nod, without which a product cannot begin trading legally in the U.S. Market.

As previously covered on crypto.news, Canary’s proposed Litecoin spot ETF was also added to the list back in February, but it has yet to receive approval.

Yet, Bloomberg ETF analyst ERIC Balchunas, who agreed that a DTCC listing isn’t a final nod, believes historical precedents suggest that most tickers added to the system do eventually make it to market.

“Agree, nothing to see here,” Balchunas wrote in a Sep. 12 reply on X, adding “how many tickers are added that never launched, probably almost none.”

SEC has delayed ETF approvals

Since the start of the year, the SEC has delayed decisions on the aforementioned ETF products alongside a number of other altcoin ETFs for several other issuers without offering any clarification other than the fact that it needs more time to review.

Back in August, the commission postponed its decision on Canary’s XRP ETF to a window between October 18 and 23. Canary’s HBAR ETF was pushed to November, while Fidelity’s Solana ETF decision was likewise extended into October.

Yet the consensus is that most altcoin ETFs are expected to be approved, especially as there’s a new pro-crypto leadership at the SEC’s helm.

According to Balchunas and fellow Bloomberg analyst James Seyffart, the odds of a Solana (SOL) and XRP (XRP) getting approved are 95%; meanwhile, Hedera’s odds stand at 90%.

All of the tokens added to the DTCC’s list were trading in the green at press time, with SOL leading with gains of over 7% in the past 24 hours, followed by HBAR and XRP with gains of 3.63% and 1.88% respectively.

ETF analyst Nate Geraci believes that once approved, altcoin ETFs, specifically funds tied to SOL and XRP, could attract significant investor demand.

“People are severely underestimating investor demand for spot XRP & SOL ETFs,” he said in an X post earlier this month.