Ethereum Overtakes Bitcoin in Trading Volume: The King is Dead, Long Live the King?

Ethereum just flipped the script—and Bitcoin's crown is looking wobbly.

The upstart protocol isn't just competing; it's dominating daily volume, signaling a seismic shift in crypto's hierarchy. Forget 'digital gold'—this is about utility, speed, and a ecosystem that actually does something besides sit there looking expensive.

Traders are voting with their wallets, and let's be real—when was the last time Bitcoin devs shipped anything that wasn't a SegWit-level disappointment?

Ethereum's surge isn't a fluke. It's built on real use: DeFi, NFTs, staking yields that don't put you to sleep. Meanwhile, Bitcoin maximalists are still arguing about block size over cigars. Wake up—adapt or become a relic.

So yeah, Bitcoin might keep the 'store of value' narrative alive—for now. But in the race for relevance? Ethereum isn't just challenging dominance. It's rewriting the rules. And Wall Street? They're still trying to figure out how to short both without looking stupid.

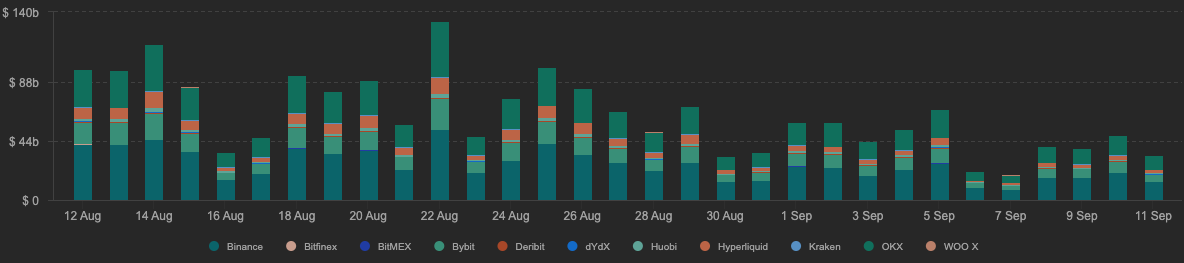

Ethereum daily spot trading volume | Source: Coinalyze

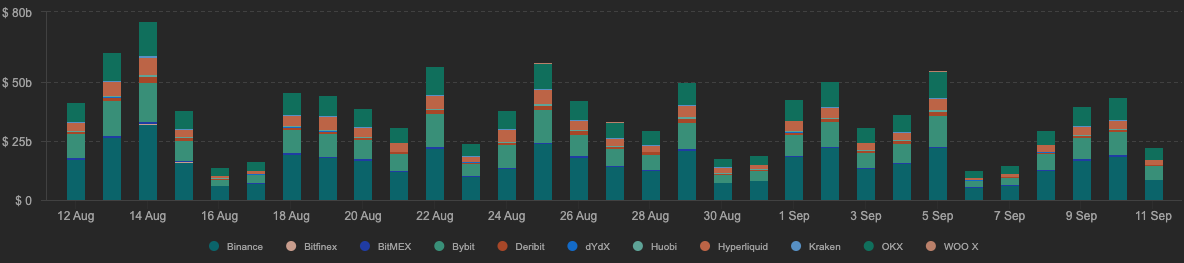

Ethereum daily spot trading volume | Source: Coinalyze

From early August to September 9, Ethereum’s (ETH) trading volume was at 32.9%, according to CryptoRank. At the same time, that figure for Bitcoin (BTC) was 32.6%. What is more, this trend continued, and Ethereum’s spot trading volume reached $48 billion on September 10, compared to $43 billion for BTC.

ETFs show Ethereum and Bitcoin diverging

Ethereum’s rise in spot volume coincided with a divergence of Ethereum and bitcoin spot ETF flows. Notably, according to VanEck, Ethereum ETFs pulled $4 billion in inflows in August, while Bitcoin ETFs experienced outflows.

The most likely reason for this divergence is growing risk appetite among investors. Bitcoin is NEAR its all-time high levels, while investors anticipate that the Federal Reserve will lower interest rates. In this environment, investors are willing to take riskier bets that potentially offer higher returns.

For this reason, Ethereum traders are testing the $4,400 to $4,500 resistance zone while trading above $4,200. Currently, these are critical levels for the coin. Passing this zone could lead the coin to $5,000, while a collapse below support could lead it below $4,000.