BitMine’s Massive ETH Accumulation: Treasury Soars with 46k New Ethereum as Holdings Approach $10B Milestone

BitMine just turbocharged its treasury with a staggering 46,000 ETH purchase—pushing total holdings toward the psychological $10 billion barrier.

Strategic Aggression

While traditional finance plays catch-up with bond yields and inflation fears, BitMine executes pure alpha moves. This isn't diversification—it's conviction betting on Ethereum's infrastructure dominance.

Market Implications

That's nearly $150 million worth of ETH scooped up in one go. Institutions keep talking digital asset adoption—BitMine actually deploys capital like they mean it.

Timing The Bottom?

Accumulating at these levels either proves brilliant contrarian instinct or spectacular timing—Wall Street analysts won't know which to critique first.

Final Thought

While traditional funds rebalance their 60/40 portfolios toward mediocrity, BitMine demonstrates what actual treasury management looks like in the digital age—where else are you finding asymmetric upside? Certainly not in your financial advisor's bond fund recommendations.

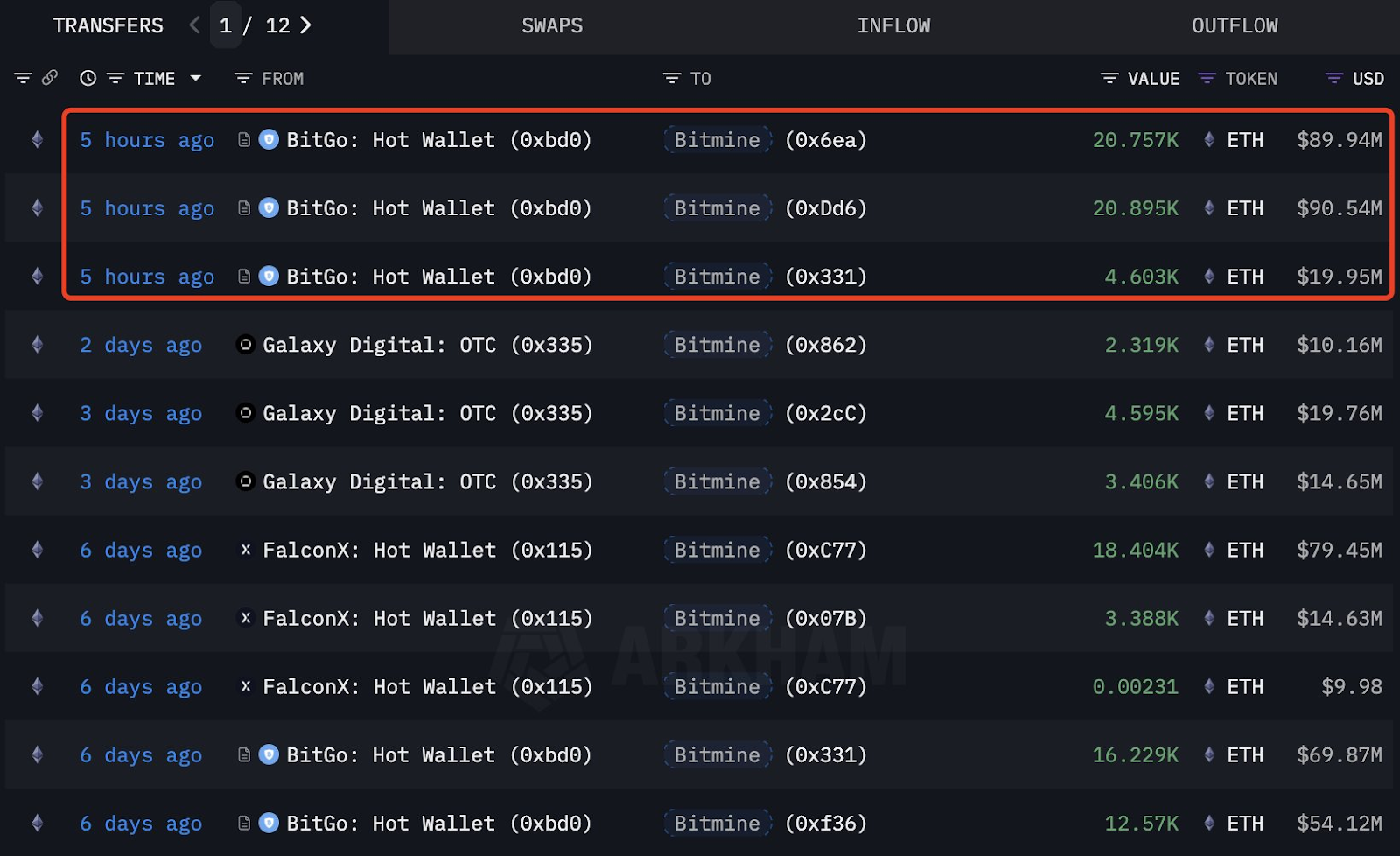

BitMine ETH purchases | Source: Lookonchain on X.

BitMine ETH purchases | Source: Lookonchain on X.

BitMine reportedly executed the purchase across three separate transactions via digital asset trust Bitgo, with the investment amount standing at roughly $200.43 million as estimated by Lookonchain.

BitMine remains the largest ETH treasury firmIncluding today’s ETH buy, the Nevada-based company’s total purchase this week has translated into a roughly $250 million allocation, with the company picking up 56545 ETH.

On Monday, the company said it had picked up over 202,469 ETH the previous week for approximately $881 million at the time.

As of Sep. 11, BitMine’s total Ether holdings constitute approximately 2.116 million ETH, valued at over $9.2 billion. This makes up around 1.75% of Ethereum’s circulating supply, and cements BitMine’s status as the world’s largest public Ethereum holder.

Since pivoting to a crypto treasury strategy in June and adopting an “asset-light” model focused on capital markets and staking yields, the company has steadily funded its Ether stash via direct investments. Over the long run, it plans to hold 5% of Ethereum’s total supply.

One of the key motivations behind the firm’s pivot was to enhance shareholder value, and that bet has played off quite nicely, with company shares up roughly 970% since it disclosed its ETH treasury plans.

Among its largest shareholders is Ark Invest, the Cathie Wood–led asset management firm, which holds 6.7 million shares in BitMine Immersion Technologies.

Last month, the company onboarded David Sharbutt, a former American Tower board member who is known for scaling infrastructure-heavy businesses, to its board to help guide BitMine’s long-term Ethereum strategy.

Ethereum treasury race heats up

BitMine joins a slowly growing list of public companies that have bet on Ethereum’s long-term potential. Some of the leading names include SharpLink Gaming, The Ether Machine, and Bit Digital, all of which have made sizable ETH allocations in recent weeks as part of their treasury strategies.

At the time of publication, approximately 3.62 million ETH were being held by public companies according to data tracked by Ethereum Treasuries.