Pi Network Price Shows Accumulation - Is a Major Reversal Imminent?

Pi Network's price action reveals strong accumulation patterns brewing beneath the surface—just as smart money starts positioning.

Market whales are quietly loading up while retail sleeps on this mobile-mined asset. The classic signs are all there: consistent support levels holding, decreasing sell pressure, and those sneaky large transfers into cold storage.

Technical indicators flash bullish divergences as trading volume picks up steam. RSI creeping out of oversold territory while MACD prepares for a potential crossover.

Remember—accumulation phases often precede the most explosive moves. Institutional players love building positions when everyone's looking the other way.

Could this be the setup before Pi Network finally breaks out of its prolonged consolidation? The charts suggest yes, but then again, crypto markets have a special talent for humbling both bulls and bears alike.

Pi Network key technical points

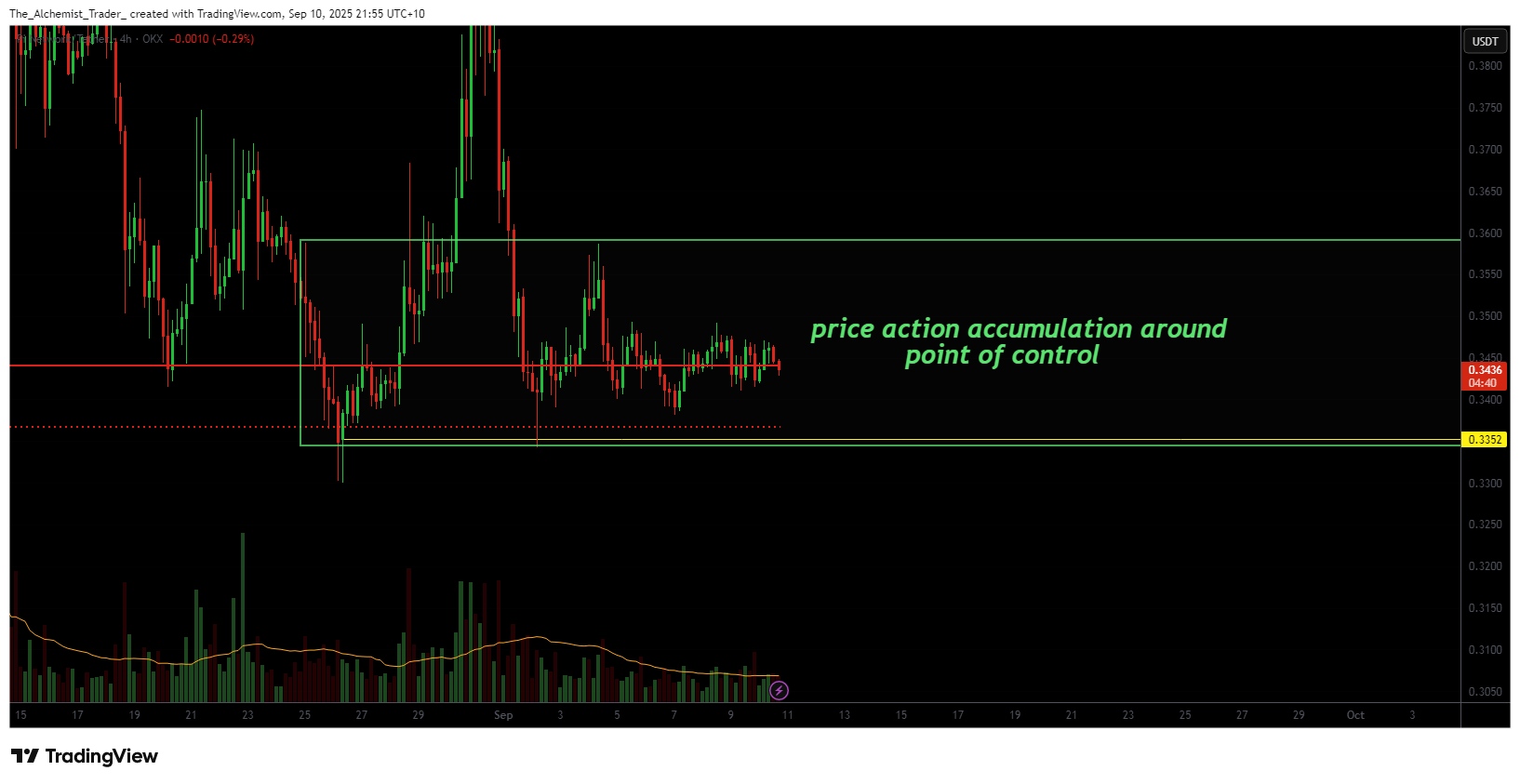

- Support at $0.35: Multiple daily closes confirm accumulation at high-time-frame support.

- Bearish Trendline Overhead: Consecutive lower lows still weigh on structure, creating an apex zone.

- Upside Target at $0.50: A confirmed breakout could trigger a rally toward the next resistance.

Pi Network’s chart highlights a distinct accumulation phase. The $0.35 level, also marked by the value area low, has consistently attracted buyers as price action hovers in this zone. Several daily candle closes above support reinforce the strength of this base, suggesting that market participants are positioning for an eventual breakout. The point of control, the price with the highest traded volume within the range, further confirms that activity is clustering here.

Despite these bullish underpinnings, the broader trend remains capped by a bearish descending trendline. This resistance has kept Pi locked in a sequence of lower highs and lower lows, compressing price into an apex structure. Such formations often precede decisive moves, but until the bearish resistance is broken, momentum remains subdued.

For the accumulation phase to shift into a reversal, PI must produce a breakout above this descending resistance. Crucially, the breakout must be accompanied by a sustained influx of bullish volume. Without this confirmation, any upside moves risk becoming short-lived rallies.

However, if volume inflows align with structural strength, Pi could accelerate toward its next significant target at $0.50, a level that has previously acted as resistance on higher time frames.

Volume analysis will be the key indicator in the coming sessions. Current trading behavior shows muted but steady accumulation, pointing to market participants quietly building positions. Once a breakout is attempted, traders should look for confirmation across multiple volume nodes to validate whether accumulation has indeed transitioned into bullish expansion.

What to expect in the coming price action

Pi Network is at a critical juncture. If price continues to hold $0.35 and successfully breaks through the descending trendline with strong volume support, a rally toward $0.50 becomes highly probable.

Failure to reclaim resistance, however, WOULD leave the token consolidating within its range, delaying the next major move until accumulation completes.