Kraken Shatters Barriers: Tokenized U.S. Stocks Launch in EU Through Revolutionary xStocks Platform

Wall Street meets blockchain—Kraken just flipped traditional finance on its head.

The exchange giant launched xStocks, bringing tokenized U.S. equities to European investors without the usual regulatory gymnastics. Finally—global market access without the paperwork nightmare.

How It Works

Each token represents actual shares—fully backed and tradeable 24/7. No more waiting for NYSE opening bells or dealing with legacy brokerage delays. Kraken’s leveraging blockchain to cut settlement times from days to seconds.

Why Europe First?

The EU’s progressive crypto framework made it the ideal testing ground. Kraken bypasses fragmented national regulations by operating under a unified pass—smart move against archaic financial borders.

Traditional finance brokers are sweating—their 1% fees and three-day settlements just got obsolesced by code.

Tokenization isn’t just a trend; it’s the inevitable fusion of traditional assets with decentralized efficiency. Watch traditional finance institutions scramble to keep up—or get left behind entirely.

Kraken’s xStocks offering

Initially, xStocks were first deployed as SPL tokens on the Solana blockchain. Now, Kraken claims that it has plans to expand xStocks token support to include BEP-20 on the ethereum mainnet. Users will be granted the choice to either interact with xStocks through Solana (SOL) or Ethereum (ETH).

Overtime, Kraken plans to expand support for xStocks by integrating with more blockchains, including Ink and other chains in the future.

Kraken’s Global Head of Consumer, Mark Greenberg, called expanding access to xStocks for customers in the European Union as a “natural next step” for the platform because of its established presence there.

“For too long, it’s been unnecessarily challenging to gain exposure to U.S. markets, and with xStocks we’re removing many of the barriers,” said Greenberg.

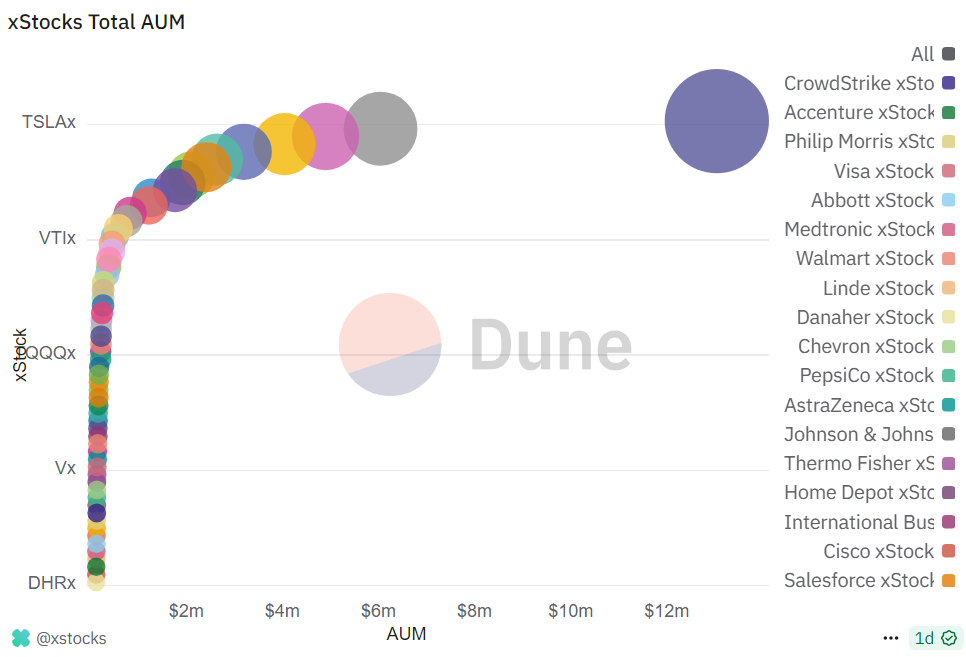

According to data from Dune analytics, xStocks has reached more than $3.6 billion in cumulative trading volume since its launch on June 30 this year. This figure accounts for volumes across centralized and decentralized exchanges, including Raydium and Kraken.

So far, the largest share of volume comes from TSLAx, NVDAx, MSTRx and CRCLx, tracking tracking Tesla, Nvidia and Circle stocks respectively.

Most recently, xStocks made up roughly 58% of all tokenized stock trading in mid-August this year. In fact, solana alone held a majority share of the xStocks market value at $46 million out of $86 million, as reported by crypto.news.