Bitcoin Futures Market Cools as Whales Retreat and Retail Takes Over

Bitcoin's futures frenzy hits the brakes—big money exits while Main Street doubles down.

The Whale Exodus

Major players are pulling billions from derivatives, leaving open interest at multi-month lows. Their leveraged positions unwound faster than a degenerate gambler's bankroll during margin call season.

Retail's Reckoning?

Smaller traders now dominate the action, flooding into perpetual swaps with the same cautious optimism that usually precedes a 'learning experience.' Their share of futures volume surged past 65%—because nothing says sustainable market like amateur hour.

Liquidity Vanishes

Bid-ask spreads widen as market makers retreat. The once-roaring futures engine now sputters like a crypto fund manager explaining yet another 'strategic reallocation' to limited partners.

Volatility Compounds the Pain

Wild price swings trigger cascading liquidations, wiping out over-leveraged positions. Turns out betting the farm on futures works great—until it doesn't.

This retail-driven cooling period either sets the stage for a healthier market foundation or becomes another cautionary tale in crypto's endless cycle of euphoria and despair. Place your bets—responsibly, or at least with the money you can afford to lose.

BTC futures market weakens as whale activity declines

According to CryptoQuant analyst EgyHashX, the futures market is transitioning from being whale-driven to more retail-led, with implications for Bitcoin’s near-term trajectory.

“Bitcoin’s futures market is cooling, with reduced whale activity and stronger retail influence reinforcing bearish sentiment. Unless whales demand returns, the price is likely to remain range-bound or face downside pressure,” EgyHashX stated.

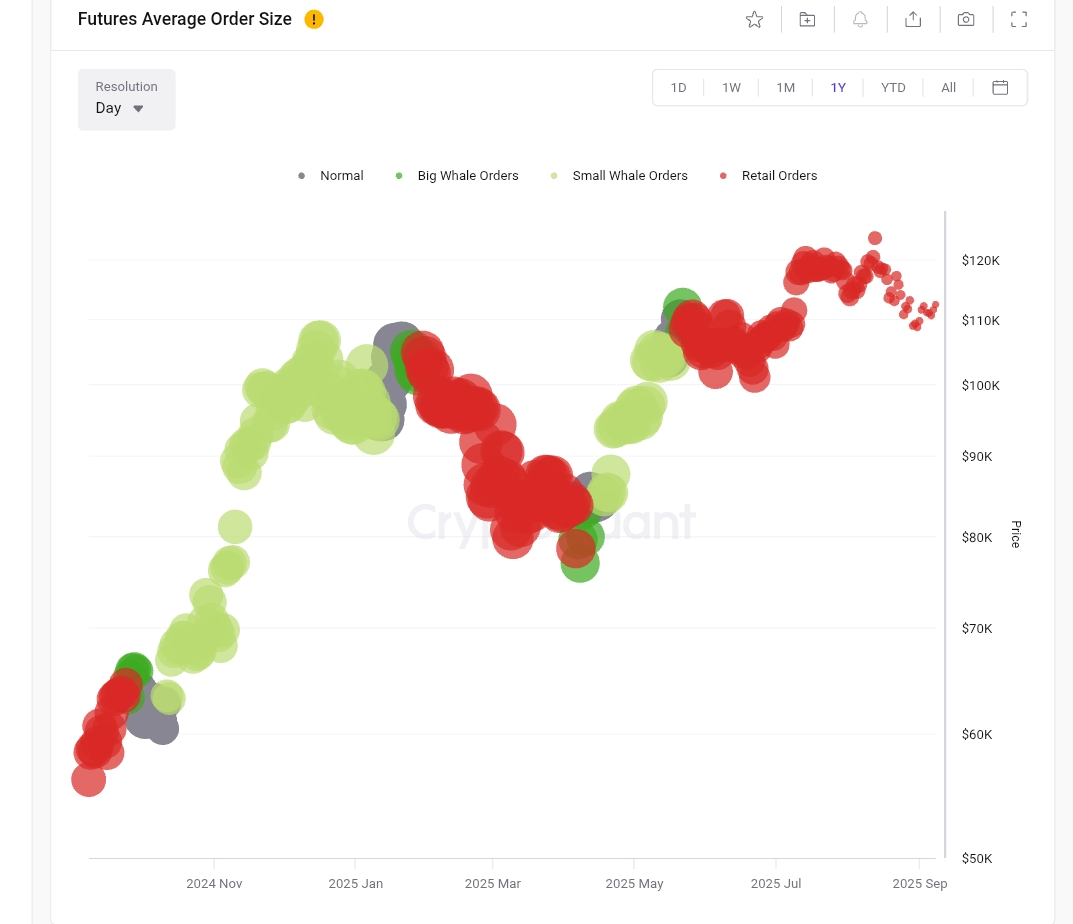

The Futures Average Order Size chart, which reflects trading volume per transaction, shows a clear decline in large trades.

During Bitcoin’s rise from $100K to $120K between June and September 2025, retail participation surged, overpowering the influence of institutional players. This pattern stands in contrast to the October 2024 to January 2025 period, when whales entered the market during Bitcoin’s sub-$90K accumulation phase.

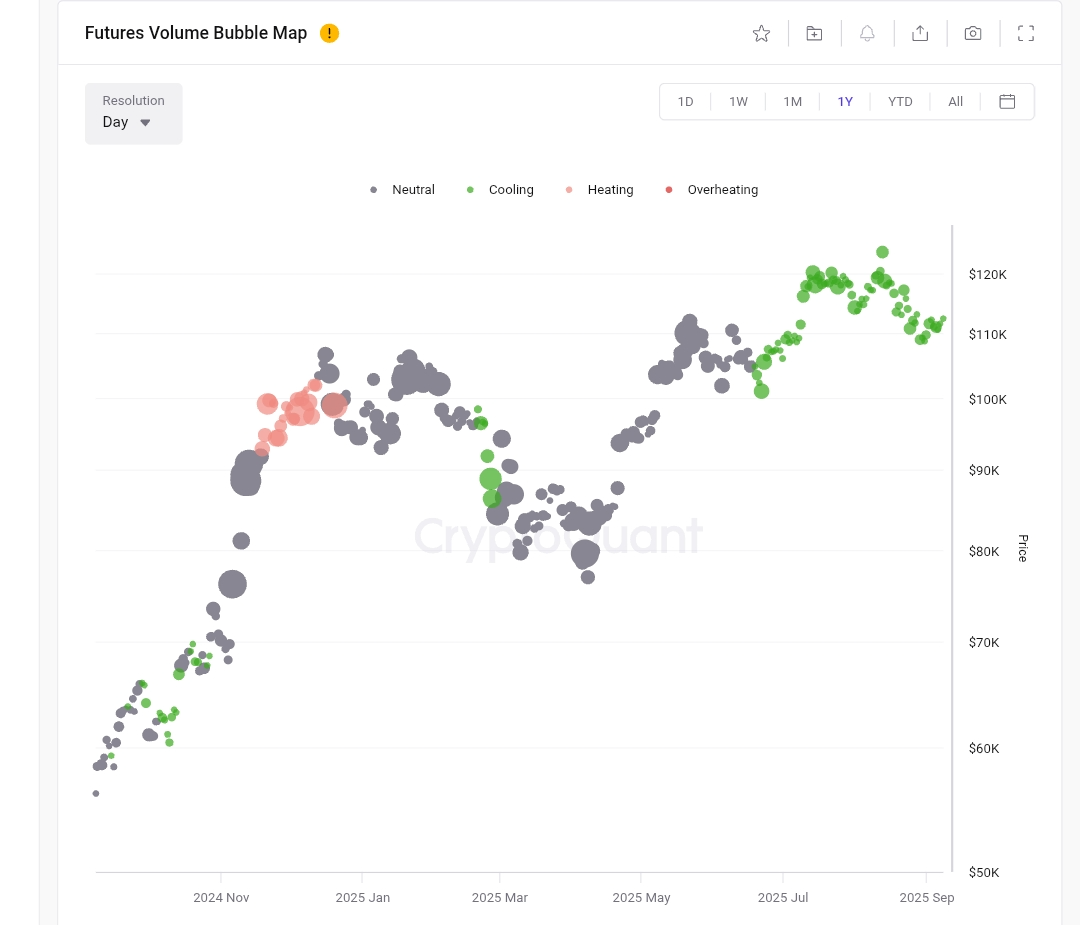

Supporting this observation, the Futures Volume Bubble Map highlights how the current price rally differs from earlier speculative spikes.

The recent months have shown mainly green “cooling” bubbles, suggesting healthy trading activity without the excess leverage that often precedes sharp corrections. The organic nature of the current rally implies a more structurally stable climb, but it also indicates reduced market excitement, pointing to a more cautious sentiment among large players.

Sellers take control as rice rises

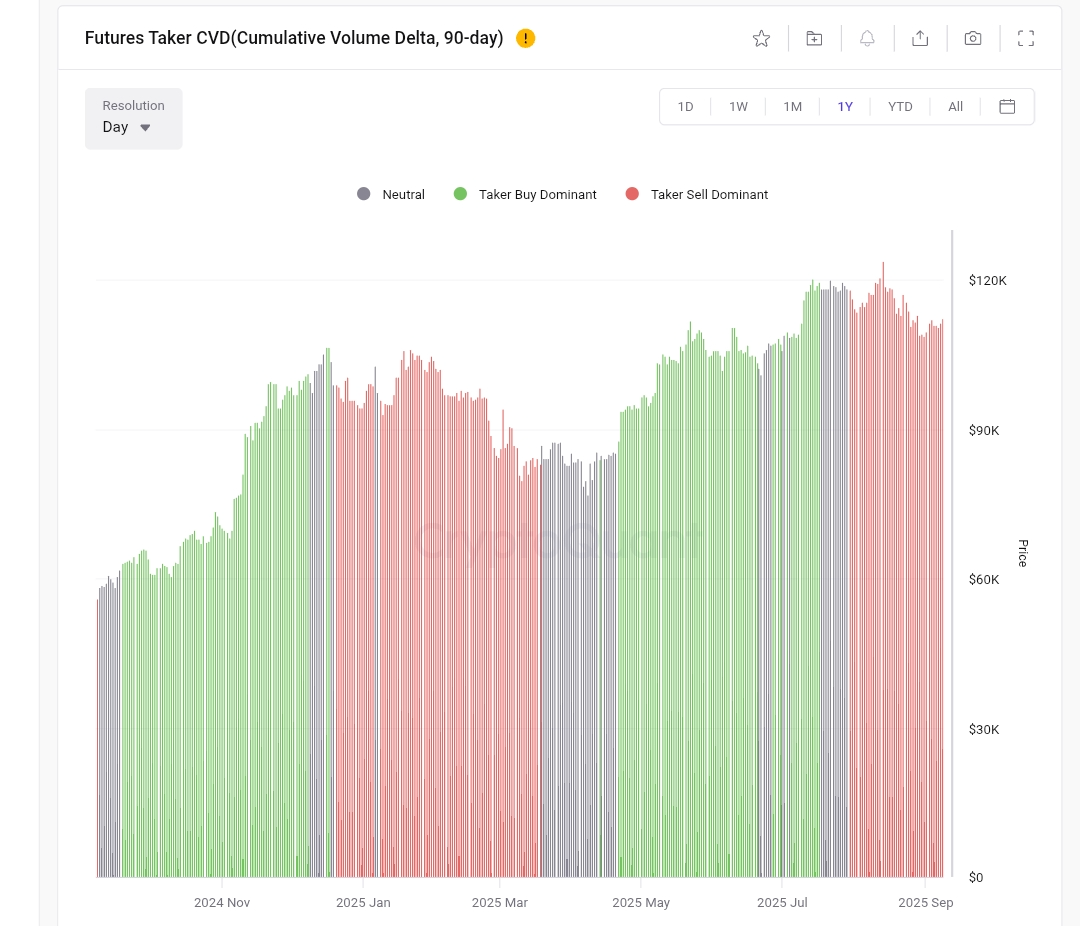

Adding to the bearish tone is the Bitcoin futures Taker CVD (Cumulative Volume Delta), which reflects dominant selling activity.

Between January and April 2025, red bars on the chart signaled that taker sell orders had taken over. There was a short-lived buyer revival in May-July, but since late July, sellers have again taken the upper hand despite Bitcoin price surging above $110K. This mismatch between price action and futures sentiment makes the current uptrend less convincing.

crypto.news reported earlier that whales have dumped 100,000 BTC in the past 30 days, further supporting the latest shift from a whale to a retail-led market. For now, market data shows that Bitcoin is trading at $112,952 at press time, slightly recovering after falling out of the $110,000 support zone.

Meanwhile, technical indicators are turning bullish. The MACD histogram has flipped green, and the MACD line is crossing above the signal line, indicating early bullish momentum. The RSI stands at 51.55, recovering from oversold territory, suggesting neutral-to-positive momentum.

Nevertheless, the major resistance at $114,800 has to be overcome to allow BTC to test the $118,500 or even revisit the current high of $124,475. On the other hand, $110,000 and $107,500 are important support levels. A drop below might open bitcoin to additional correction, possibly to as low as $103,000.

Although the current picture is optimistic, the declining futures market and whale involvement indicate that the continuation of a bullish trend will depend on new institutional demand. Without it, BTC may continue to trade sideways in the coming days.