Bitcoin Battles at $110K: Whale Exodus Meets Institutional Retreat

Bitcoin's throne wobbles as massive holders cash out and big money pulls back—just another day in crypto's volatile kingdom.

The Whale Dump

Whales unloaded holdings at the $110K threshold, creating immediate selling pressure that rattled retail traders. These large-scale moves often signal short-term turbulence ahead.

Institutional Cold Feet

Major funds and corporate players slowed their accumulation pace, opting for caution rather than conviction. When institutions retreat, liquidity shrinks—and volatility expands.

Market Mechanics Exposed

No fancy algorithms or dark pool tricks here—just old-fashioned profit-taking meets institutional skittishness. Sometimes the market’s simplest moves pack the hardest punch.

Welcome to digital gold—where even a $110K price tag can’t buy stability. Maybe next time hedge your bets with something less exciting… like bonds. Or beige paint.

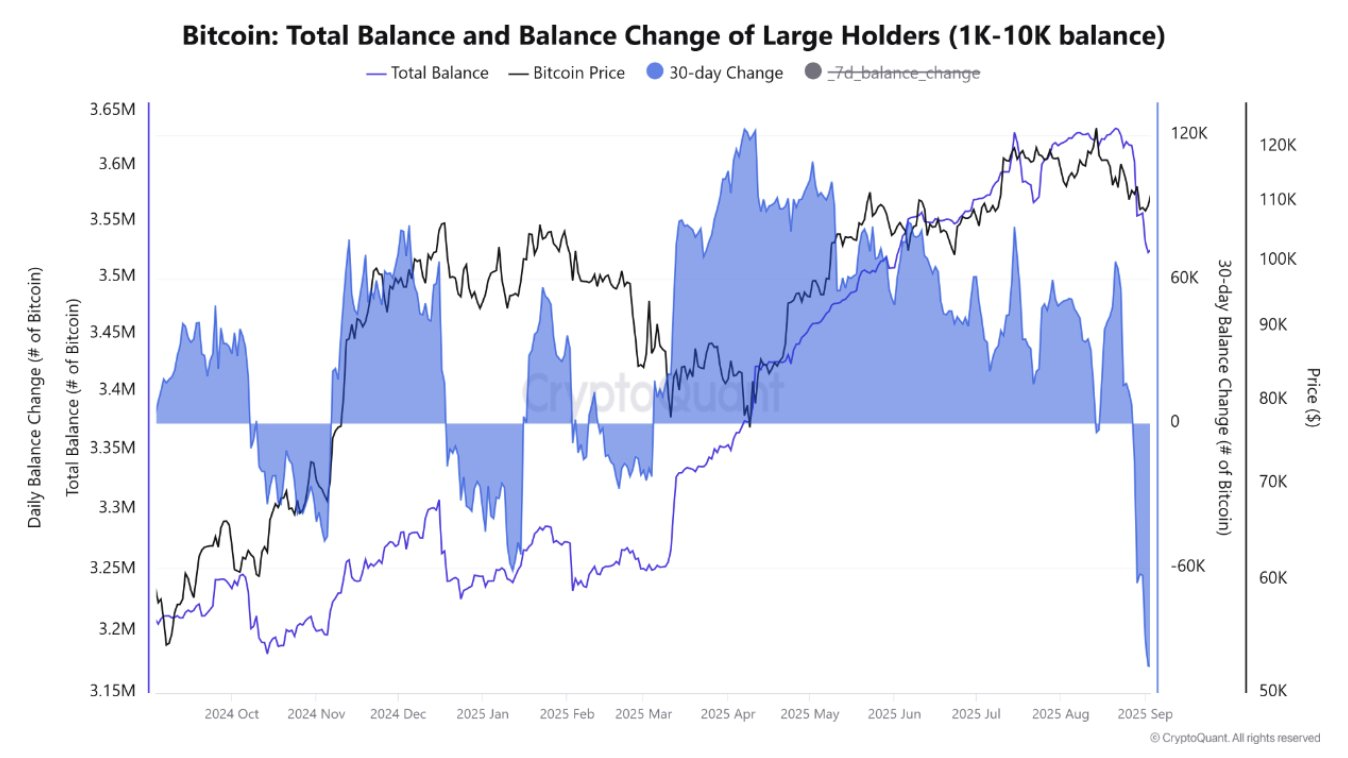

Bitcoin whale sell-off hits highest level since 2022

According to CryptoQuant analyst Caueconomy, the Bitcoin market is experiencing the largest wave of whale selloffs since 2022. In the past 30 days alone, whale reserves have declined by more than 100,000 BTC, equivalent to roughly $11.1 billion at current prices.

“This selling pressure has been penalizing the price structure in the short term, ultimately pushing prices below $108,000,” Caueconomy noted.

These large holders appear to be reducing exposure amid growing market uncertainty. Caueconomy also warned that the trend is not over, stating that current whale portfolios are still in decline, which could continue to weigh on bitcoin over the coming weeks.

Adding to the concern, another analyst Maartun revealed on Monday that long-term holders offloaded 241,000 BTC, one of the largest since early 2025. The sheer scale of this selloff suggests that even seasoned holders are beginning to lock in profits or reduce risk exposure.

Institutional activity cools despite record holdings

A separate trend of declining institutional interest is also unfolding. Although Bitcoin treasuries currently hold a record 840,000 BTC in 2025, the growth rate has sharply declined. According to CryptoQuant, Strategy, the biggest holder with 637,000 BTC, experienced a decrease in its monthly purchases, which were 134,000 BTC in November 2024 and only 3,700 BTC in August 2025.

Bitcoin buys by other companies also slowed during this period, reaching only 14,800 BTC, far below this year’s peak of 66,000 BTC. Although the number of transactions is still high, the size of those purchases is shrinking. Strategy’s average transaction size dropped to 1,200 BTC, while others averaged just 343 BTC, down 86% from early 2025 levels.

This trend suggests caution and possibly liquidity constraints. Institutions are still active, but they are buying less per transaction, showing hesitance in current market conditions despite headline holdings being at all-time highs.

Price action signals range-bound trading as bulls lose steam

Bitcoin is trading at press time at $111,134, per market data from crypto.news. The crypto market giant is down over 10% from its all-time high of $124,128 and remains in a range of consolidation between $110,000 and $115,000. In the meantime, technical indicators are giving neutral signals. The ADX (Average Directional Index) is 16.10, which indicates a weak direction in line with the current sideways movement.

BTC must overcome $115,000 to continue the bullish trend, with $120,000 or $125,000 as potential targets. Conversely, a decline below $110,000 can pull BTC to the $105,000 mark once again.