BNB Nears All-Time High: $1000+ Rally Imminent as Binance Momentum Builds

Binance's native token flirts with historic peaks as consolidation pattern signals potential explosive breakout.

The Consolidation Catalyst

BNB's sideways action near all-time highs isn't stagnation—it's coiled energy. Market patterns suggest this consolidation phase typically precedes major upward movements, with technical indicators flashing bullish across the board.

Institutional Accumulation Accelerates

Whale wallets keep loading up while retail hesitates—classic pre-pump behavior. Exchange reserves hit multi-month lows as smart money positions for the next leg up.

The $1000 Psychological Barrier

Breaking four figures would trigger algorithmic buying waves and FOMO from traditional finance tourists who still think digital gold only comes in bar form.

When a token this dominant consolidates at highs, it's not asking permission—it's gathering force. The only question isn't if BNB breaks $1000, but how fast it races past it once momentum kicks in. Just don't expect your traditional wealth manager to understand why.

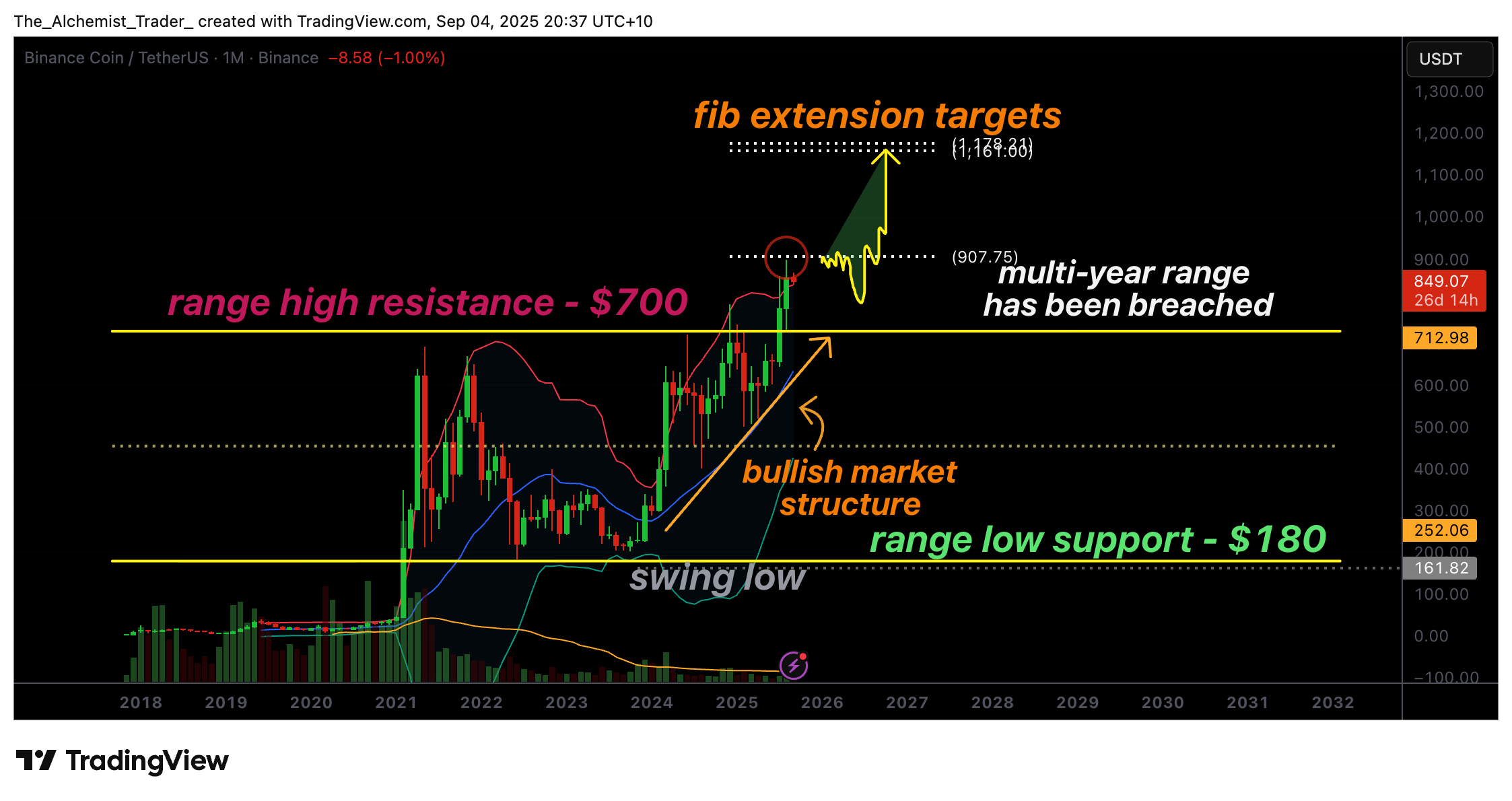

Binance price key technical points

- Range Breakout: BNB has breached the $700 multi-year resistance on a closing basis.

- Market Structure: Consecutive higher highs and higher lows remain intact since the $180 range low.

- Fibonacci Targets: $1,000 acts as the immediate resistance, with $1,450 as the next bullish extension.

The decisive breakout above $700 represents a critical milestone for BNB. This level acted as resistance within a multi-year range, containing price for an extended period. A confirmed close above it indicates acceptance at higher levels and signals that the consolidation phase may have transitioned into a trending market.

BNB’s bullish market structure has been intact since it bottomed at $180, where price established a clear higher low before beginning its sustained rally. Since then, the chart has consistently printed consecutive higher highs and higher lows, a defining feature of bullish continuation. This structure not only validates the strength of the breakout but also increases confidence in the likelihood of further upside.

The Fibonacci extension levels add another LAYER of technical confluence. The $1,000 region has already been briefly tested, acting as both a psychological and technical milestone. If BNB can reclaim this resistance and close above it, the next measured move points to the $1,450 extension level. This projection suggests that while short-term consolidations may occur, the broader trajectory remains firmly skewed toward the upside.

Volume dynamics also support this breakout. While the initial MOVE above $700 occurred with a surge in activity, the market is now consolidating, awaiting renewed influxes of demand. Sustained bullish volume will be required to drive continuation, especially as price approaches psychological levels where sellers are likely to emerge.

What to expect in the coming price action

As long as BNB remains above $700, the bullish outlook stays valid. A reclaim and breakout above $1,000 could trigger acceleration toward $1,450, continuing the multi-year uptrend. Failure to hold $700 WOULD weaken the bullish thesis.