Top 3 Reasons the Soaring Cronos Price Is Headed for a Major Correction

Cronos rockets to unsustainable heights—here's why gravity's about to kick in hard.

Technical Overextension Signals Pullback

The rally's pushing technical indicators into extreme territory. RSI levels scream overbought while trading volumes fail to confirm new highs—classic divergence that historically precedes sharp reversals.

Ecosystem Growth Can't Keep Pace With Valuation

Despite network activity increases, fundamental metrics lag far behind price appreciation. Daily active addresses and transaction volumes simply don't justify current multiples—reminding everyone that in crypto, sometimes the numbers do lie.

Macro Headwinds Gather Strength

Broader market conditions turn hostile as regulatory scrutiny intensifies and liquidity tightens. Cronos isn't immune to sector-wide pressures—especially when traders start taking profits to cover losses elsewhere in their portfolios.

The correction isn't a matter of if, but when. Smart money's already rotating out while retail chases the pump—because nothing says 'financial wisdom' like buying the top and praying for a miracle.

Cronos price will crash as the CRO news fades

Crypto and stock prices always surge after a major announcement as investors buy, and the Fear of Missing Out prevails. Historically, these jumps tend to be short-lived.

A good example of this is the OKB price, which surged after the recent token burn news. With the news behind us, OKB token has now plunged by 35% from its highest level this month.

Similarly, Bio Protocol price, which went parabolic last week, has now plunged by 45% from its highest point. The CRO price will have a similar performance once the excitement cools.

CRO price has become highly overbought

Technicals suggest that the Cronos price could plunge in the coming days. First, top oscillators like the Relative Strength Index and the Money Flow Index have all moved to the overbought zone. A highly overbought asset tends to decline as some holders sell.

CRO price has moved much higher than its moving averages. It is 90% above the 50-day EMA and 116% above the 100-day EMA. As such, the token will likely have a mean reversion, where an asset drops to MOVE closer to the moving averages.

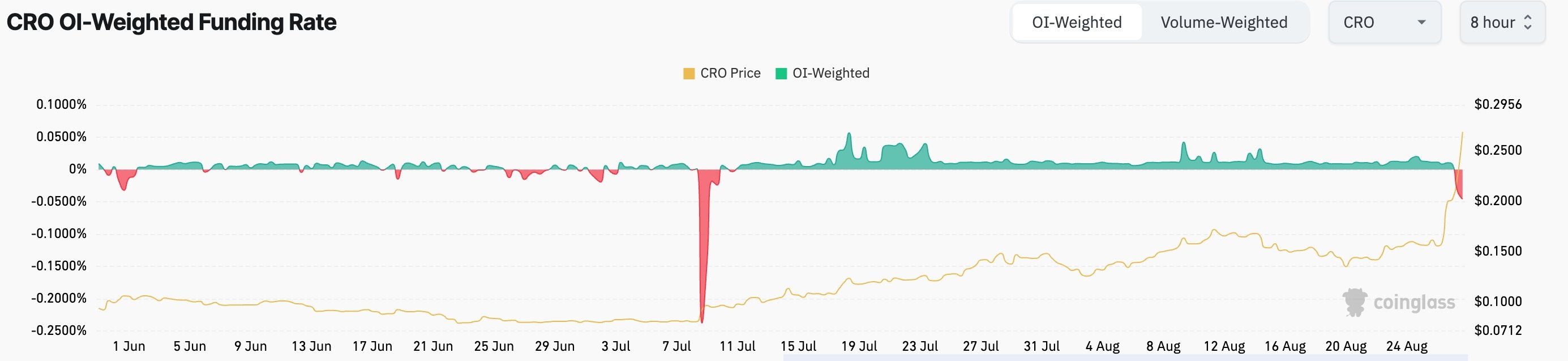

Falling funding rate

The derivatives market also points to further Cronos Price declines. One of the top metrics in the market is the funding rate.

A funding rate is a small fee or rebate that bulls and bears pay to maintain positions in perpetual futures. A negative funding rate is a sign that investors anticipate that the future price will be lower than the current one.

Also, the futures open interest jumped to a multi-year high of $53 million. While a rising open interest is a good thing, in most cases, reversals start when it reaches extreme levels.