Solana’s xStocks Explodes: $2B+ Volume in Just 6 Weeks with 60+ Tokenized U.S. Equities

Wall Street's worst nightmare just went live on-chain—and it's racking up numbers that'd make traditional exchanges blush.

Tokenized Trading Frenzy Hits Solana

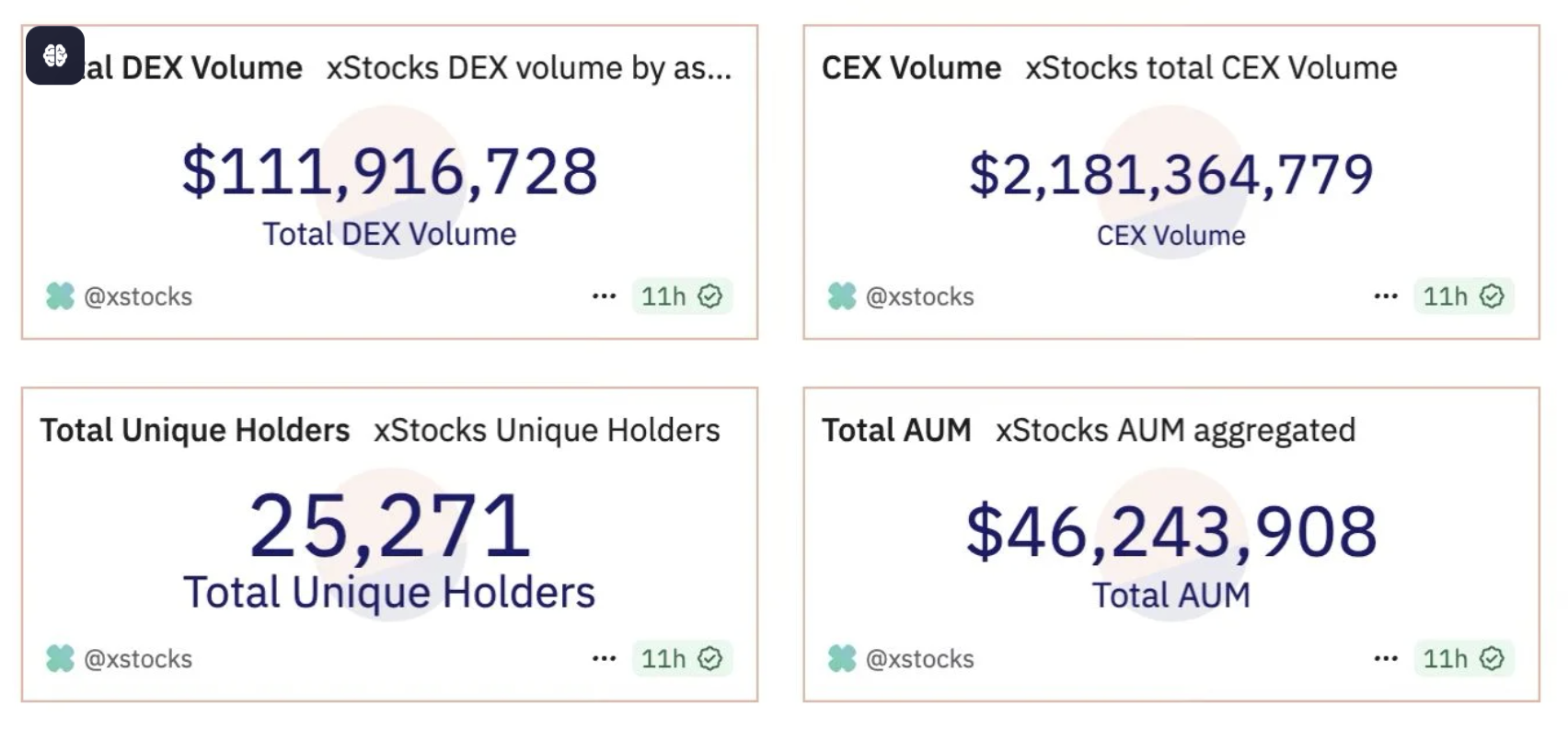

xStocks isn't just dipping toes into tokenization—it's diving headfirst into deep liquidity. Hitting over $2 billion in volume barely a month after launch screams one thing: demand for on-chain equities isn't speculative anymore. It's here, it's liquid, and frankly, it's outpacing legacy platforms at their own game.

Scaling Beyond 60 Real-World Assets

Forget vaporware promises. With sixty-plus U.S. equities now tokenized, Solana's proving that high-throughput chains can handle real-world assets without breaking a sweat—or charging custody fees that'd make a hedge fund manager smirk. Each token acts as a direct mirror to its traditional counterpart, only without the settlement delays or the middlemen skimming off the top.

Why This Isn't Just Another 'Crypto Gimmick'

This isn't DeFi 1.0 speculation—it's convergence. Real stocks, real volume, on a chain built for scale. While traditional finance still debates T+2 settlement, Solana's running circles around them with near-instant finality. The irony? Wall Street's 'efficiency' looks increasingly like a expensive relic.

Volume Speaks Louder Than Prospectuses

Two billion in six weeks isn't a fluke—it's a signal. Investors aren't waiting for permission to trade faster, cheaper, and without begging a broker for access. They're voting with their wallets, and the tally is looking brutal for the old guard. Maybe finance needed a little disruption after all—even if it came from a blockchain the suits still don't fully understand.

Source: Dune

Source: Dune

What are xStocks on Solana?

xStocks are SPL tokens on Solana representing fractional ownership of real U.S. stocks and exchange-traded funds, each backed 1:1 by shares held with regulated custodians. As of August, there are 60+ xStocks live on Solana, including household names like Apple (AAPLx), Microsoft (MSFTx), Tesla (TSLAx), Nvidia (NVDAx), Meta (METAx), Amazon (AMZNx), and the S&P 500 index (SPYx).

xStocks are available to non-U.S. residents worldwide for 24/7 trading and with instant settlement , providing access to U.S. equities without traditional brokerage barriers. Centralized exchanges like Kraken and Bybit handle broader distribution, while wallets such as Phantom and Solflare and on-chain venues including Raydium, Jupiter, and Kamino enable direct self-custody and composable use of holdings.

Beyond simple ownership, xStocks integrate with DeFi protocols, letting investors use their positions as collateral, participate in liquidity pools, and transfer holdings across platforms.