Centrifuge Smashes $1B TVL Barrier as Tokenized Credit Fund Goes Berserk

DeFi's quiet disruptor just dropped a mic.

Centrifuge—the protocol turning real-world assets into crypto gold—has bulldozed past $1 billion in total value locked (TVL). The surge comes courtesy of institutional money flooding its tokenized credit fund, proving even Wall Street dinosaurs want a piece of blockchain's yield buffet.

Tokenized debt eats traditional finance's lunch

While banks still process loans with fax machines (probably), Centrifuge's on-chain credit infrastructure is mopping up institutional capital. The $1B milestone screams one thing: tokenization isn't coming—it's already here, and it's vacuuming up assets faster than a hedge fund manager spotting a tax loophole.

Closing thought: Maybe the 'real yield' narrative wasn't just hopium after all—unless you're still waiting for those 20% APY stablecoin returns from 2021.

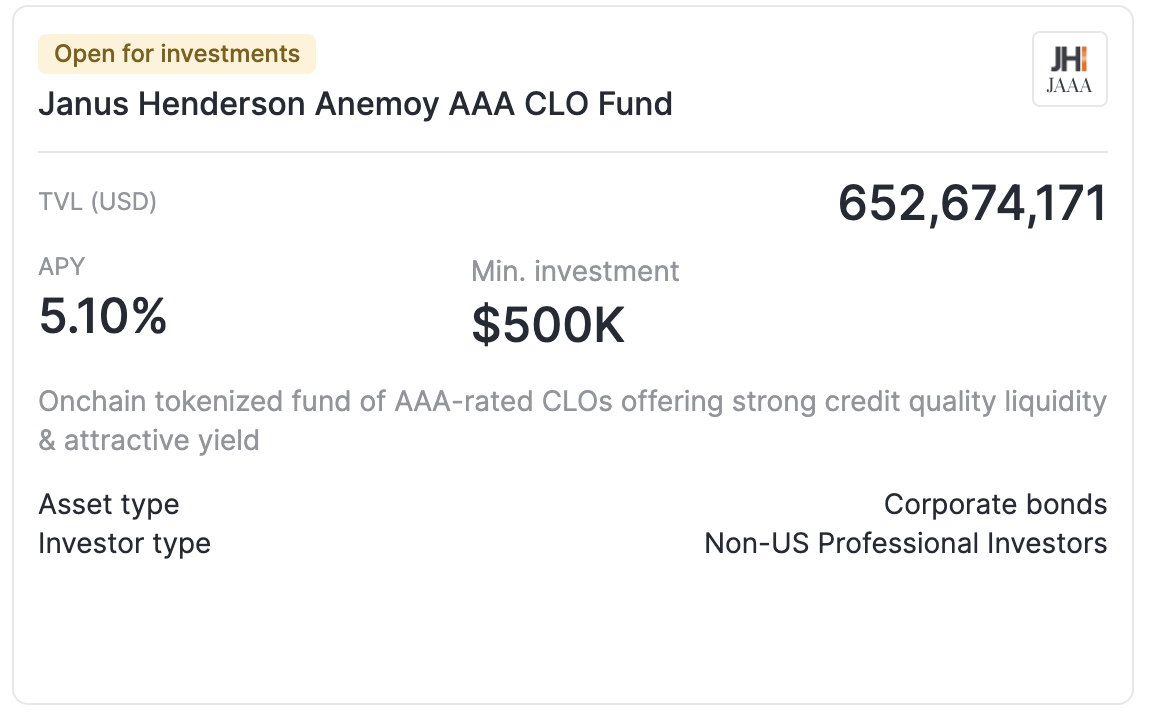

Source: app.centrifuge.io

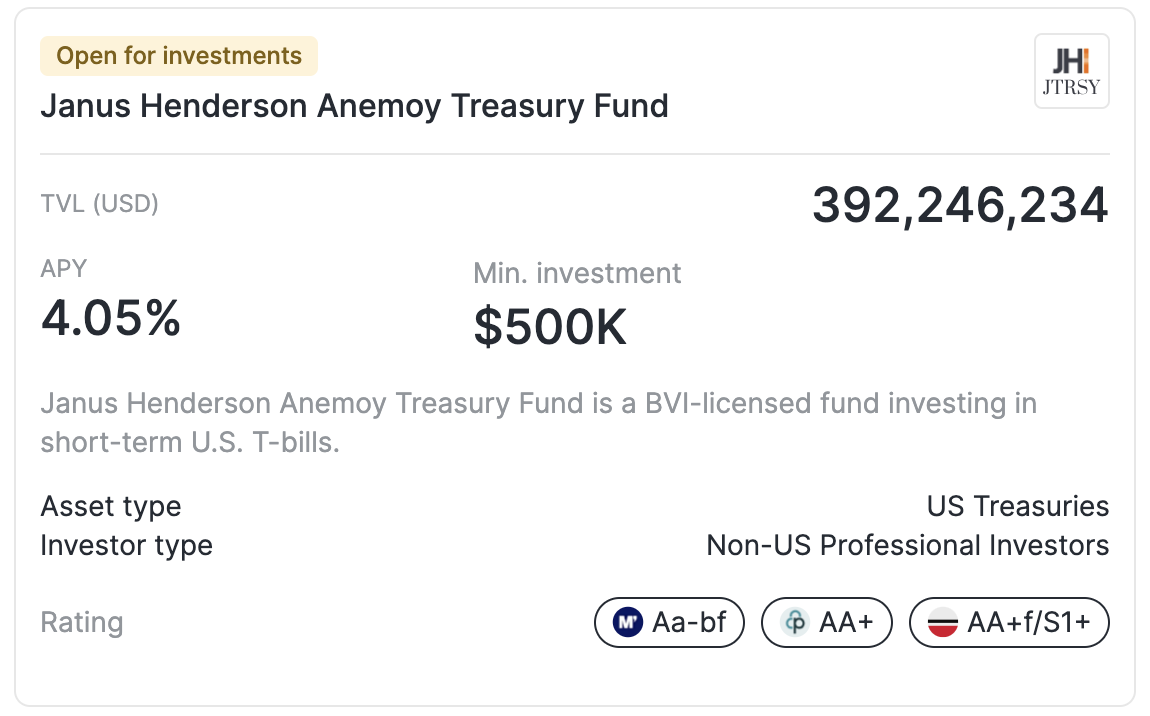

Source: app.centrifuge.io

Alongside JAAA, Centrifuge also offers the Janus Henderson Anemoy Treasury Fund, a vehicle investing in short-term U.S. government bills, which has attracted more than $392 million in assets.

The $1 billion milestone places Centrifuge alongside Securitize, which tokenized BlackRock’s BUIDL fund and holds over $3.1B, and ONDO Finance, with $1.3B.

As Centrifuge CEO Bhaji Illuminati told Cointelegraph, products like the JAAA fund are attracting rapid interest as institutions seek higher yields and diversified credit exposure, even though U.S. Treasurys remain the primary entry point for many allocators. Illuminati also highlighted that private credit and other differentiated fixed-income strategies are gaining traction, and hinted at forthcoming launches aimed at expanding these offerings.

S&P 500 fund launch and Ethereum migration

The $1 billion TVL milestone follows Centrifuge’s early July launch of a tokenized S&P 500 fund in partnership with S&P Dow Jones Indices.

It also comes after the platform’s major infrastructure upgrade, with Centrifuge completing its migration from Polkadot to ethereum on July 24 with Centrifuge V3, becoming a multichain, EVM-native protocol that enhances DeFi composability and strengthens integration across its expanding suite of tokenized real-world assets.