Ethereum ETFs Stumble: $59M Flees as ETH Retreats from Record Highs—Buying Opportunity or Warning Sign?

Ethereum's ETF hype hits a speed bump as investors yank $59 million—just as ETH cools off from its blistering all-time highs. Was this the 'smart money' cashing out… or weak hands folding too soon?

The great ETF unwind begins

After months of institutional euphoria, the first cracks appear. Outflows suggest some whales see greener pastures elsewhere—or just enjoy watching retail panic sell a 10% dip.

ATH? More like 'All-Time Hiccup'

Ethereum's pullback from peak prices feels inevitable (this is crypto, after all). But with staking yields still juicy and upgrades looming, the exodus might be premature. Or—as Wall Street loves to say—'a healthy correction.'

Bottom line: When ETFs bleed, hodlers breed. Either the 'institutional adoption' narrative just got stress-tested… or some suit got spooked by a 4am crypto Twitter thread. Place your bets.

Ethereum price surge drives institutional interest

The recent surge in inflows coincided with Ethereum’s rally to $4,788. This brought ETH within 3% of its all-time high of $4,891.

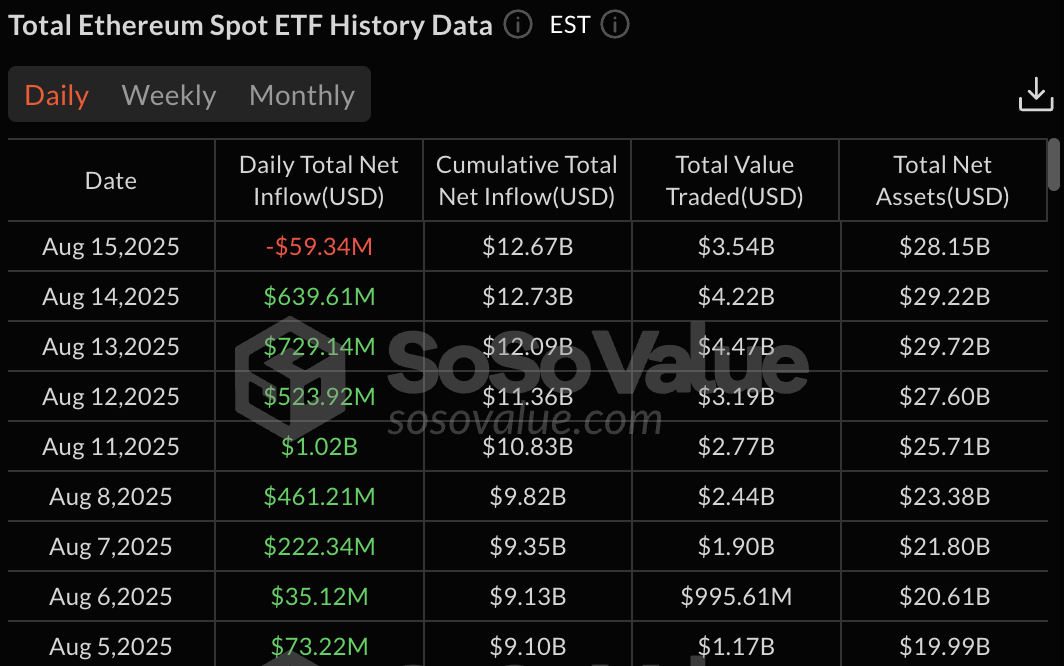

The price surge attracted institutional investment through ETF products, resulting in cumulative total net inflows of $12.67 billion across all Ethereum ETF products.

BlackRock’s ETHA has accumulated $12.16 billion in cumulative inflows since launch. This makes it the leading Ethereum ETF in terms of assets.

Fidelity’s FETH holds $2.74 billion in cumulative inflows, despite the recent outflows. This has helped it earn its position as the second-largest Ethereum ETF.

VanEck’s ETHV and Franklin’s EZET reported zero flows for the day, and smaller ETFs including ETHW, CETH, and QETH posted mixed results.

ETF flows mirror price action

The correlation between Ethereum’s price movement and ETF flows shows how institutional investors respond to market strength.

The eight-day inflow streak began as Ethereum broke above key resistance levels and surged as prices approached all-time highs.

Current outflows may show profit-taking after substantial gains or rotation into other cryptocurrency products.

An #Ethereum ICO participant "0x61b9" just transferred all 334.7 $ETH($1.48M) out today after 10+ years of dormancy.

He invested only $104 in the ICO and received 334.7 $ETH — now worth $1.48M, a 14,269x return!https://t.co/JJEGgmYmvz pic.twitter.com/5sUF8a0DkH

Ethereum’s retreat from $4,788 to $4,450 has cooled retail enthusiasm. However, as Lookonchain reported, an Ethereum ICO participant transferred 334.7 ETH after over ten years of dormancy.

The participant invested only $104 in the ICO and achieved a 14,629x return.