SHIB Burn Rate Skyrockets: Single Wallet Incinerates 85 Million Tokens in Deflationary Power Move

Another day, another meme coin defying gravity—this time with a flamethrower.

SHIB holders just witnessed a jaw-dropping supply shock as an anonymous whale torched 85 million tokens in one transaction. The burn rate? Vertical.

Supply Shock Therapy

While traditional finance clings to quantitative easing, crypto's degenerates are pioneering quantitative burning. That vanished 85 million SHIB won't be mooning—or tanking—ever again.

The Deflation Arms Race

Token burns are crypto's version of corporate stock buybacks—except with more volatility and zero SEC oversight. Every incinerated SHIB theoretically pumps the value of remaining tokens... assuming demand doesn't evaporate faster than the supply.

Will this move move the needle? In a market where Elon's tweets move markets more than fundamentals, never underestimate the power of a good narrative—or a well-timed lighter.

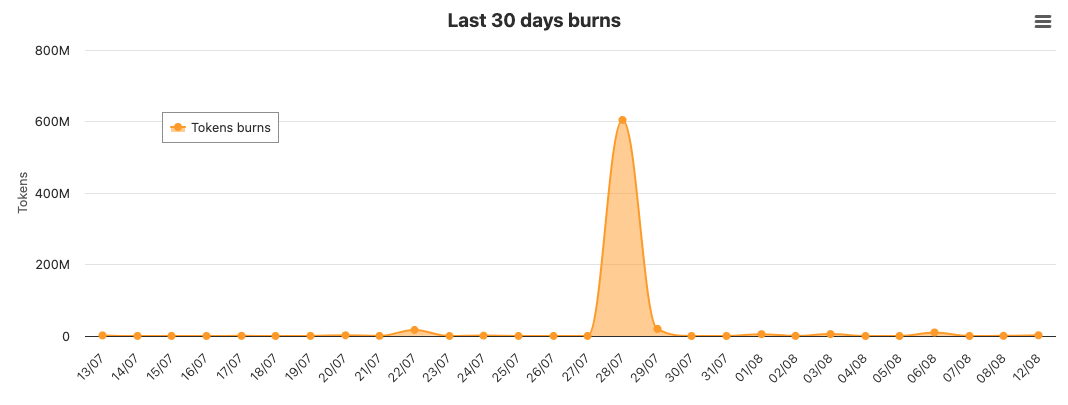

Shiba Inu burn rate in the last 30 days | Source: Shiba Burn Tracker

Shiba Inu burn rate in the last 30 days | Source: Shiba Burn Tracker

Shiba Inu price moves sideways despite token burn

Interestingly, despite the major late-July burn, SHIB’s price moved in the opposite direction. Between July 28 and August 2, the token fell from $0.000014 to a monthly low of $0.000011. It has since recovered to $0.00001386.

This drop coincided with Bitcoin’s fall from above $119,000 to a monthly low of $122,321 in a few days. What is more, Shiba Inu’s recovery in the last seven days also coincided with Bitcoin’s (BTC) recovery.

While token burns are important for Shiba Inu’s long-term outlook, they rarely drive prices higher in the short term. Instead, SHIB’s day-to-day price action remains closely tied to broader crypto market sentiment, particularly Bitcoin’s performance.