Tether’s XAUT Gold Mint Sparks 20% Surge in Tokenized Supply—Overnight

Tether just dropped a gold bomb on crypto markets—minting enough XAUT to spike the tokenized gold supply by a staggering 20% in 24 hours.

Why it matters: When the world’s most controversial stablecoin issuer flexes its gold-pegged muscle, even traditional commodity traders sit up. XAUT’s latest mint isn’t just a blip—it’s a power move in the race to digitize everything from bullion to bananas.

The cynical take: Because nothing says 'stable' like backing tokens with an asset that swings 5% before breakfast. But hey—at least it’s not Venezuelan bolivars.

What’s next? Watch for institutional players using XAUT as both inflation hedge and crypto on-ramp. Gold 2.0 just got an algorithmic upgrade.

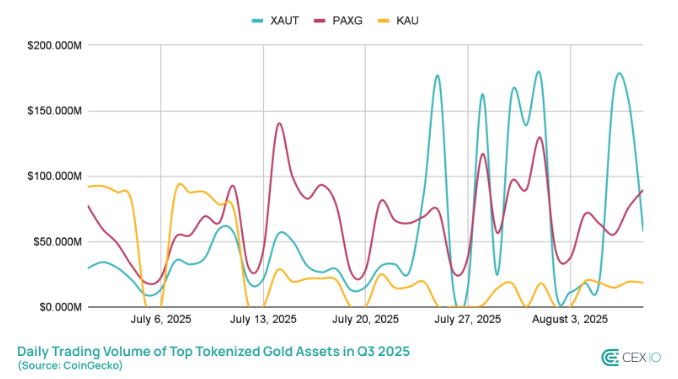

Trading volumes of the top three tokenized Gold assetts in the third quarter of 2025 | Source: CEX.io

Trading volumes of the top three tokenized Gold assetts in the third quarter of 2025 | Source: CEX.io

XAUT also dominated in terms of new tokenized gold holders. In 2025, the number of XAUT holders ROSE by 173%, compared to 29% for PAXG. While PAXG still has a larger userbase, with a seven-fold advantage, the gap is closing quickly.

Macroeconomic conditions favor tokenized gold

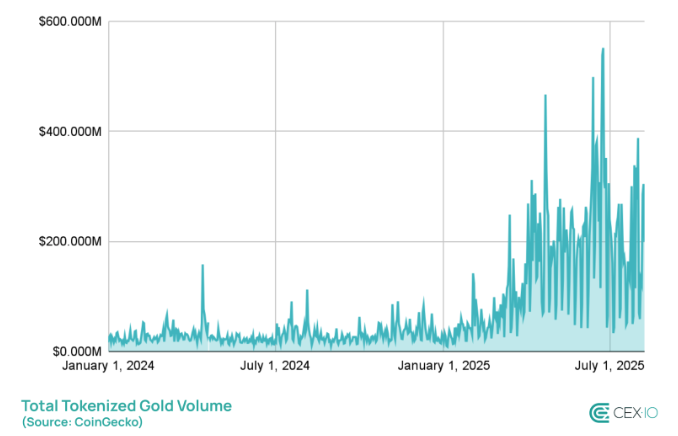

As the original safe-haven asset, gold has benefited from the recent macroeconomic uncertainty. Specifically, since President Donald TRUMP announced his tariffs on major U.S. trading partners, tokenized gold volumes saw multi-week rallies. PAXG, XAUT, and KAU volumes all benefited, with quadruple digit growth in some cases.

Tensions in the Middle East, sluggish labor market growth and other negative economic indicators also contributed to intrest. Notably, in the second quarter of 2025, tokenized gold volume surpassed $19 billion, overtaking major gold ETFs.